Blog

The New Risks: Are Insurers Prepared to Respond?

Business model disruption is just a new risk or two away. In today’s new market dynamic risk is a two-way street for insurers. Some new risks may afford them the opportunity to step in and provide coverage to another market. Other risks might shake the foundations of insurance and force them into new business models and developing new products. An insurer’s ability to de-risk any risk may be found in the ability to think ahead and respond. This is the thinking behind Majesco’s latest thought leadership report, Strategic Priorities 2019: Accelerating the Path to the Future of Insurance. Using our survey data, we are going to pose and answer some pointed questions about how insurers are responding to a new dynamic that future risk will affect their businesses.

Are insurers prioritizing properly to meet the new risks?

Let’s begin with a current example of new risks from the realm of property and casualty.

Rental car company Turo has captured the best of what the gig and sharing economy has promised, converting unused assets into owner cash. Turo is an app-based business that allows anyone to rent their car to someone else. It has been likened to an Airbnb for autos.

Now, however, what started as individual vehicle sharing has turned into individuals purchasing high demand used vehicles and becoming their own car rental agencies. If you are a P&C insurer, and you wanted to capitalize on this new realm of risk, would this make you consider expanding your personal lines coverage or push you toward redefining your small business coverage to include rentals of this type or a hybrid approach?

In this case, Turo is one step ahead, facilitating the layers of insurance that are needed over and above personal automotive coverage. Instead of going through the hassle of gathering insurance information from thousands of renters and owners, Turo backs itself up through an ecosystem partnership approach with Liberty Mutual in the US and Intact Insurance in Canada. Our takeaway is two-fold.

First, the new insurance opportunities will come easily for those insurers that are innovative and responsive. To do so, they must be prepared to construct a business model and approach with a product quickly. And they must be willing (and able) to partner with others in innovative new ways. This kind of innovative responsiveness will only happen if an insurer has a foundation of core insurance systems and processes that are flexible and able to respond rapidly … days, weeks or a few months, rather than years.

