Blog

Technology is Powering Insurance Business Transformation

Last week, Samsung released its latest tech gadget — a flip phone.

Updated flip phones are giving many of us a sense of déjà vu. (“Didn’t we do this already?”) Or a sense of “those are used only by non-techies” like Leroy Gibbs on NCIS, one of my favorite shows and characters. Admittedly, smart phones have been growing larger. Their massive screens have the cool factor but holding them can be unwieldy. Some of them are close enough to tablet-size to make us wonder just what it is we’re carrying around with us — laptop? camera? TV? So, the current solution seems to be to fold it all over again. Make what’s big seem small. Take the large functionality and reduce it into a package that fits our pocket and style.

This is remarkably close to what is happening with the legacy systems that have grown highly functional at the expense of size and, well…expense. Insurers are still needing to add digital capabilities, but the system is threatening to outgrow the business by dragging on the bottom line. If the technology that insurers need can’t fit into the traditional system, insurers need to change the size of the package. The same technologies, or better, can be ‘folded’ into cloud-based, SaaS solutions that will lighten the load at the same time that they expand capabilities. This is just another picture of how platform technologies will transform the way we work and how they are transforming the business of insurance. Platforms will give us what we need in a package that fits corporate pockets.

In Majesco’s latest thought-leadership report, Strategic Priorities: Insurance Transformation Gains Momentum, we look closely at how technology is driving transformation and how platforms have become the digital enabler. In our last blog, we saw that technology is hindering some insurers in their quest to move forward. Looking at the results from our Strategic Priorities Survey, we found that the three top challenges for P&C and L&A multi-line insurers are: legacy systems, talent and budget. All three areas stand to benefit from technology-powered business transformation. In this blog, we’ll look closely at business transformation from the ground level. What percentage of insurers are in the process of transforming with technology? Which systems are they prioritizing? Which platform technologies do they consider integral to their current and future business model?

Leaders Have Linked Tech Investment to Lower Expenses

Leading insurers are investing in technology to transform the business to better serve customers, launch innovative new products, expand market reach with new channels and to optimize operations with technology … ultimately reshaping today’s business while creating tomorrow’s at the same time. As noted in the December 2019 McKinsey article, “The insurance switch: Technology will reshape operations,” more insurers are investing in SaaS applications as well as other technologies like analytics, AI, microservices, APIs and more. But they are also finding fringe benefits in their bottom line. The article notes that these technologies are helping digital-first companies shrink their expense ratios to almost 40% lower than traditional P&C insurers.[i]

This highlights why insurance leaders must invest time and resources into those areas that will ensure they remain leaders in the future of insurance. As customer, market boundary and technology trends challenge long-held foundational assumptions and elements of the insurance business, the leaders are those who have grasped the significance of what lies on the horizon and how it relates to their current investments.

Current State of Core Systems: Platform vs. Non-Platform

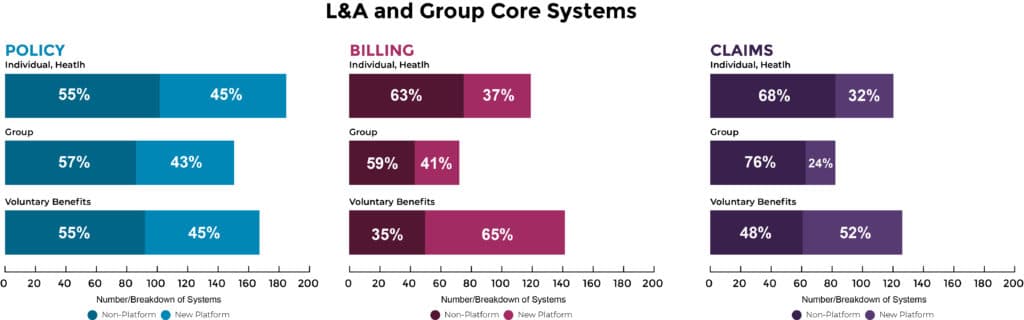

Within Majesco’s 2019-2020 Strategic Priorities Survey responses, we wanted to understand where insurers were in their core system transformation, defining four answers within two simple concepts: Platform and Non-Platform.

