Blog

Responding to Priorities: What Insurance Leaders are Doing Differently

What do you think of when you think of a leader? Do you think of a person — one who leads — or do you think of a company — one that is out in front of the competitive pack? Is there a relationship between the leader/person and the leader/company?

The answer, of course, is yes. In some ways, this is the story of the Strategic Priorities 2019 report from Majesco. Leaders prioritize their insurance organizations in ways that will drive them toward industry and market leadership. Our findings about leader/companies are instructive. They demonstrate how insurance leaders are prioritizing in order to position their companies for success. Through their survey answers we can clearly see common traits and priorities among leading insurers.

If you would like to be a leader/person within a leader/company, you will find the rest of this blog to be highly informative as we share some of the details with you.

Now is the time for effective leaders

InsurTech innovations sparked and heightened the need for definitive leadership. As the need for direction and action accelerates, the need for reasonable guidance accelerates right along with it. Without being rash, insurance leaders need to make sure they are moving the organization rapidly forward in order to capitalize on the market opportunities that are opening up. But they must prioritize efforts on those insurance capabilities that will help them reach the future of insurance.

Our Strategic Priorities survey began with high level questions surrounding the next three years and looked at insurer expectations across four areas:

- Business Model Development

- Product Development

- Channel Expansion

- Technology Upgrade/Replacement

The answers allowed us to classify insurers into groups (Leaders, Followers and Laggards) that reflected three paths to the future of insurance that we identified in last week’s blog Including:

- Modernize the Existing Business

- Optimize the Business Today

- Create a New Business for Tomorrow

Leaders are laser-focused on modernizing and optimizing their existing business while at the same time creating a new business for the future. Followers are not that far behind the Leaders, but primarily focused on modernizing and optimizing. However, Laggards are significantly behind, focusing primarily on modernizing their business with minimal optimization underway.

Further analysis identified additional key differences across other areas including: views on the technologies important for their businesses; their distribution channels and customer journeys; participation in partnerships and ecosystems; views on internal and external challenges and strategic initiatives; and responses to technologies and marketplace trends. We identify the following traits among the leaders.