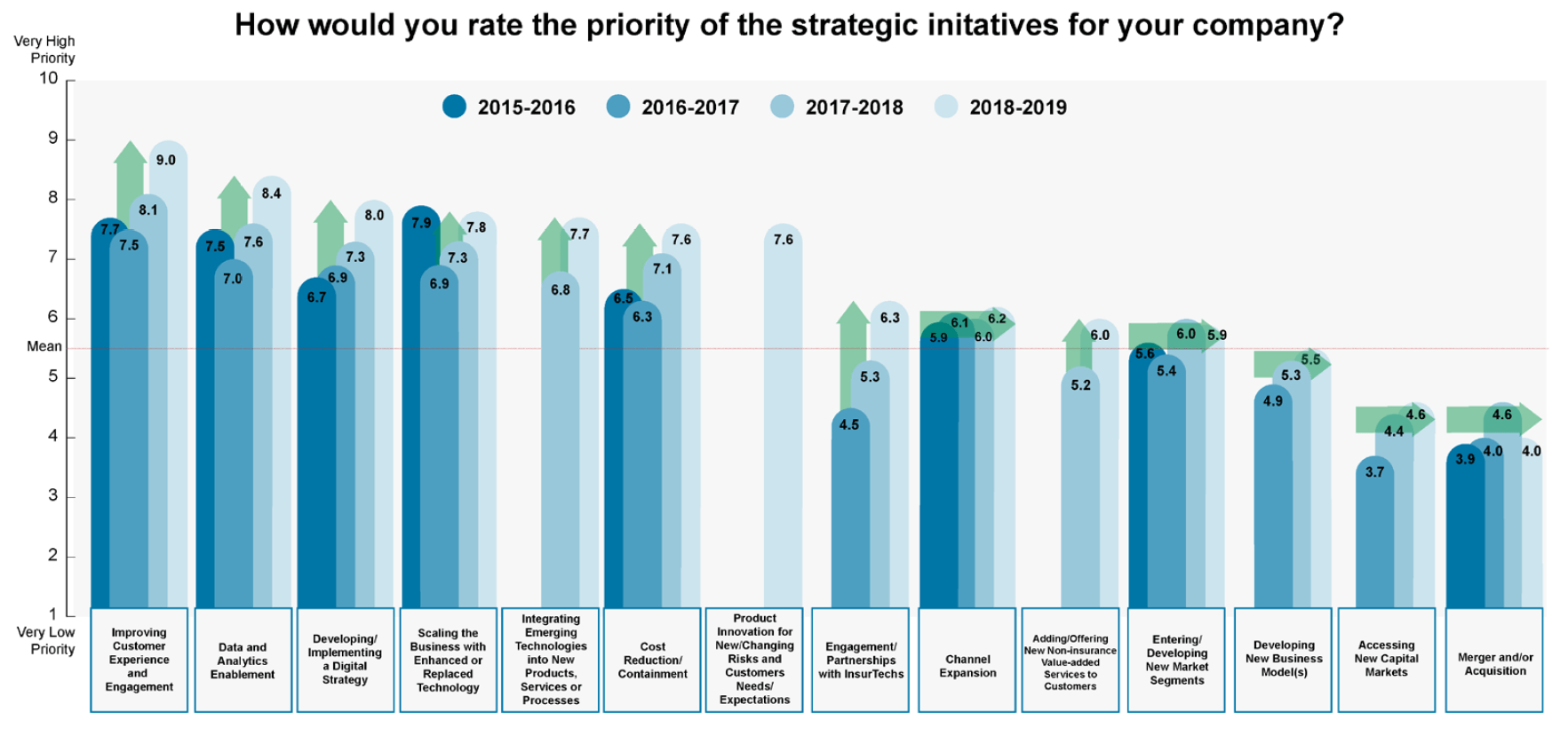

According to our Strategic Priorities Report, Engagement and Partnerships with InsurTechsis a rapidly growing priority. In 2016, it was rated a 4.5 (on a scale of 10). In 2018, it had jumped up to a 6.3 — one of the largest increases (29%) in our multi-year study of insurer priorities. (See Figure 1.)

Figure 1

Figure 1

Second, insurers that are forward thinking are much more prepared by keeping their eyes open to market changes and new or emerging risk opportunities. Where are the new risks? How do insurers become experts at looking at future lifestyles and business trends and then rapidly assessing where new risks will occur? How can they then capitalize on those opportunities to protect and cover property and individuals that are affected by those risks? Though we may not have the answers to all of these questions, we can at least measure the prioritization of risk among insurers. In our first year measuring Product Innovation for New/Changing Risks and Customers’ Needs/Expectations, insurers considered this a very high priority, giving it a 7.6 rating.

How will our strategic priorities dictate our ability to help customers address new risks?

Looking ahead at potential new risks, anyone could probably create a list as long as their note pad. The September 2018 issueof Insurance Journal magazine listed 15 new risks that insurers should be considering. These included a broad spectrum of risk types including urban scooters, geopolitical instability, health and safety in delivery drivers, coastal flooding and privacy. And in our thought leadership report, A New Age of Insurance: Growth Opportunities for Commercial and Specialty Insurance in a Time of Market Disruption, we also identified the top 10 growth industries, for which many are technology-based and represent new risks. Though each one of these varied risks certainly contains its own list of insurance responses, many of them require the same levels of preparation across certain key insurance capabilities.

