Blog

Design Secrets of Platform-Based Architectures Part 1

Nest home products are designed to make life easy for homeowners, save them money and protect their homes. That might sound like a commercial aimed at homeowners, but it is really a wake-up call for insurers to pursue platform-based architectures. Nest maintains a developer site for its APIs, so that subscribers/partners can integrate and use Nest data. Unfortunately, most insurer architectures aren’t designed to effectively take advantage of all that Nest — and a growing list of others — have to offer that can be used for new products, services, pricing, underwriting, and more. A platform-based architecture, such as the one we describe in Majesco’s recent thought-leadership report, A New Business Model for a New Era of Insurance, opens an insurer up to a world of data, capabilities and possibilities! With Nest and so many other potential ecosystem partners, what is good for the customer is also great for the insurer, if the insurer is pursuing a platform model.

As we noted in last week’s blog, A New Platform for a New Era, platform-based architectures meet the needs of a new era of insurance … and a Digital Insurance 2.0 insurer.

“Platform and open API-based business models provide innovative companies speed to value, unique customer engagement, a test and learn platform for minimal viable products, and value-aligned optimized costs.”

Defining a platform-based architecture isn’t simple. It is best to break it into components to uncover how it works AND to grasp why it is so effective at accomplishing its role in today’s insurance. The end result of its complexity is really a form of simplification — answering the need to adjust quickly, add functionality and data analytics that may not exist yet, and meet the needs of insurance customers with fluid ease and streamlined, multi-channel efficiency. With this in mind, let’s attempt to answer some of the common questions surrounding platforms and look into some of the valuable secrets of successful platform design.

What is the difference between traditional business models and platform models?

Traditional insurance business models have been centered on products, siloed processes and departments, backward-looking actuarial risk pricing, claims management and payment, and more. A digital insurance platform breaks down these conventions and enables the creation of new and innovative digital insurance business models. This reinvention of the insurance business as a digital enterprise should result in customer-centric efforts, a reduction of silos, real-time pricing and an increase in forward-looking risk prevention.

What is the secret to transforming a traditional architecture into a platform-based architecture?

The digital insurance platform is not a retrofit architecture. It is a complete redesign that fuses common capabilities across transaction processing, insights and engagement needs with a strong “find and bind” integration architecture to tap into an ecosystem of innovative data and solutions. It is open to non-native components, supports rapid change to adapt to shifting industry needs, and allows for continuous innovation. It can generate analytics and calibrate the customer-centric solution without losing speed or increasing total cost of ownership. In short, it positions the insurer for market adaptability, innovation and most importantly, continued growth.