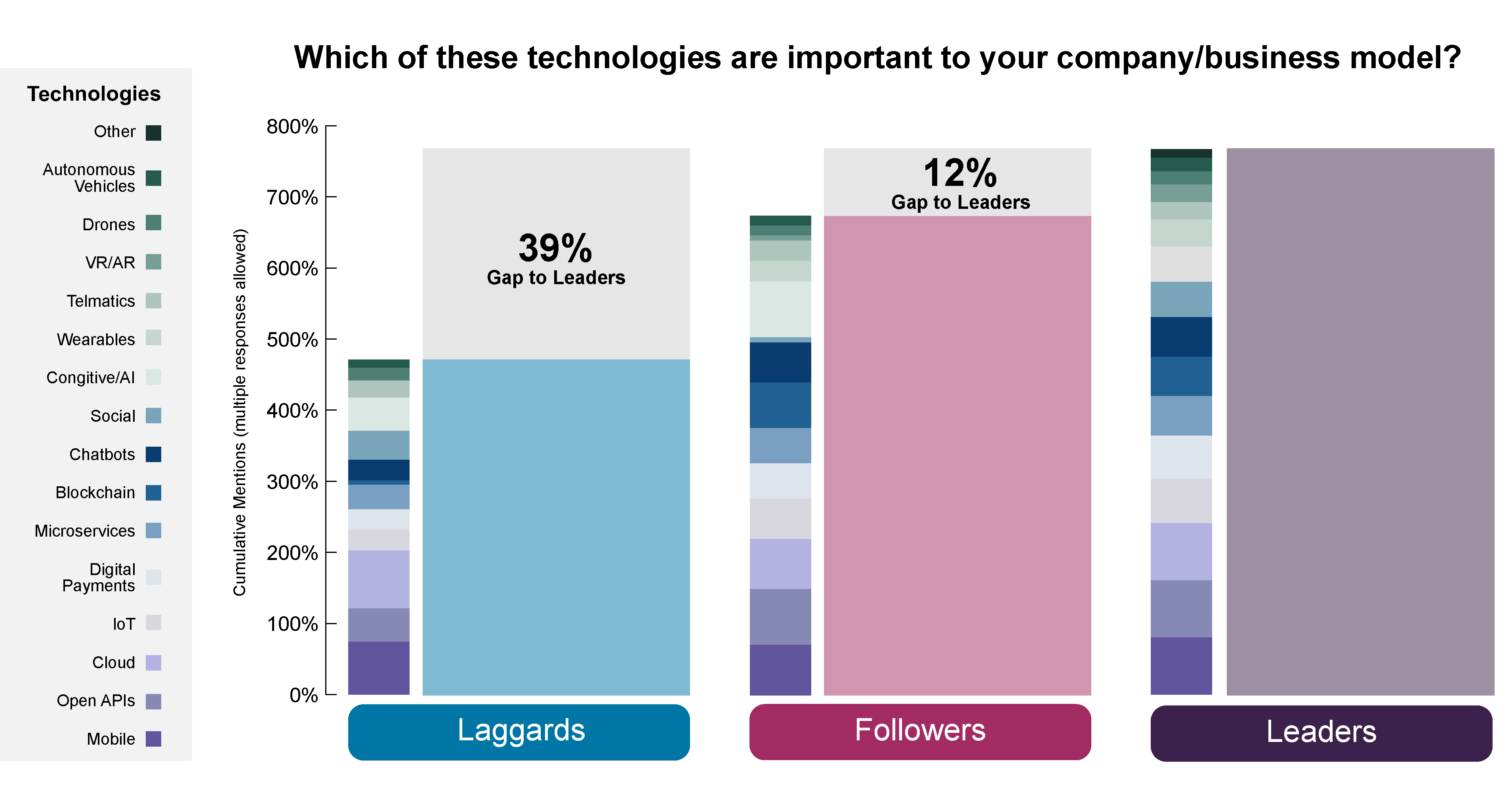

Leaders are Positioning for the API and Platform Economy

Leaders view a broader range of technologies as important to their companies, as seen in Figure 1. Followers, true to their name, are close behind. However, Laggards are strikingly 39% behind leaders, placing them at risk. Leaders surpass the others in key technologies that are foundational to the platform and API market shift, including open APIs, mobile, IoT, microservices and digital payments. This is significant given that a 2016 study by McKinsey noted that insurers who invest in more technology are performing 6% better than peers and growing twice as fast.[i]

