Blog

The Knowing-Doing Gap: Does Insurer Size Matter on the Path to Digital Insurance 2.0?

We often look at large insurance companies as having more complexity, making it more challenging for them to change, yet having the resources, both people and funding, to act on opportunities. Conversely, smaller insurance companies are often nimbler and able to act on opportunities, yet may not have the resources to take advantage of opportunities. Is this reality?

Majesco’s recent analysis of the Knowing, Planning and Doing components by large insurers (over $1 billion in DWP) versus mid-market (under $1 billion), both confirms and challenges some of these assumptions. You can read the full contents of our report in Strategic Priorities 2018: The Digital Insurance 2.0 Gap.

Why do we look at Knowing, Planning and Doing?

When it comes to implementation of solutions to enable business strategies within insurance organizations, Knowing, Planning and Doing are three benchmark phases. In any trend, we can track timeframes and “intent to implement,” filtering out areas where insurers have a knowledge, but have no intent to follow through. If a trend moves from Knowing to Planning, that’s a step in the right direction. Plenty of efforts, however, never make it out of the planning stage and into full execution. The proof is in the corporate priorities and budget. Does an activity receive the funding to move forward both from the Knowing to Planning and Planning to Doing phases? We identified the disparity between Knowing, Planning and Doing as the Knowing-Doing Gap. It is universal across all sizes of organizations and you can read about it in one of our recent blogs, Shrinking the Knowing-Doing Gap to Drive Growth and Innovation.

With this context in mind, Majesco surveyed insurance executives, looking at a number of trends and criteria across Knowing, Planning and Doing — adding in the additional criteria of large insurers versus mid-market insurers. We looked at two contrary theories. First, that in some cases, mid-market insurers would find it easier to move projects into the Planning and Doing phases, simply because of their ability to remain focused and agile, plus their traditional ability to avoid operational complexity. Second, we considered a counter-theory that large insurers with greater resources and perhaps more “discretionary” resources, could jump ahead with increased and effective utilization.

