Blog

No Code Insurance Platform – The DIY Promise of No Code/Low Code

We hate to wait. With the exception of the British, who stereotypically don’t mind a “queue,” most of us spend a great deal of time figuring out how to save time. We don’t want to wait on hold for 20 minutes for customer service to pick up our call. We don’t like long lines at the drive thru. If we have a home project, we don’t like waiting on specialists to get the job done (even though they might do it better). We say to ourselves, “Just give me YouTube and a hardware store and I’ll do it myself.”

Waiting, however, isn’t just about impatience. In insurance companies, waiting to make changes to customer experiences, products, technologies or services, let alone creating new ones that we can quickly and cost-effectively test in the market, is a “competitive black hole.” If we’re given the choice to create something now, built easily with our own hands, or wait in the IT queue for the next few months or years depending on the backlog, we’re liable to say, “I’d rather do it myself.”

So, we are caught in a conundrum. If we try to accomplish some things on our own, we may not have what it takes to get the job done. If we are over-reliant upon IT or developers to accomplish tweaks to our systems, we may lose out on a market opportunity or competitive edge. This is the short story of DIY insurance that has led to the explosion of no code / low code business dynamics.

The burgeoning no code / low code technology space is leading the disruption and shift to the digital era of insurance. Unfortunately, like other over-used “buzz words” the use of no code / low code platforms has led to confusion on what they are. The term is misleading because it is not about whether you code or not, it is about broadening the pool of people who can use the platform to build applications. Not only is the definition of the term confusing, but the real benefits to no Code / low Code aren’t always fully appreciated.

This month, Majesco will release its latest thought leadership report, Insurance Platforms: The Digital and No Code / Low Code Platform. In our report, we consider platforms – core insurance platforms, digital insurance platforms and horizontal no code / low code platforms – in order to assess the use of no code / low code technology across the three different platforms and how they differ in creating value for insurers. In today’s blog, we’ll get a preview of the report by looking at perceptions. What do some industry leaders see as the potential value propositions behind no code / low code platforms, as well as the overall benefits of a platform approach?

Similarities and Differences: Definitions of No Code / Low Code

In a July 2020 Forbes article, Jason Bloomberg notes the following:

“In the No-Code corner are the ‘citizen developers’ – business users who can build functional but generally limited apps without having to write a line of code. The Low-Code corner, in contrast, centers on professional developers, streamlining and simplifying their work – delivering enterprise-class applications with little or no hand-coding.”

These no code / low code solutions are offering new levels of usability, capabilities, and access to data and other technologies to create next-generation business solutions ranging from portals, to full enterprise-level solutions, to innovative new products such as on-demand or parametric products that require real-time data for continuous underwriting. Too often, insurers are using a variety of disparate tools on a piecemeal basis, rather than looking for a platform that can support every step of their digital transformation journey, from portals for personalized experiences, to innovative new products and business models.

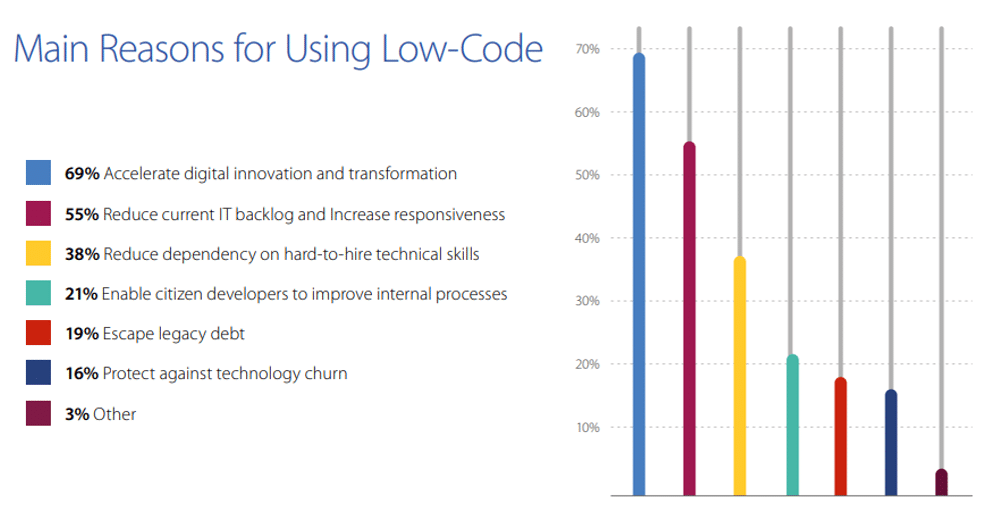

No code / low code platforms that can support this array of capabilities offer benefits for companies, including greater agility, reduced complexity, decreased cost, and improved productivity and speed. Research conducted by OutSystems identified the key reasons companies cite for adopting no code / low code solutions, as reflected in Figure 1. The top three reasons were the ability of these solutions to accelerate digital transformation (69%), reduce current IT backlog and Increase responsiveness (55%), and reduce dependency on high tech skills (40%).[i] With no code / low code, companies are getting more for less … faster!

Figure 1: Key reasons for adopting low code solutions

In alignment with this, our Strategic Priorities research highlighted that no code / low code platforms and digital experience platforms – which often use no code / low code – are emerging as a top priority to accelerate digital transformation.

