Blog

Strategic Priorities: Where are Insurance Leaders Placing Bets?

Insurance is a completely unique and interesting business when one considers that insurers make a profit by hedging their bets against risk. Insurers hold assets. They hope that claims aren’t high. Yet, they don’t really know the outcome of the coming year. They place their bets when they create their products and they may not know the complete results of their bets until years have gone by.

Living in Omaha where the “Oracle of Omaha” lives, Warren Buffett’s statements are well known and followed. In this year’s annual shareholder meeting, he highlighted the risk aspects for insurance:

“Danger always lurks. Mistakes in assessing insurance risks can be huge and can take many years – even decades – to surface and ripen. (Think asbestos.) A major catastrophe that will dwarf hurricanes Katrina and Michael will occur – perhaps tomorrow, perhaps many decades from now. “The Big One” may come from a traditional source, such as wind or earthquake, or it may be a total surprise involving, say, a cyberattack having disastrous consequences beyond anything insurers now contemplate. When such a mega-catastrophe strikes, Berkshire will get its share of the losses and they will be big – very big. Unlike many other insurers, however, handling the loss will not come close to straining our resources, and we will be eager to add to our business the next day.”

Insurance may not be a risky business, but it does contain risk.

The disruption of insurance, however, has placed a new type of bet in the insurance mix. You might call it a whole new game — the New Game of Insurance. In the New Game, insurers place bets by launching new business models, products and services. They bet when they branch out into uncharted markets with newly tested offerings and creating new customer experiences. They may place some bets on channel expansion, new partnerships, or legacy system replacement. These bets, like insurance itself, can feel risky, but it can be argued that the odds are dramatically greater for those who choose to place these bets than for those who choose to not bet at all. In the New Game, choosing the risk may lead to security and choosing “security” may lead to the risk.

In a December 2018 Boston Consulting Group (BCG) article on creating value from disruption, the authors describe how some companies successfully navigated disruption— earning the title, “thrivers.”[i] It states that successful reinvention requires making a large bet—one that can overcome the drag of the old way of doing things. Making that big bet requires leadership, confidence and expertise to eliminate the “knowing – doing” gap. We see big bets being made in new business models, products and services from both InsurTech and incumbent insurer leaders who are “early responders,” capturing customer and market attention.

As noted in the BCG article, those who wait will need to make bigger and potentially riskier bets to gain parity with the “early responders.” As “early responders” gain growth momentum, the “knowing –doing” gap we have identified in our Strategic Priorities research grows, leaving Followers and Laggards with dwindling options and relevancy in a fast-changing market as the Leaders who placed the bets stand on stable ground.

If this is the case, then all insurers should examine where the insurance Leaders are placing their bets.

We can find this information in Majesco’s latest thought-leadership report, Strategic Priorities 2020: Insurance Transformation Gains Momentum. The Strategic Priorities report sheds light on the last five years of strategic activity among P&C and L&A insurers. By examining their survey results, Majesco has been able to follow the Leaders, Followers and Laggards through many steps of recognition, planning and change that we’ve termed the Knowing-Planning-Doing continuum. These assessments allow us to chart the gaps that have been growing between Leaders and all those who follow, while at the same time we have been able to see specifically what Leaders are doing to grow the gap and stay in the lead. Today, we’ll share insights on how and where Leaders are placing their bets.