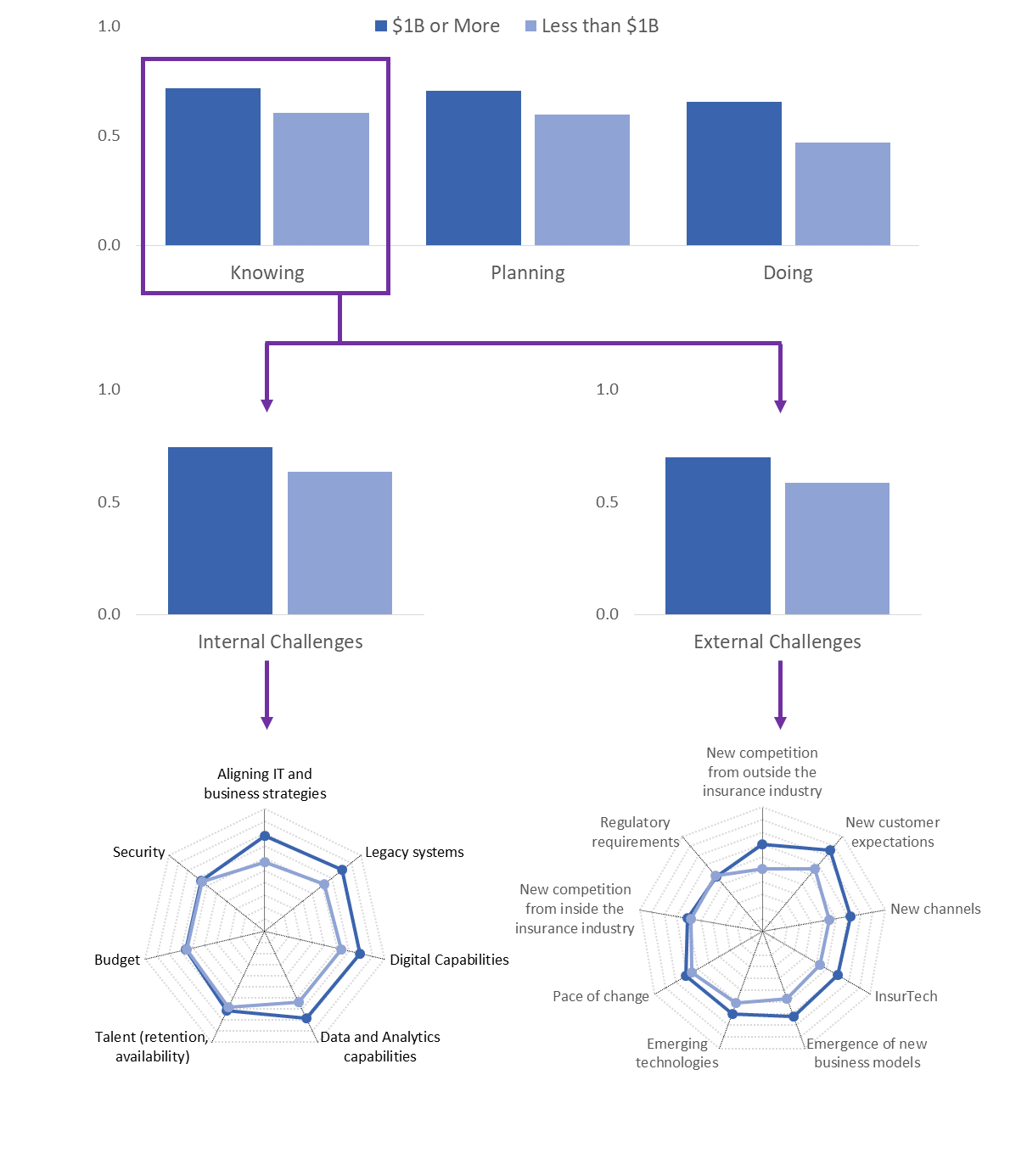

Knowing — Measuring Levels of Concern

In designing our survey, we wanted to not only find out what insurers “know,” but we also wanted to assess their levels of concern for trends that may impact insurers both internally and externally. When we looked at the level of concern for internal challenges we found the following:

- Digital capabilities

- Talent

- Data and Analytics capabilities

- Legacy systems

- Security

- Budget

- Aligning IT and business strategies

Among these internal challenges, 71% (5 of 7) receive higher levels of concern from larger insurers, reflecting their complexity.

Only Security and Budget garner equal levels of concern between large and mid-size insurers. In particular, aligning business and IT strategies stands out, with larger insurers placing higher priority on this area (See Figure 1).

We then reviewed the level of concern over external challenges, finding the following challenges:

- New customer expectations

- Pace of change

- Emerging technologies

- Emergence of new business models

- New channels

- InsurTech

- New competition from inside the insurance industry

- New competition from outside the insurance industry

- Regulatory requirements

With external challenges, the contrast is even greater, with 88% (8 of 9) of the areas ranking higher for larger insurers, with regulatory changes the only common issue for both. The lower levels of concern for external challenges highlight a very internal focus for mid-market insurers, a significant blind spot and risk to their organizations.

This disparity between large and mid-market insurers is amplified in the external challenges, highlighting the significant risk for mid-market insurers’ ability to understand, plan and shift to Digital Insurance 2.0. The lack of response will likely result in a less competitive position, declines in customer retention, limited growth and growing irrelevance within a fast changing marketplace.