Figure 1

Figure 1

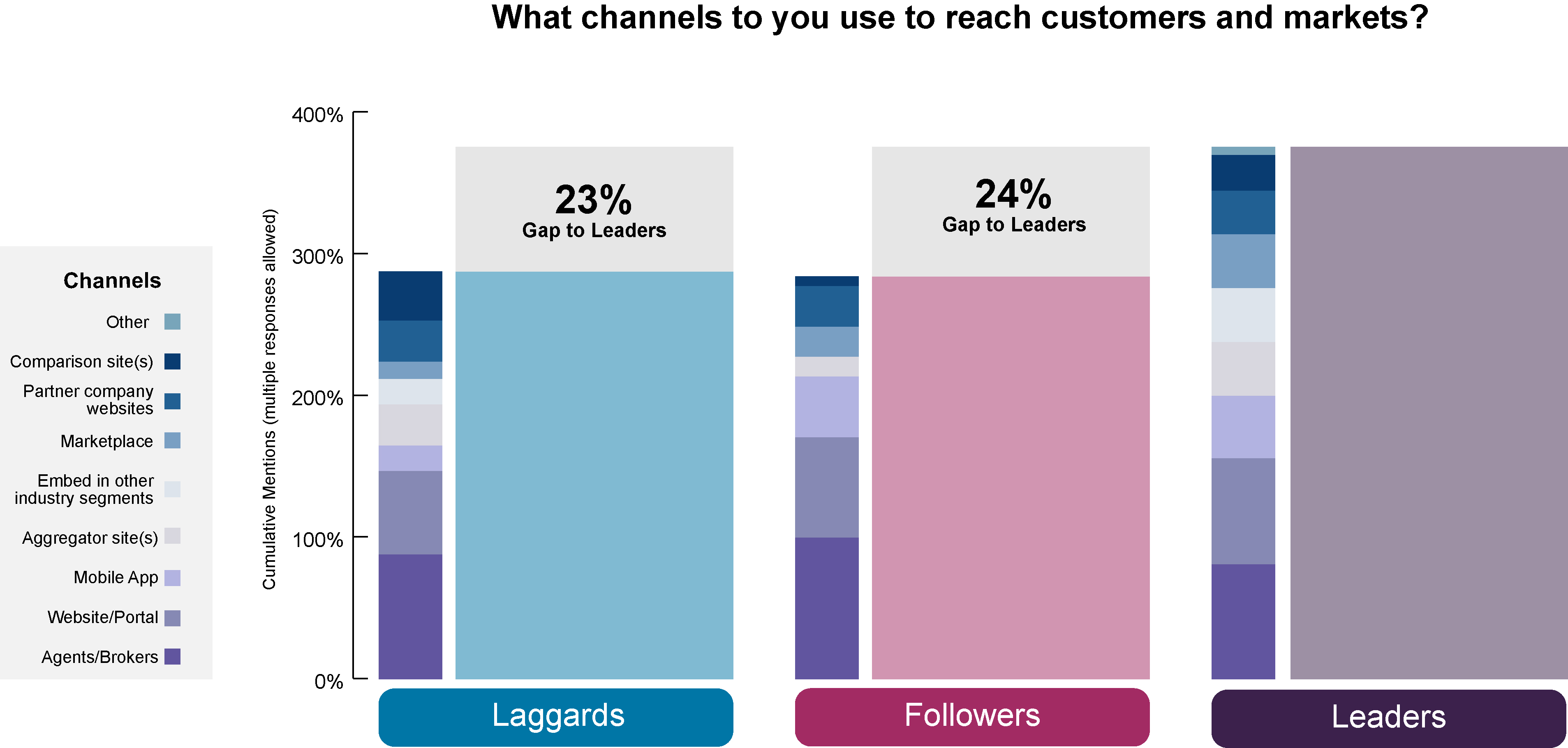

Leaders Have Extensive Distribution Strategies

As expected, all three segments are heavily focused on using the traditional channels of agents/brokers and website/portals, with Leaders and Followers also using mobile apps, as seen in Figure 2. However, Leaders outpace the other two segments by using a broader set of channels to expand market reach and enable their distribution strategies, including aggregators, embedding in other industry segments, and marketplaces.

Figure 2

Figure 2

While numerous studies continue to show that the agent channel is still dominant for buying insurance, it is also well understood that customer preferences and expectations are shifting to digital channels, driven by experiences with other industries and generational differences. Leaders and Followers are clearly aligned to a multi-channel, digital world.

In this strategic area, leadership must take a clear role in prioritization. Sales channels should be broad, but engagement channels should see even more priority in the near future. Every generation of customer is growing in their understanding and use of digital channels. Organizations that embrace Digital Insurance 2.0 will become familiar with smart phone apps, text/SMS, social media and the use of marketplaces. The survey results distinguished Leaders because they offer a much broader range of options, embracing both a multi-channel and a multi-engagement approach, ensuring a compelling, seamless and consistent customer experience.

If you are an insurance business leader, then it might be beneficial for you to develop an engagement – channel scorecard. Make a list! What are all of your channels? How do they engage with your customers? Are they integrated with each other to ensure a seamless customer experience? What channels aren’t you pursuing and why? Ask your customers what they want. The goal isn’t to add channels that don’t fit, but to be aware of what your customers are experiencing elsewhere during their customer journeys.