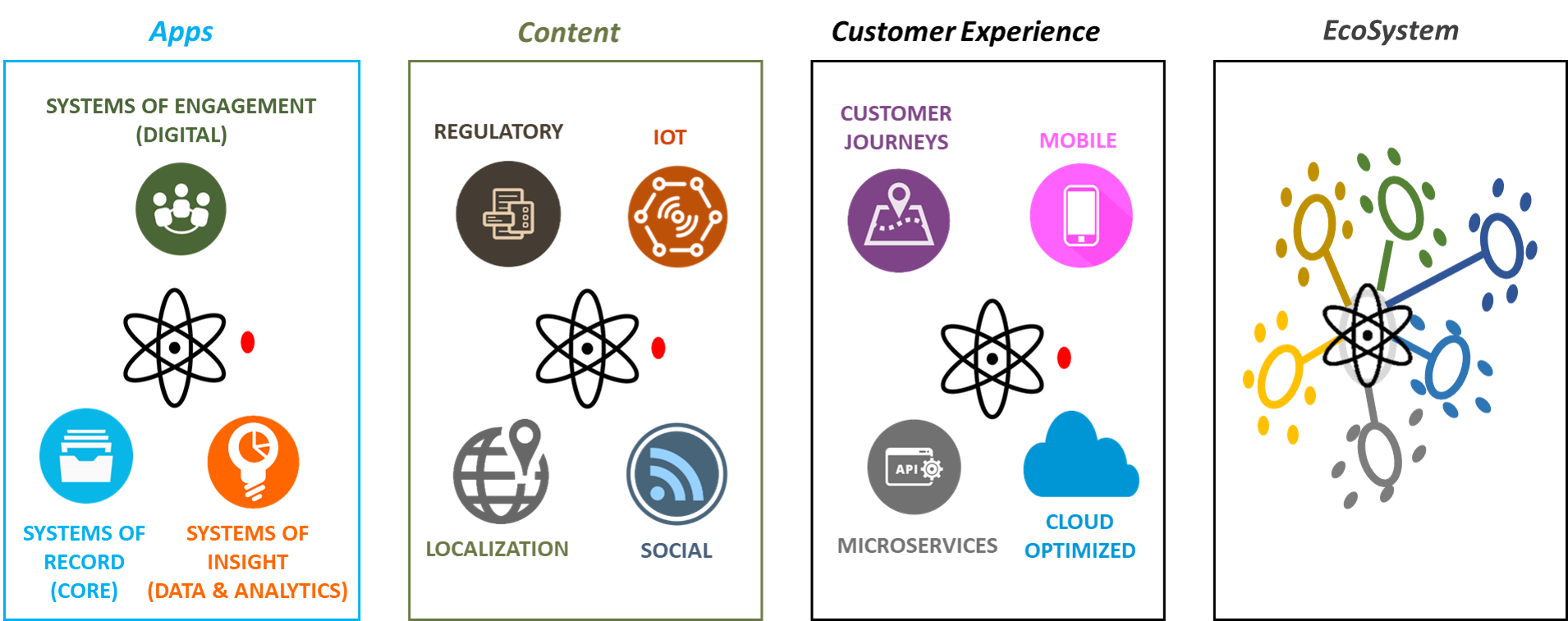

A digital insurance platform is somewhat like a fusion reactor that effectively and safely conducts the molecular fusion of core transactional capabilities and innovative emerging technologies and InsurTech capabilities to provide exponential energy to the enterprise. The fusion occurs across four “chambers” that comprise Apps, Content (i.e. Data), Customer Experience and an EcoSystem of partners and capabilities (see Figure 1). In addition to these four chambers, there are four more unique “secret ingredients” that accelerate the power of the digital insurance platform, including microservices, APIs, cloud-native computing and AI and machine learning.

Figure 1: The “Reactor Chambers” of the Digital Insurance Platform

These components are increasingly being recognized by insurers as critical to achieving their strategic goals for cost, speed to market with new products, and improved customer experience. According to Celent, insurers understand that “the benefits they can derive from the cloud models are superior to their risks and costs,” and that “API integration and a Microservices-oriented architecture are the new state of the art in the industry.”[i]

The Four Chambers of Digital Fusion

To bring clarity to the core of the platform, we can discuss the “chambers” in the digital fusion reactor.

Apps

Apps constitute the first chamber in the reactor. Digital Apps are known as systems of engagement, Analytics Apps are known as systems of insight, while Core Apps are the systems of record. In the traditional Insurance 1.0 business model it is common for each of these systems to be distinct and disparate, separated by line of business or function. In a digital insurance platform, however, apps do not operate within silos. They are exposed to each other so they can provide power through digital fusion.

The power that comes through app fusion is specifically related to innovation and growth because it represents regular, ongoing innovation and improvement. Insights will fuel new methods and measures of engagement. Enhancements to engagement will create deeper knowledge and expanded growth.

Content (Data)

Content is one of the underutilized assets in insurance but it is quickly becoming a strategic asset in the digital era. Content is no longer defined as that which is stored within the enterprise; it is all data that is accessible to the enterprise, including (but not limited to) the following:

- Regulatory data (rates, rules, forms)

- Internal data compiled over time, such as customer, transactional and actuarial data

- Localized data (region or country-specific)

- External data related to risks and underwriting (MVRs, MIB, Rx, usage patterns, GIS, climate information, Nest devices, wearables, telematics, and more)

- Social media data, social preferences, customer sentiments, buying behaviors, satellite images etc.