Figure 1: “Knowing” gaps between large and mid-market insurers

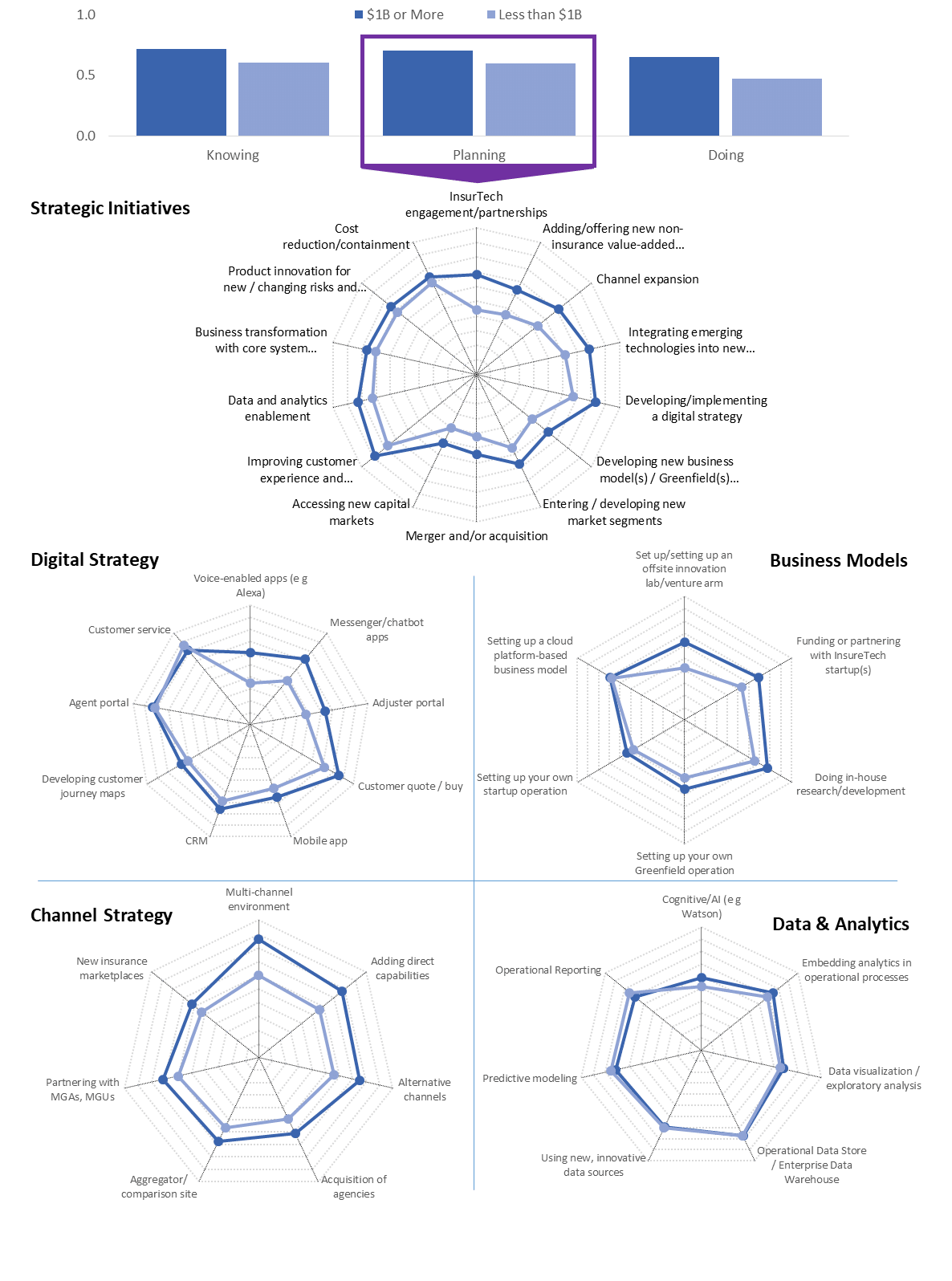

Planning — Developing Strategic Priorities

When looking at the state of their companies over the previous year, insurers continue to be on the positive side of the scale when assessing five key strategic areas: growth, legacy replacement, new products, expanding channels and new business models. We examined the details of strategic initiatives that are currently in the Planning phase for both Large and Mid-Market insurers, measuring dozens of strategic indicators.

From a planning perspective, the Large to Mid-market gap is further exemplified with mid-market insurers lagging behind larger insurers across all of the strategic initiatives (Figure 2) we identified. Only three of the initiatives (Cost reduction / containment, Product innovation and Business transformation with core systems replacement) are relatively close in priority, highlighting a significant gap between them, further demonstrating the difference in focus … with mid-market on Insurance 1.0 vs. large on Digital Insurance 2.0.

From a Digital Strategy view, larger insurers outpace mid-market insurers in the key digital priority areas, except for traditional ones like Customer service and Agent portal. Mobile apps, Chatbots, Voice-enabled apps and Customer quote/buy receive higher priority from larger insurers, placing mid-market insurers behind in an increasingly digitally-enabled world.

Likewise, both New Business Models and Channel Strategy are overwhelmingly more important to larger insurers. Setting up an innovation site, Partnering with InsurTech, and Setting up a greenfield, highlight how larger insurers are focused on innovation, test and learn and experimentation of new models, products and channels to reach new, unservered or underserved markets. Further emphasizing this, larger insurers’ strong focus across all the channel options provides them a broader and varied reach to the market, critical for growth.