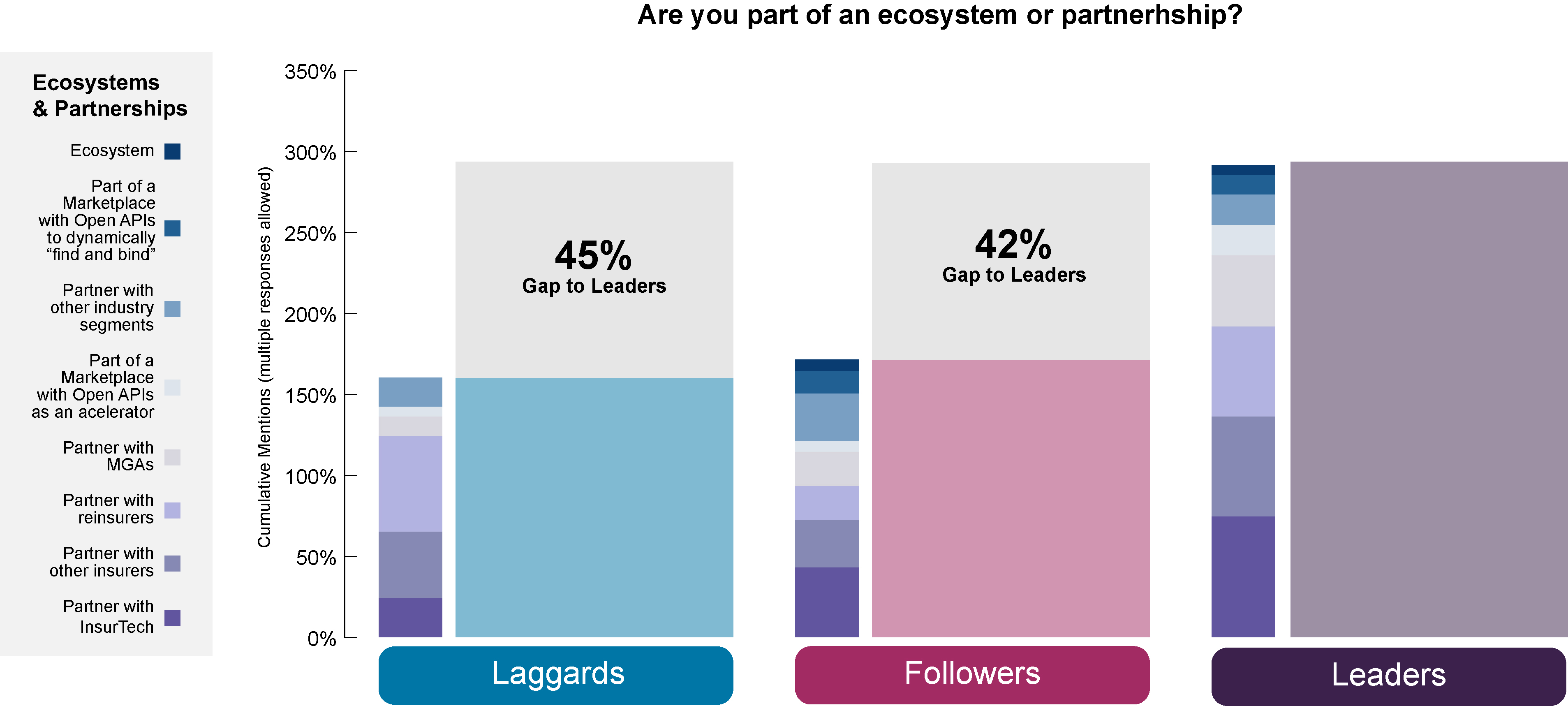

Leaders Embrace Partnerships, Ecosystems and InsurTech

Leaders embrace different ecosystems, partnership arrangements, and InsurTech more than the other two segments. Specifically, they partner more with other insurers, MGAs and InsurTechs that offer product, service and market options to strengthen their businesses and customer relationships through the growth multiplier effect achieved with ecosystems. Notably, Followers and Laggards are not involved in any of these arrangements.

A recent McKinsey report, states that, “Ecosystems will account for 30 percent of global revenues by 2025.”[ii] No matter which group you may identify with, this statistic should push any insurer toward an ecosystem approach.

