Majesco Announces Strong Fourth Quarter Product Revenue and Full Year Fiscal 2020 Results

Press Release

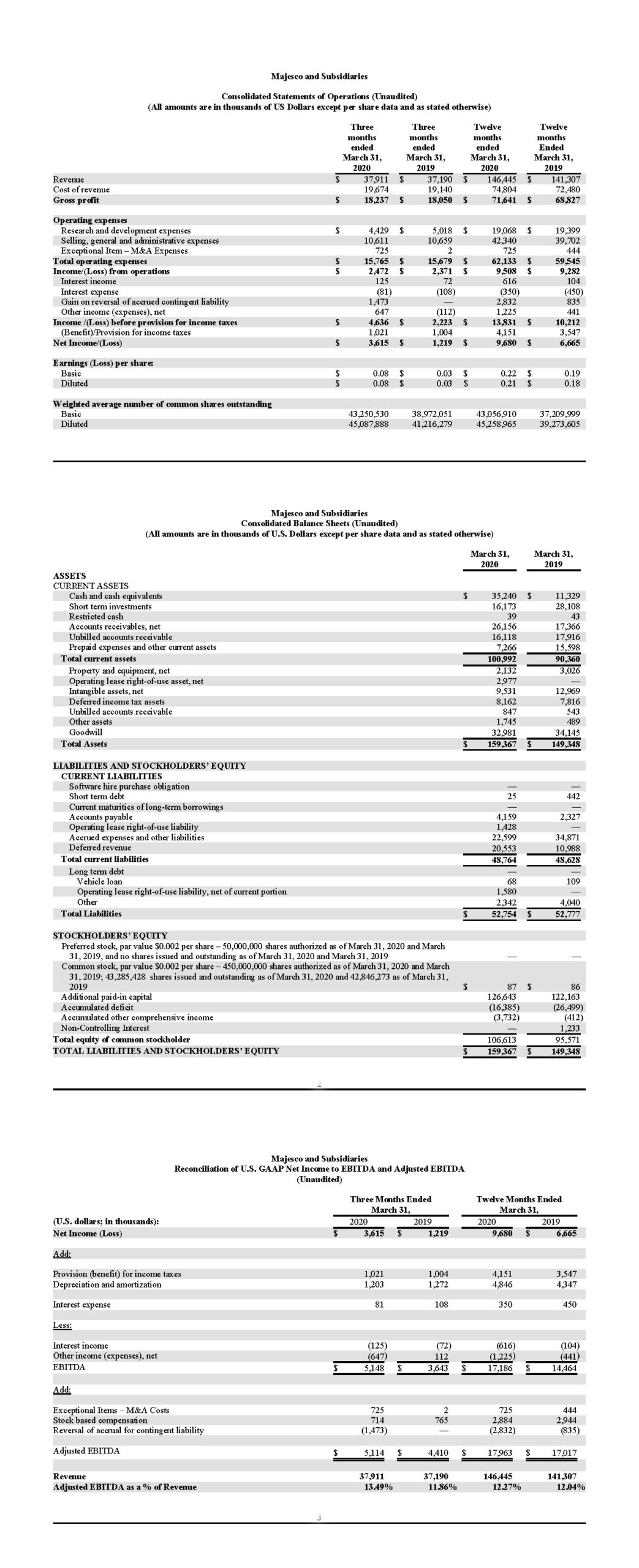

Fourth quarter total revenue of $37.9M and Full year total revenue of $146.4M Fourth quarter Adjusted EBITDA of $5.1M and Full year Adjusted EBITDA of 18.0M Fourth quarter Net Income of $3.6M and Full year Net Income of $9.7M

Full Year product revenue of $61.8M up 33.2% year over year and represents 42.2% of revenue Full Year cloud subscription revenue of $22.1M up 34.8% year over year and represents 15.1% of revenue

Morristown, NJ – May 28, 2020 – Majesco (NASDAQ: MJCO), a global provider of cloud insurance platform software, today announced strong financial results for the fiscal 2020 fourth quarter and full year ended March 31, 2020. “We are living in unique times; times none of us have experienced before, and our number one priority is to protect the health and safety of our employees, customers, partners and the communities in which we operate”, stated Adam Elster, Majesco’s CEO “We were an early adopter of the ‘work from home’ transition, and all Majesco’s global employees have been operating remotely since March 16th. We have successfully managed all customer expectations, while ensuring our business continuity, seamless focus and commitment to projects and services.” “Fiscal 2020 was a record year for Majesco, demonstrating the success of our cloud product-based strategy. Companies of all sizes are turning to Majesco to partner with us on their digital transformation journey. I am more excited than ever about the opportunity ahead, the future of Majesco and the insurance industry. Our relentless focus on delivering innovation and customer success has fuelled our growth and solidified our leadership.” “While it may be premature and difficult to predict the business impact due to the unprecedented environment caused by the COVID-19 crisis, we believe customers are likely to shift focus and investment, and move to cloud and digital experience platforms, automation, efficiency and modernization.” “We remain confident in our strategy, committed to its execution and believe we have the right platform in place to handle the near-term challenges associated with COVID-19, while continuing to pursue long-term growth opportunities.”Key Revenue Drivers:

- License, subscription, and maintenance revenue (product revenue) of $61.8 million, up 33.2% year over year, and constituted 42.2% of total revenue for fiscal 2020.