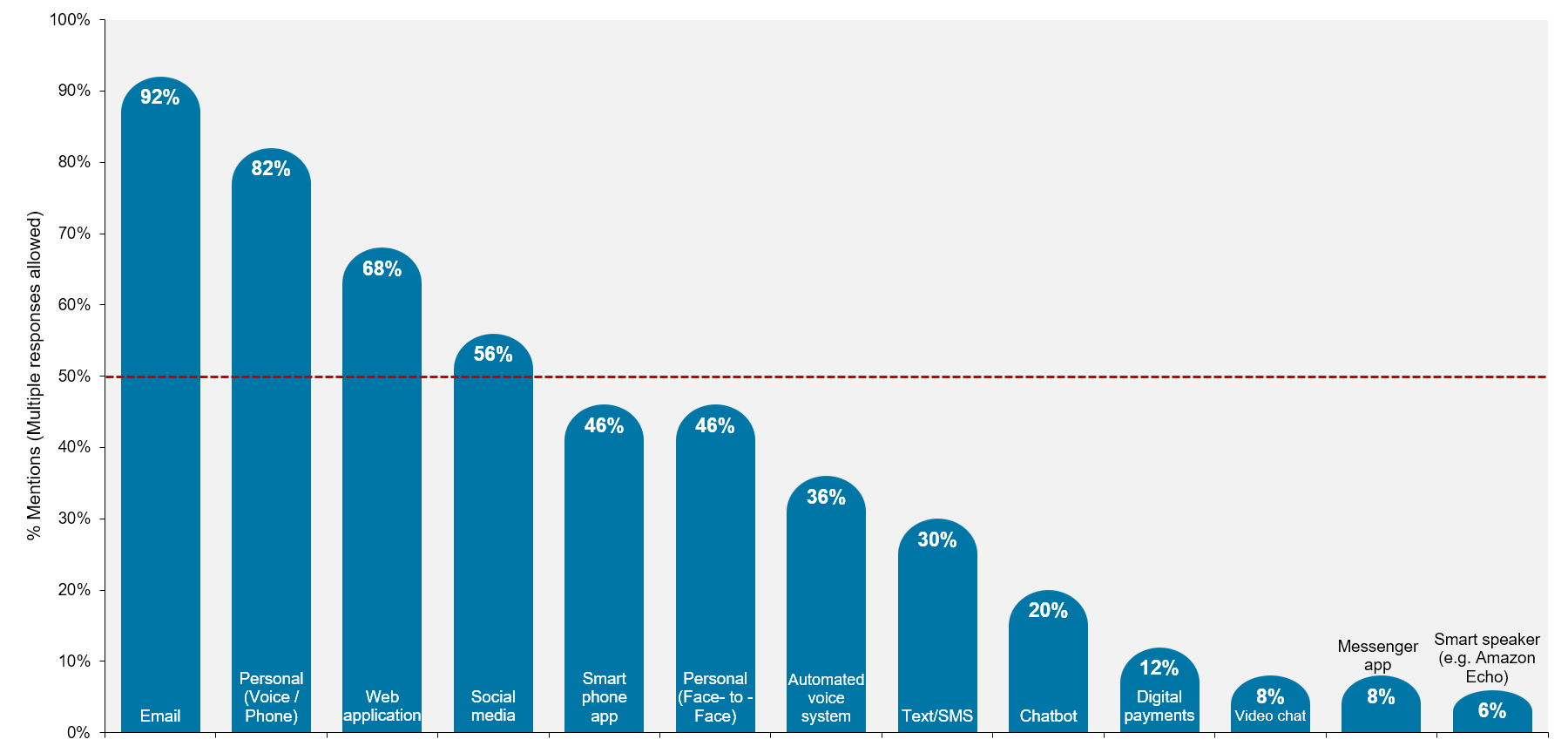

Let’s use coastal flooding as an example. Cross-referencing covered properties with GIS information and weather data, insurers should be able to institute protective measures that will inform property owners and minimize damage claims at the same time that it looks out for physical well-being. This capability requires linking policy data and automation with new sources of data and new communication tools. When the storm is coming, a time-sensitive policyholder may not receive an e-mail and may not pick up the phone. The most likely tool for vital communication will be mobile text, SMS messages or even Alexa. Are insurers tech-savvy enough to make this happen?

As a part of our Strategic Priorities survey, we measured Interaction Capabilities Offered to Customers. Surprisingly, only 30% of insurers have the ability to send a text or SMS message to a policyholder. At one time, texting may have been considered invasive. But, with a rapid decrease in mobile voice usage, customers are coming to see text communication and Alexa data as vital links between themselves and the companies that serve them. Text/SMS capability is crucial to the prevention of risk in order to accomplish timely communication. It is a must-have tool within the insurance ecosystem.

Figure 2

Figure 2

How likely is it that we will need an ecosystem of numerous partnerships to respond to new risks?

Partnerships and ecosystems in insurance are as important as oxygen is to survival. This is because the nature of managing risk is requiring specialized technologies, a plethora of data sources, a growing list of service channels, new expertise and improved systems to handle insurance’s complexities. To see the realities of risk, we need more minds, eyes and hands.

Let’s look at an example of new risks caused by the gig economy and a trend in commercial freight. Traditional truck drivers are aging out of the industry. Point-to-point rapid shipping is in increased demand. Independent “hot shot” drivers use their unregulated personal pick-up trucks to haul oversized trailers. Anyone can be a hot shot driver. Most drivers don’t need a CDL.

Because the freight is hauled with a personal vehicle, many insurance companies would never know that their policyholder is carrying additional risk. Policyholder health and life insurance are also affected. Gig jobs that involve driving for long hours will negatively affect health and well-being, and they represent a safety risk. Does the auto insurer know that the vehicle is being used for commercial purposes where the driver is compensated for fast delivery? Does a life insurer know that their insured is driving for 12 hours at a time, six days a week? Does the health insurer recognize the risk of chronic disorders from a new sedentary lifestyle?

To cope with the new risks, insurers will need to adopt an ecosystem approach for risk management. With industry-wide partnerships, ecosystems will enhance the ability of insurers to keep tabs on these changes and respond appropriately. The goal may someday be to provide “enterprise-wide” risk management for individuals or businesses in a similar fashion to the way that credit bureaus keep tabs on creditworthiness. Insurance ecosystems, comprised of InsurTech, traditional 3rdparty data providers, distributors, other insurers and more will paint realistic pictures of risk and help insurers to respond with protective coverage and communications.

You could make a case that insurance ecosystems, because of their capabilities and flexibility, will be the greatest security against the new risks.

As we outlined in our report, InsurTech: Energizing the Shift to Digital Insurance 2.0, a key success factor in Digital Insurance 2.0 is a recognition that it is no longer desirable or optimal to “go it alone,” particularly in a “platform economy” where ecosystems are a multiplier effect for growth. Most insurers agree on the value, with 80% indicating they are involved with at least one partnership or ecosystem.

Almost 90% of large insurance companies view InsurTechs as partners or solution providers, with some of them also considering InsurTechs as potential acquisitions.

Of course, managing risks is just one of the many strategic priorities that insurers must pursue as they push toward the future and Digital Insurance 2.0. Is your organization prioritizing efforts that will move it toward the future and proactively handle the new risks? For a deeper look at Strategic Priorities across the full spectrum of insurance initiatives, be sure to download Strategic Priorities 2019today.