Figure 3

Figure 3

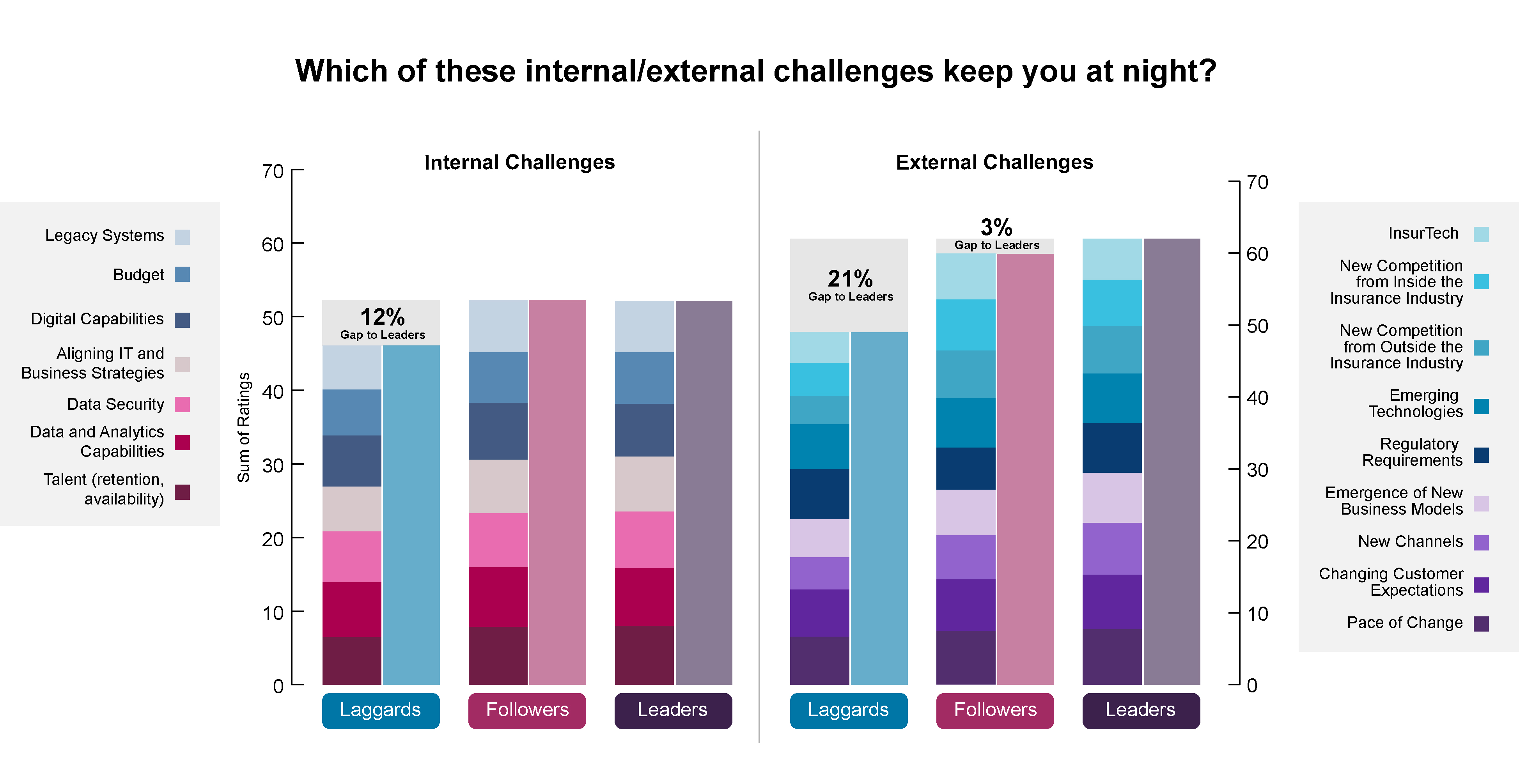

Leaders are More Aware of Internal and External Challenges

The awareness of challenges is another sign of good leadership. On 7 of 16 (43%) of the internal and external challenges, a pattern of increasing awareness and concern emerges between the levels of Laggard, Follower and Leader, reflecting motivational differences underlying their paths to the future. Of the seven, three (42%) are internal capabilities including talent, data security and alignment of Business and IT. But the four external issues (58%) reveal Leaders’ stronger recognition of the importance in creating a new business model.