Platform

- Cloud-enabled, API and SaaS-based solutions.

- Next-gen, cloud-native, API and microservices solutions.

Non-Platform

- Old, monolithic legacy solutions.

- Modern on-premise solutions.

We asked insurers to respond by core component and line of business for each of the four categories.

What we found is that there are significantly more Non-Platform solutions still being used by insurers, limiting their ability to support new business models, new products, and customer experiences, leverage ecosystems, and much more.

To understand just how prevalent Non-Platform solutions are, we analyzed the core systems data based on P&C, L&A and Group and New/Innovative Product insurer segments. Overwhelmingly, with a few exceptions, such as specialty insurance, both P&C and L&A and Group are operating with Non-Platform solutions at nearly 60%.

In particular, claims systems are the highest representation for Non-Platforms, at nearly 70%. This is not surprising given they were the first solutions transformed for P&C and most L&A and Group claims solutions were built in-house decades ago. Policy and billing solutions, however, are nearing a 50-50 Platform vs. Non-Platform basis.

When you look at the strategic priorities around innovation, new products and new business models – selecting a Platform-based policy and/or billing solution is crucial to support these initiatives from a time, cost, agility and innovation perspective. Based on the shift in speed and cost, insurers will increasingly be open to multiple policy and billing solutions to support new strategic initiatives – from startups and greenfields to new markets and products. The days of a single solution are likely over.

The strategic imperative to use “future-focused” capabilities that take advantage of new computing trends like AI, microservices, and the connected world will only increase, accelerating the demand for Platform solutions.

Figure 1: Status of P&C core systems

Figure 2: Status of L&A and Group core systems

We also found that new products and services are more likely being placed on Platform-based solutions, in the 60-70%+ range – nearly a complete flip from current business lines. Most traditional core systems are “too heavy” to handle the real-time flow of data, the need for continuous underwriting, the ability to bill in real-time or for new services, and to adjudicate and pay claims differently. This is where Cloud-enabled or cloud-native, API, microservices and SaaS based platforms provide a new set of technical capabilities to support the rapid development and launch of new products cost effectively, a significant competitive advantage for companies using Platform solutions.

Moving to Platform Technologies

The heart of the insurance platform is an orchestration of next gen technologies, including cloud-native computing, microservices, APIs, new data sources, and artificial intelligence and machine learning, coupled with an ecosystem of partners that provide innovative or complementary products and services or link to new channels to extend reach. With this unified combination of components, insurers can shift from being the “owners of complex core systems” (unwieldy, less mobile systems) to become the “owners of greater technical agility and flexibility, digital fluency, innovation and speed to value” (‘folded’ agile systems with uncompromised power) required in today’s pace of change.