Leaders Are Looking at the Full Table of Options

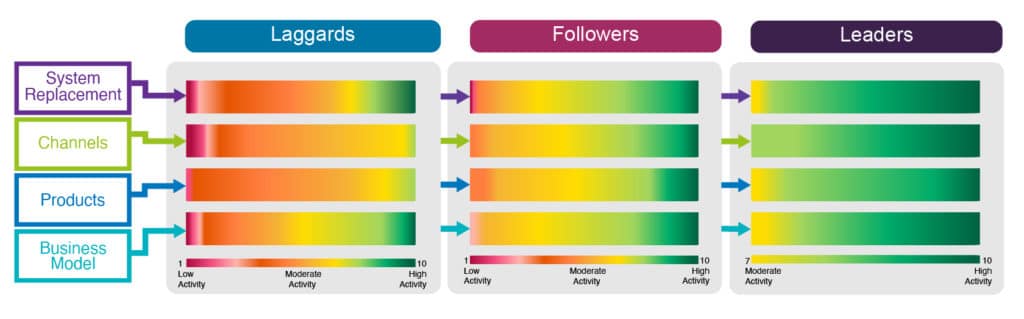

Majesco’s survey results point to the fact that Leaders, Followers and Laggards hold distinctly different outlooks regarding how they are or are not creating their futures. Leaders, Followers and Laggards are placed into their groupings based upon the strength and consistency of their expectations over the next three years across four areas: new business model development, new product development, channel expansion and system replacement.

Majesco found within its surveys that Leaders are more interested in placing bets within all four areas compared to Followers and Laggards. Most surprisingly, Laggards and Followers are less concerned about replacing systems than in previous years, particularly given the high percentage of Non-Platform solutions used by insurers. In a moment, we’ll discuss how the Platform bet can make a tremendous difference in bridging the gap.

Figure 1

Details Over the Past Year

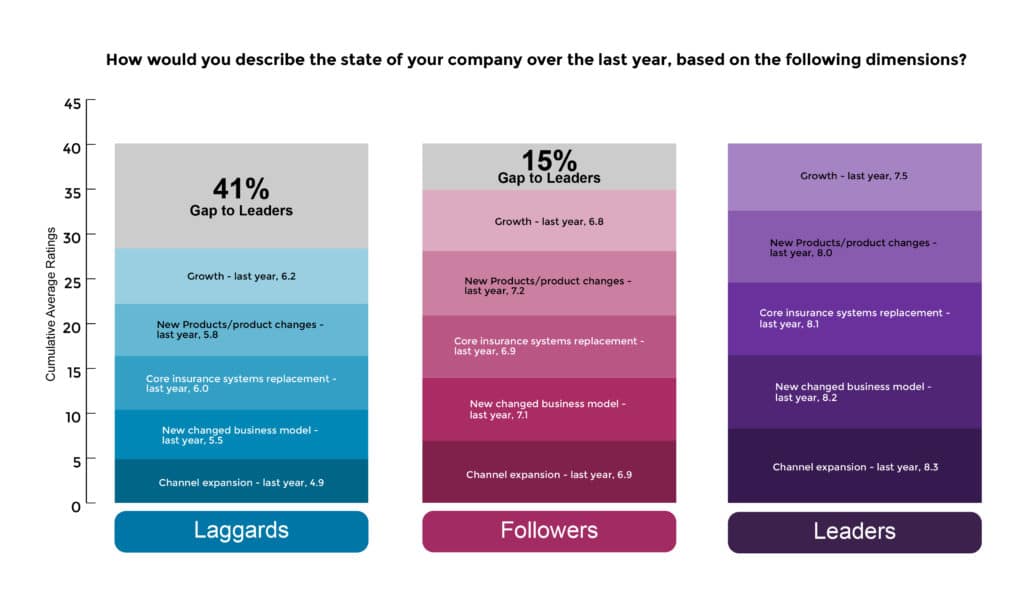

When comparing Leaders to Followers and Laggards in terms of describing the state of their companies over the past year, Leaders outpace both across all areas, as reflected in Figure 2. When you look at the details, the following stands out for Leaders:

- Leaders are expanding channels at a staggering rate of 20% more than Followers and 69% more than Laggards – expanding market reach and the ability to acquire and retain customers, and revenue.

- New products are greater by nearly 40% higher compared to Laggards but only 10% to Followers.

- New business models for Leaders are 49% higher than Laggards and nearly 15% more than Followers.

- Replacement of legacy core is greater by 35% as compared to Laggards and 17% for Followers.