Figure 2: “Planning” gaps between large and mid-market insurers

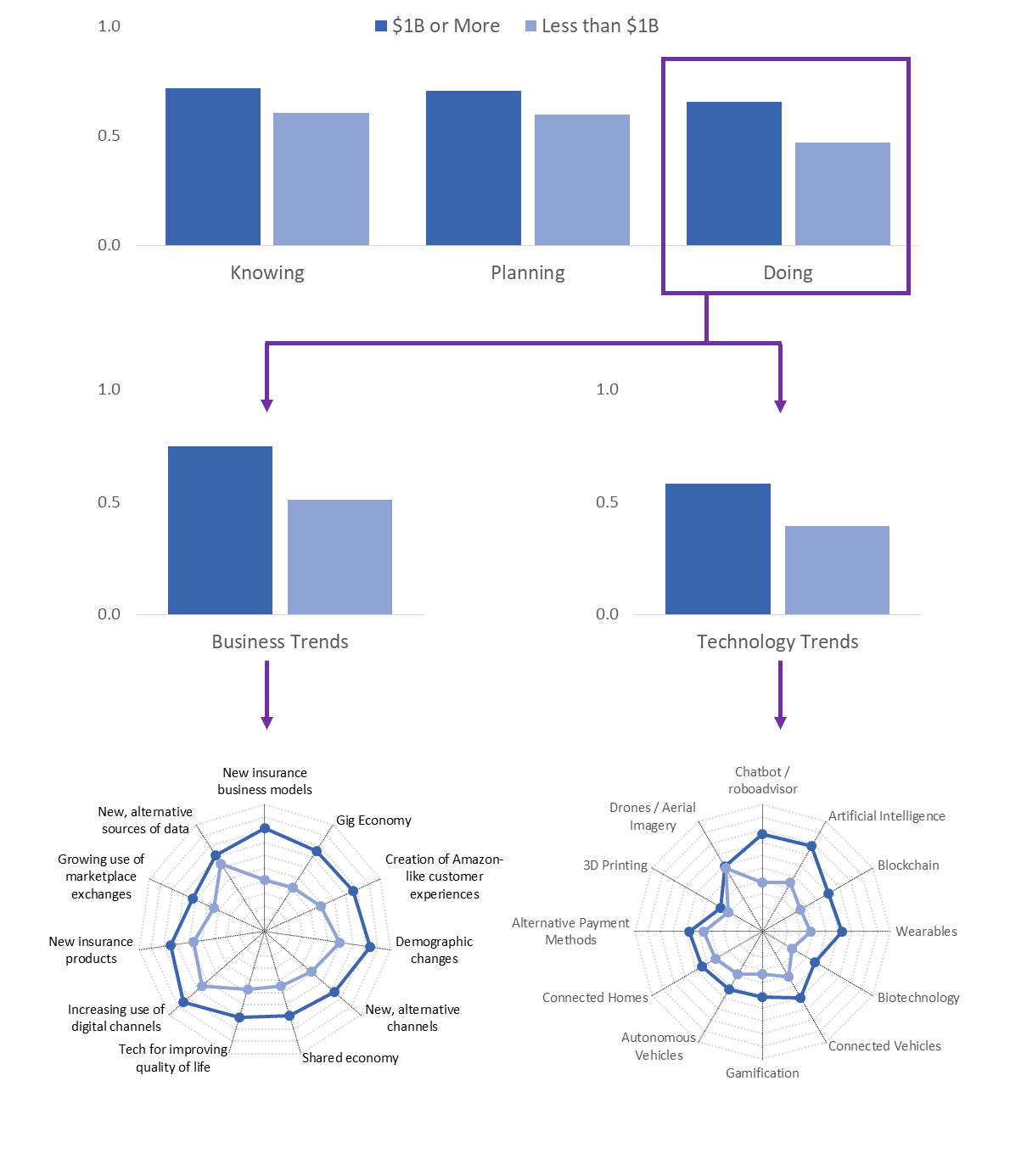

Doing — Closing the Gap to Digital Insurance 2.0

The Doing view (See Figure 3) illuminates the large vs. mid-market gap with 100% of the business trends and 91% (11 of 12) of the technology trends receiving more active levels of response from larger insurers, reflecting the breadth and depth of the activity in which they are engaging, whether through experimentation or actual implementation. Extremely concerning is the “out of touch” view of the mid-market insurers to the business trends, often lagging large insurers by 40% or more. This continues with the technology trends, with the exception of drones.

Figure 3: “Doing” gaps between large and mid-market insurers

The results appear to indicate that larger insurance companies are leveraging their strength in resources, both people and funding, to act on market changes. Conversely, mid-market insurance companies are not acting on these changes, likely due to their more limited resources. This requires them to stake out the priority areas where they can leverage their key strength of nimbleness, then take advantage of these opportunities and find ways to allocate resources to them. Not doing so is not an option.

We live in a rapidly changing marketplace. We must adapt to new business models, new products, new channels, and new customer expectations by investing in and utilizing new technologies and competing on a broader market basis due to shifting market boundaries and new competitors. It’s no surprise that insurance companies of varying sizes view these areas differently. Regardless, every insurer must leverage their strengths to address these areas, based on their unique business strategies to begin to rapidly shift to Digital Insurance 2.0 and ensure growth. Being a fast follower will no longer be an advantage with the pace of change we are experiencing. Preparing for and embracing the changes by Knowing, Planning and Doing is more important than ever.

To dive deeper into how relevant gaps are impacting insurers, be sure to download Strategic Priorities 2018: The Digital Insurance 2.0 Gap.