Gartner forecasts that low-code application platforms will account for 65 percent of all app development by 2024. This means the majority of apps created in 2024 will be developed using platforms and tools that provide turnkey ways to program.[ii]

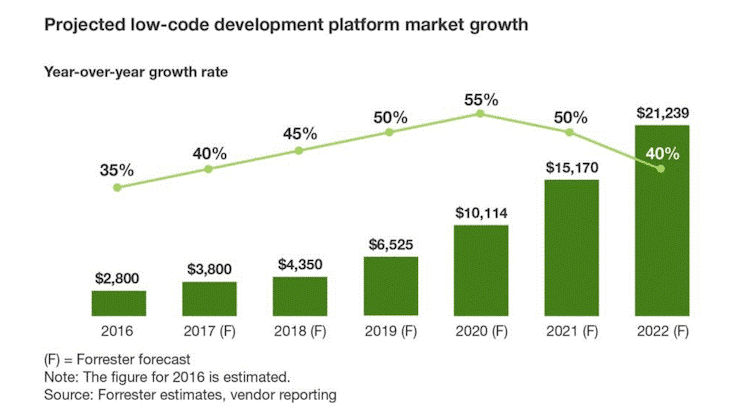

In addition, Forrester is forecasting significant growth of 40%-55%, as reflected in Figure 2.[iii]

Figure 2: Projected low-code development platform market growth

Industry Analyst View — Platforms and No Code / Low Code

Many of the prominent insurance industry analyst firms have been studying the rise of platform technologies and platform-based business models over the last 2 years. Not surprisingly, there is a range of views, but with some commonality. Key common descriptions include:

- Described as a development paradigm and a market segment

- Supports rapid application development and delivery

- Model-driven design and metadata-based programming languages

- Visual programming with graphical representation of workflows and business logic

- Enables development of user interfaces, business logic and data services

- Expands the pool of developers by reducing technical expertise required and minimal training

- A key strategy to accelerate application delivery and digital business transformation

Interestingly, Forrester notes that no code / low code has the potential to make software development as much as 10 times faster than traditional methods. They note that these platforms help advance digital business in three major ways: “They have the potential to greatly decrease the time needed to meet business requirements; they harness the forces of shadow IT for good, not evil; and they play a vital role in automating operational processes.”[iv]

DIY — No Code / Low Code Business Applications and Capabilities

Now it’s time for specifics. Which areas of insurance technology are ready to be acquired and used without a tremendous amount of developer or integration effort? Insurance-specific digital platforms, which have extensive no code / low code capabilities (like horizontals), make it easy to rapidly create business applications using these 4 key components:

- Pre-built insurance blueprints with a variety of insurance apps and accelerators such as insurance objects, templates covering end-to-end insurance functionality, page layouts, UI widgets and more.

- Digital ecosystem of partner capabilities, data or services that can be used via a plug-and-play configuration such as artificial intelligence (AI) allowing companies to create and launch smart business applications that integrate AI partner capabilities rather than creating algorithms.

- Built-in integration hubs that connect to a variety of systems through SOAP, REST and OAS APIs without writing code and allow the ability to publish custom APIs for partners to extend and enhance digital capabilities.

- No code / low code capabilities including:

- Digital – Branding, visualization, journey design, and usage analytics capabilities.

- Configuration – Robust UI builder, data modeler, workflow and localization capabilities.

- Architecture – Fully cloud native, microservices, multi-tenant, built-in DevOps, release board and auto-scaling.

- Flexibility – Ability to provide sandbox and multi-geo instances.

Stating the Case: A Summary of Benefits

- Speed to market – Stop waiting in the IT queue! Decrease the development cycle dramatically for custom-built-for-purpose applications, estimated to be upwards of 80%.

- Enhanced productivity and cost effectiveness – Accelerate IT and business alignment and bridge the historical gap allowing business and IT to collaborate and deliver business value quicker, allowing business users to create their own applications and having IT focus on the more complex development, aligns resources, saves time and money.

- Digital anywhere and any way – Allow application deployment across any device, anywhere and at any time with full integration to core systems and enabling the flow of data to appropriate systems or data stores.

- Enhanced risk management – With a single unified platform, companies can meet new business requirements, deadlines, project goals and market changes more rapidly, enabling enhanced risk management and governance.

Majesco Digital1st® Insurance is a digital no code / low code insurance software solution that has all the capabilities of a horizontal platform, but with insurance-specific templates and content that accelerate development and launch. This is why not all no code / low code insurance software solutions are equal – and why industry-specific platforms can offer all that horizontals have but with the added benefit of industry-specific content, eliminating the need for multiple platforms. This takes Insurance DIY to the next level — opening doors to capabilities that will support your strategic goals with less effort.

For an in-depth discussion over today’s digital platforms, be sure to tune in to my conversation with KPMG Principal, Jeanne Johnson entitled, Digital Transformation Tipping Point: Digital Platforms Redefining a New Era of Leaders, and then catch our upcoming thought leadership release of Insurance Platforms: The Digital and No Code / Low Code Platform.

[i] “The State of Application Development, 2018,” OutSystems, https://media.bitpipe.com/io_14x/io_141278/item_1651051/OutSystems%20-%20State%20Application%20Development%20Report%202018%20-%202018-06-18_v1_web%20(2).pdf

[ii] Vincent, Paul, et al., “Magic Quadrant for Enterprise Low-Code Application Platforms,” Gartner, September 30, 2020

[iii] Rymer, John, “Why You Need to Know About Low-Code, Even If You’re Not Responsible For Software Delivery,” Forrester, August 8, 2018, https://go.forrester.com/blogs/why-you-need-to-know-about-low-code-even-if-youre-not-responsible-for-software-delivery/

[iv] Rymer, op. cit.