Figure 2

The cumulative impact of these creates a gap for Laggards which is serious and potentially impossible to bridge, putting their future at significant risk. Fortunately, Followers are still in the game with options to compete. But staying focused on these areas will be crucial to avoid a widening gap for them.

Leaders Grasp Two-Speed Transformation

Compared to last year, Leaders’ understanding of internal challenges increased by nearly 15 points, increasing the gaps between them and Followers and Laggards. These challenges include areas such as Innovation, Legacy System Replacement, Increasing Competition from Traditional Competitors and New Competition from InsurTechs, as well as New Regulatory Requirements.

Leaders realize that to meet these challenges, they must focus on strategic initiatives that support the two-speed strategy: Speed of Operations, which is foundational and focused on modernizing and optimizing the existing business, and Speed of Innovation, which is transformative and focused on creating the future business. While there are gaps, they are relatively small and can be addressed.

Leaders Are Betting on Key Technologies

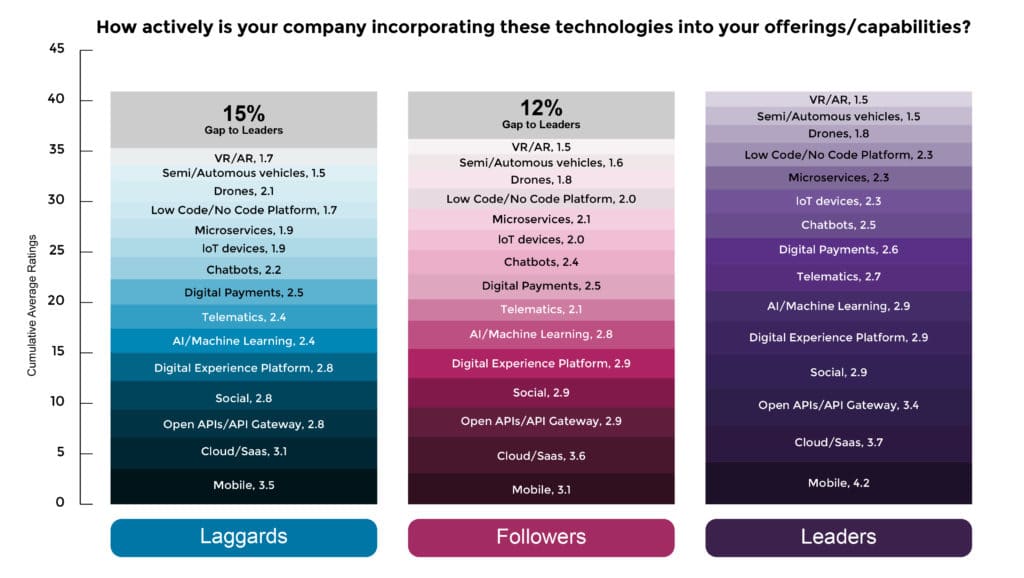

Technologies can have a dramatic impact on how Followers and Laggards catch up to Leaders, because the use of the latest technologies will necessitate the adoption of Platform technologies. The good news? Leaders are pointing the way with 64% using platform technologies, making Followers and Laggards take notice.

There are signs that at least within all technologies, Followers and Laggards may be closing the gap by placing bets of their own. Year over year, technology gaps for Laggards significantly decreased from 39% to 15%, an impressive move, while the Followers gap remained the same. This is encouraging and reflects a growing focus on experimentation.

Figure 3

Further segmentation of the technologies to those crucial for Platforms shows that Laggards have a significant gap within some crucial technologies, including: Open APIs/API Gateway, Mobile, and Digital Experience Platforms.

Going “All in” on Platforms

With the breadth and velocity of change in technologies, customer risk needs and engagement expectations, it is nearly impossible for any insurer to possess (nor afford) the acquisition of the resources and capabilities needed to keep up with the changes, let alone anticipate and stay ahead of them. A platform-based insurance business model that leverages platform technologies and a digital ecosystem of diverse third-party partner services completely removes this barrier. This is the one bet that Followers and Laggards can make that will close the gap quickly.