- Professional services revenue of $84.7 million, down 10.7% year over year.

- Majesco’s 12-month order backlog on March 31, 2020 was $109.8 million, up 8.0% from $101.7 million on December 31, 2019 and up 13.3% from $96.9 million on March 31, 2019.

- We added 8 new clients organically for the year ended March 31, 2020.

Fourth Quarter 2020 Financial Results

- Revenue was $37.9 million, compared to $37.2 million for the same period last fiscal year. The 1.9% increase was driven by higher product revenue from existing accounts and new logos.

- Gross profit was $18.2 million (48.1% of revenue), compared to $18.0 million (48.5% of revenue) for the same period last fiscal year. Gross margins from growing product revenue was somewhat mitigated by inflationary impacts to the business, investments being made to scale the business and challenges in the international segment of the business.

- Research and development (R&D) expenses were $4.4 million (11.7% of revenue), compared to $5.0 million (13.5% of revenue) for the same period last fiscal year. Investments in R&D are focused on Majesco’s product roadmap to support next generation insurance solutions and digital offerings.

- Selling, general and administrative (SG&A) expenses were $10.6 million (28.0% of revenue), compared to $10.7 million (28.7% of revenue) for the same period last fiscal year.

- Adjusted EBITDA was $5.1 million (13.5% of revenue), compared to $4.4 million (11.9% of revenue) for the same period last fiscal year.

- Net income was $3.6 million or $0.08 per diluted share as compared to net income of $1.2 million or $0.03 per diluted share, for the same period last fiscal year.

Fiscal Year 2020 Financial Highlights

- Revenue for fiscal 2020 was $146.4 million, compared to $141.3 million last fiscal year. The 3.6% increase in revenue was driven by strong growth in product revenue, which increased 33.2% and offset the 10.7% decline in professional services revenue.

- Gross profit was $71.6 million (48.9% of revenue) for fiscal 2020, compared to $68.8 million (48.7% of revenue) last fiscal year.

- R&D expenses were $19.1 million (13.0% of revenue) for fiscal 2020, compared to $19.4 million (13.7% of revenue) last fiscal year.

- SG&A expenses were $42.3 million (28.9% of revenue) for fiscal 2020, compared to $39.7 million (28.1% of revenue) last fiscal year. The increase in SG&A was led by higher sales driven activities and additions to the leadership team.

- Adjusted EBITDA for fiscal 2020 was $18.0 million (12.3% of revenue), compared to $17.0 million (12% of revenue) last fiscal year.

- Net income for fiscal 2020 was $9.7 million or $0.21 per diluted share, compared to $6.7 million or $0.16 per diluted share last fiscal year.

Other Highlights

- Majesco had cash and cash equivalents of $51.4 million at March 31, 2020, compared to $39.4 million at March 31, 2019.

- Majesco had zero debt as of March 31, 2020, compared to $0.4 million at March 31, 2019.

- 5 successful Go-Lives during the fourth quarter of fiscal 2020 and 37 total go-lives for the full fiscal 2020.

- New deal wins, upgrades and expansions for the fourth quarter fiscal 2020 included:

- A tier 1 insurance carrier implementing Majesco Billing

- A global tier 1 insurance carrier selected Majesco for their core solution

- A longtime customer of Majesco expanded its scope with Majesco adding Digital 1st and upgrading to latest version transitioning to the cloud model

- A global tier 1 insurance company continued its expansion with Majesco’s core solutions to additional specialty lines of business

- A global tier 1 insurance company expanded its implementation of Majesco’s core solutions to additional countries and lines of business

- Cloud customer count stood at 65 at the end of fiscal 2020

- The Company announced the acquisition of Inspro Technologies, a Philadelphia based insurance software business. The transaction closed on April 1, 2020.

- Majesco was named a Leader by Gartner in the September 2019 Magic Quadrant for P&C Core Insurance Platforms, North America.*

- Majesco was positioned as a Visionary in the Gartner 2019 Magic Quadrant for Life Insurance Policy Administration Systems, North America.**

- Majesco’s P&C Core Suite was named the top “Best-in-Class” Vendor in the P&C Policy Administration Aite Matrix Report.

- Majesco’s L&A and Group Core Suite was named “Best-in-Class” Vendor in the Aite Life PAS AIM Report.

- Key Focus Areas for Majesco during the COVID-19 environment

- Prioritize development and operational efforts to support customers for their critical and immediate business and IT requirements, ensure speedy implementation, accelerate digital customer experiences, and expand adoption of cloud to provide business agility, scalability and cost efficiencies

- Cost and Cashflow Management – review of discretionary expenses and ensuring tighter management of working capital requirements.