The volumes and varieties of data from new external sources of data are abundant. Domo’s Data Never Sleeps 5.0 reports that 2.5 quintillion bytes of data are produced each day, and that 90% of all data in existence today was created in the past 2 years.[ii]

It is not enough to simply have all these data streams available. The insurer must also have the ability to bring diverse data sets together with a context for building insights to realize their competitive advantage. Combining data from traditional internal and new external sources can improve the richness of information used to make a wide array of business decisions and fuel discovery of new market opportunities. So, a practical definition of content is: All the specific data about a person or business that allows you to rapidly set up a product and assess the risk specific to the customer based on their unique situation, region and risk profile. The better an insurer is at applying fusion to their content, the more value their data will produce.

Traditionally, content has been indigenous to individual apps – transaction systems data was not easily accessible by engagement systems without building expensive wiring. Insights generated from analytics systems are often not actionable at the point of sale or service. In the digital platform, data is liberated from the apps and is made available for centralized data access and storage. A true digital platform architecture must enhance the benefits of apps with internal and external content.

Customer Experience

In today’s world, the insurance customer’s experience is the product. The experience is what differentiates one insurer from another. Majesco’s consumer and SMB research documented that customers feel the current Insurance 1.0 business model is not easy to do business with, which means there are tremendous opportunities for business models that can create a better experience. In our series of Playbooks for P&C and L&A/Group we used two frameworks to demonstrate how startups and Greenfields are doing just that, by creating business models based on Digital Insurance 2.0 platforms that sweep away the complexities inherent in legacy business models, products and processes.

The Customer Experience is, therefore, the most vital chamber of our fusion reactor for building the digital insurance platform. Key elements in this chamber include mobile capabilities (a table stakes customer expectation), customer journey maps, and two of the “secret ingredients” mentioned above — microservices and cloud computing. Journey maps help recraft the customer journey and its processes, to cut through silos and unify the experience so that satisfaction is reached throughout a customer’s journey. They also help establish a customer-centric brand by feeding data about the customer experience back into the design.

An organization will know that it has arrived at digital fusion when it has fashioned unique customer journeys and it is using digital capabilities to continuously and iteratively design, implement, deploy, measure and tweak them for its customers and intermediaries. The two “secret ingredients” in this chamber, microservices and cloud computing, make this possible.

EcoSystem

The final chamber of the reactor, EcoSystem, could also be considered one of its “secret Ingredients” in the overall platform design. In today’s platform economy, insurers are looking to provide products and offerings that are designed to meet customer needs and expectations but may involve components or data that originated outside their enterprises. The main objective is to design a product and service with a seamless customer experience to meet their needs as well as win their hearts by bringing together the best capabilities, both internal and external. Customers are less concerned with the origin of these capabilities as long as they are designed to solve their needs, meet their expectations and they are packaged under a brand they trust.

Insurance platforms are often touted as enabling solutions that will accelerate innovation and technology adoption while improving customer experience. Unfortunately, many insurance platforms are designed around internal capabilities and data only. It isn’t easy to integrate a new capability or data source.

A platform-based architecture allows rapid application development by using a “find and bind” approach to construction by assembling the available APIs, instead of building everything from scratch.

The core chambers of the reactor are the basis of an architecture that will allow for the creation of amazing new, innovative ideas and opportunities that will help insurers fuel their shift to a new digital era!

To get a deeper look, be sure to download and read A New Platform for a New Era today.

[i] Beattie, Craig and Michellod, Nicolas, Searching for API, Microservices, and Cloud-Native Insurance Software: Finding the Optimal Tradeoff, Celent, September 12, 2018

[ii] “Data Never Sleeps 5.0,” DOMO