A platform-based insurance framework will allow insurers to choose from a variety of vetted partner apps and plug into them via APIs. This allows insurers to quickly and easily create customized MVP products and services that they can test with different market segments and quickly launch and scale if they are successful or iterate and test again if not. This is evident in that new, innovative products are more likely to be on platform (60% or more) versus non-platform solutions – a 180° difference from traditional products.

Leaders are Betting on Ecosystems

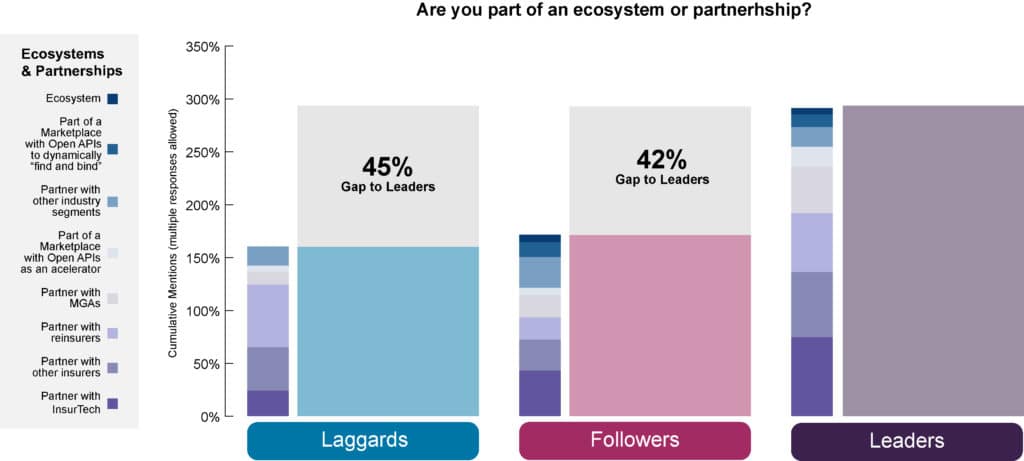

In last year’s Strategic Priorities survey, we found that Leaders significantly outpace Followers and Laggards by 45% in participation in ecosystems … a potentially game-changing difference. Leaders are looking to build ecosystems of partners across various different organizations – from the traditional approach with other insurers and reinsurers to new innovative ones with InsurTechs and embedding with other market segments like automotive, rideshare, and more to create “mobility ecosystems” that create a greater customer experience and value.

This shift to an outside-in view with ecosystems will fundamentally redefine the role of insurers in the marketplace and economy. In today’s new digital era, insurance will and must play within multiple ecosystems, rather than simply existing as an ecosystem unto itself.

Figure 4

Are Insurance Leaders Fearless?

Insurance has survived and thrived based on smart ways of dealing with risk. One could argue that fear drives insurance, both inside the organization (to hedge bets against risk) and outside the organization (informed customers and SMBs know that insurance takes away their fears). The question with transformation is not whether or not there is fear and risk involved (there is!), but what is an insurer’s response to it?

Leaders have taken the fear of competition and prioritized it over the fear of placing bets on technology, products, platforms and ecosystems. They are choosing to explore uncharted territories for new streams of profit instead of huddling at home in the illusive security of the status quo. They see the opportunities for growth and future relevance and are making every effort to capture them and rapidly move forward … embracing the wisdom of Warren Buffett -“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”[ii]

Do you see the opportunities unfolding? Is your organization ready to close the gap? Begin by looking into Majesco’s P&C Core Suite, Majesco’s L&A and Group Core Suite, and Majesco’s Digital1st® Platform technologies for all we have to offer. Then, be sure to view all of our most recent findings by downloading Strategic Priorities 2020: Insurance Transformation Gains Momentum.

[i] Farley, Sam, “Facing Disruption? The Need to Reinvent? Better Move Fast.” Boston Consulting Group, December 4, 2018

[ii] Bawden-Davis, Julie, 10 Powerful Personal Finance Quotes from Warren Buffett, Supermoney, April 15, 2019