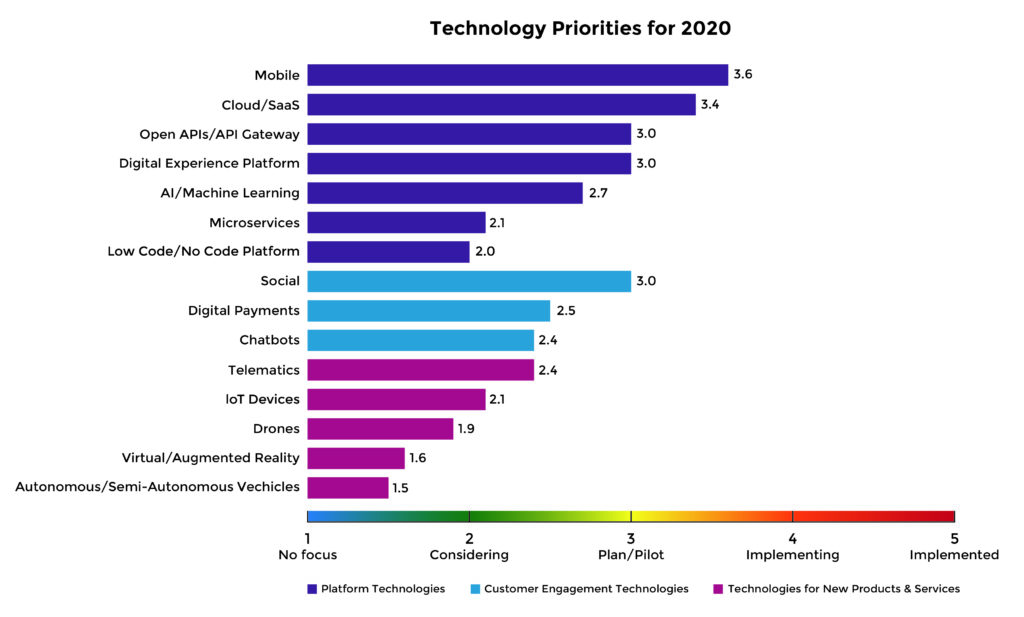

Similar to last year, platform technologies are at the top of insurers’ technology priorities for 2020. (See Fig. 3) Digital Experience Platform, a new priority and a key part of platforms, also ranked high. However, another new priority for this year, no code / low code platform, is also a key component/benefit of platform usage and it somehow ranked lower. This could be due to the relative novelty of the topic within business circles and the current lack of no code/low code solutions for the industry.

Educating the Business

When comparing IT versus Business responses, IT had a much higher rating on three “pure technology” items – microservices, APIs, and low/no code. Given the importance of these technologies and the rapid adoption to transform the business, educating the business on the value becomes critically important. Benefits and use cases can help the business grasp the need, instead of writing them off as “esoteric IT things”.

Interestingly, nearly all of the technology priorities gained in importance this year, highlighting the rapid maturation and adoption of technologies.

Figure 3: Technologies important to the business model

In analyzing the technology priorities by industry tiers, Cloud/SaaS is equally important to all three tiers. However, the largest companies lead in many of the technologies, including platform technologies, placing them at an advantage in a technology-driven world. As such, mid and small tier insurers need to develop strategies and partnerships that will help them rapidly experiment and adopt these technologies to stay competitive.

Expectations for Next 3 Years

Companies reported strong increases in all categories of strategic activities, with the exception of legacy replacement, which decreased when compared to the last year’s report. That same pattern continues in the view for the next 3 years. Why the decline in legacy replacement when insurers have significant Non-Platform solutions?

In some cases, such as with modern on-premise solutions, rather than replace, insurers will instead leverage newer technologies such as digital experience platforms and no code / low code platforms to bring digital capabilities to the existing business – providing speed of operations, while at the same time standing up a new policy and billing solution for the business of the future – providing speed of innovation. The days of expensive, long legacy replacement projects are limited. This is promising as it indicates a move into the path of creating the business of the future.

When comparing responses for the state of the company last year versus the next three years, the ratings suggest insurers have substantial optimism on all measures, highlighting progress toward the future of insurance. In particular, the largest expected improvements are in channel expansion, new business models and rapid growth — a focus on the speed of innovation and the future of the business.

With five years of data, the trends reinforce our view and hypotheses regarding how insurers view the industry and their place within it.

- First, insurers have an increasing maturity and deeper understanding of the opportunities (and challenges) associated with the future of insurance, resulting in realistic and pragmatic expectations on what they need to do to move forward.

- Second, real results and progress are being made across many areas, but the amount of progress varies depending on one’s status as a Leader, Follower or Laggard – which will have significant influence on insurers’ ability to be relevant in the future of insurance.

- Third, Leaders continue to expand the gap with Laggards (62%) and Followers (21%), challenging their potential relevance in a fast-paced changing marketplace.

In our next blog, we’ll look at a snapshot of the gap between Leaders, Followers and Laggards. Just how large is the gap? Does the gap really matter? We’ll take a look at why it does matter, and we’ll see which steps Leaders are taking to widen the gap.

For a deep look at insurer responses in order to compare your organization, download Strategic Priorities: Insurance Transformation Gains Momentum, today.

[i] Krishnakanthan, Krish, et al. “The insurance switch: Technology will reshape operations,” McKinsey, December 2019, https://www.mckinsey.com/industries/financial-services/our-insights/the-insurance-switch-technology-will-reshape-operations