- Accelerate partner led strategy to penetrate and deliver to new and existing Tier 1-2 accounts

- Integration of Inspro Technologies and expansion of the North America L&A strategy

- Re-evaluate the operating model and make necessary investments to support sustainable level of work from home environment post COVID-19

Conference Call and Webcast Information

Majesco management will conduct a live teleconference to discuss Majesco’s fiscal 2020 fourth quarter and full year financial results at 5:00 pm ET on Thursday, May 28, 2020. Anyone interested in participating should call 855-327-6837 if calling from the U.S., or 631-891-4304 if dialing internationally. A replay will be available until June 11, 2020, which can be accessed by dialing 844-512-2921 within the U.S. and 412-317-6671 if dialing internationally. Please use passcode: 10009421 to access the replay. In addition, the call will be webcast and will be available on the Company’s website at www.majesco.com or by clicking here.Use of Non-GAAP Financial Measures

In evaluating our business, we consider and use EBITDA as a supplemental measure of operating performance. We define EBITDA as earnings before interest, taxes, depreciation and amortization. We present EBITDA because we believe it is frequently used by securities analysts, investors and other interested parties as a measure of financial performance. We define Adjusted EBITDA as EBITDA before stock-based compensation, a reversal of accrual for contingent liability and mergers and acquisitions expenses. The terms EBITDA and Adjusted EBITDA are not defined under U.S. generally accepted accounting principles, or U.S. GAAP, and are not a measure of operating income, operating performance or liquidity presented in accordance with U.S. GAAP. EBITDA and Adjusted EBITDA have limitations as an analytical tool, and when assessing Majesco’s operating performance, investors should not consider EBITDA or Adjusted EBITDA in isolation, or as a substitute for net income (loss) or other consolidated income statement data prepared in accordance with U.S. GAAP. Among other things, EBITDA and Adjusted EBITDA do not reflect our actual cash expenditures. Other companies may calculate similar measures differently than Majesco, limiting their usefulness as comparative tools. We compensate for these limitations by relying on U.S. GAAP results and using EBITDA and Adjusted EBITDA only as supplemental.Gartner Disclaimer

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.About Majesco

Majesco (NASDAQ: MJCO) provides technology, expertise, and leadership that helps insurers modernize, innovate and connect to build the future of their business – and the future of insurance – at speed and scale. Our platforms connect people and businesses to insurance in ways that are innovative, hyper-relevant, compelling and personal. Over 200 insurance companies worldwide in P&C, L&A and Group Benefits are transforming their businesses by modernizing, optimizing or creating new business models with Majesco. Our market-leading solutions include CloudInsurer® P&C Core Suite (Policy, Billing, Claims); CloudInsurer® L&A and Group Core Suite (Policy, Billing, Claims); Digital1st® Insurance with Digital1st® Engagement, Digital1st® EcoExchange and Digital1st® Platform – a cloud-native, microservices and open API platform; Distribution Management, Data and Analytics and an Enterprise Data Warehouse. For more details on Majesco, please visit www.majesco.com.Cautionary Language Concerning Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbour” provisions of the Private Securities Litigation Reform Act. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of management, are not guarantees of performance and are subject to significant risks and uncertainty. These forward-looking statements should, therefore, be considered in light of various important factors, including those set forth in Majesco’s reports that it files from time to time with the Securities and Exchange Commission (SEC) and which you should review, including those statements under “Item 1A – Risk Factors” in Majesco’s Annual Report on Form 10-K, as amended by Majesco’s Quarterly Report on Form 10-Q. Important factors that could cause actual results to differ materially from those described in forward-looking statements contained in this press release include, but are not limited to: the adverse impact on economies around the world and our customers of the current COVID-19 pandemic; our ability to achieve increased market penetration for our product and service offerings and obtain new customers; our ability to raise future capital as needed; the growth prospects of the property & casualty and life & annuity insurance industry; the strength and potential of our technology platform and our ability to innovate and anticipate future customer needs; our ability to compete successfully against other providers and products; data privacy and cyber security risks; technological disruptions; our ability to successfully integrate our acquisitions and identify new acquisitions; the risk of loss of customers or strategic relationships; the success of our research and development investments; changes in economic conditions, political conditions and trade protection measures; regulatory and tax law changes; immigration risks; our ability to obtain, use or successfully integrate third-party licensed technology; key personnel risks; and litigation risks. These forward-looking statements should not be relied upon as predictions of future events and Majesco cannot assure you that the events or circumstances discussed or reflected in these statements will be achieved or will occur. If such forward-looking statements prove to be inaccurate, the inaccuracy may be material. You should not regard these statements as a representation or warranty by Majesco or any other person that we will achieve our objectives and plans in any specified timeframe, or at all. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Majesco disclaims any obligation to publicly update or release any revisions to these forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this press release or to reflect the occurrence of unanticipated events, except as required by law.Majesco Contacts:

Investor Contact SM Berger & Co Andrew Berger +216 464 6400 andrew@smberger.com