Figure 4

Figure 4

Leaders are More Responsive to Technology and Marketplace Trends

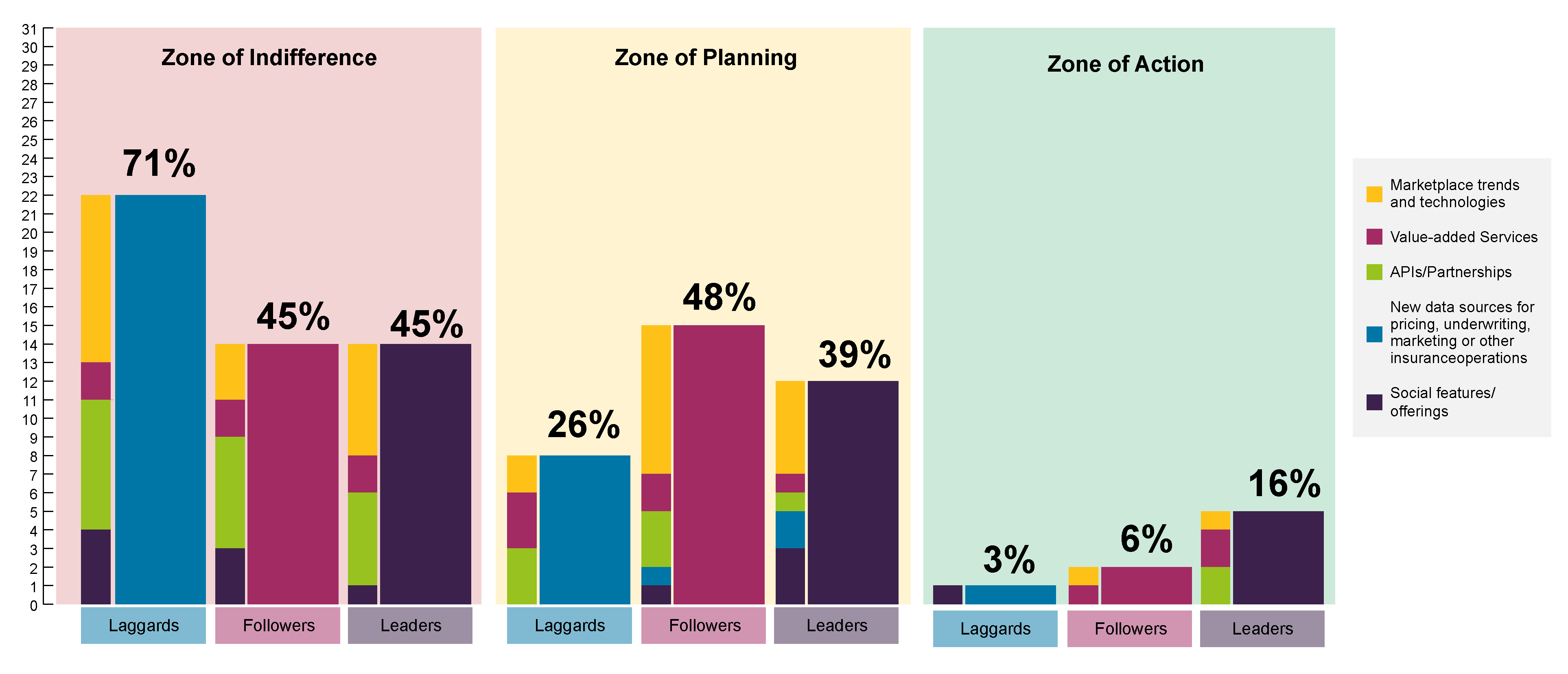

One of the most meaningful measurements is the link between seeing challenges and opportunities and acting upon them which we have called the “Knowing – Doing Gap” by looking at insurers responses to knowing, planning and doing. The result is the identification of the Zone of Indifference, the Zone of Planning and the Zone of Action. The three segments’ response levels are consistent with their overall characterizations: Laggards show the lowest levels of response, followed by increasing levels for Followers and Leaders.

For Leaders, their zone of action is heavily focused on external, customer and market reach activities including:

- Products or services that help customers prevent or minimize illness, accidents or claims

- Partnering with other companies to embed insurance as a standard, included part of another product or service (not an additional, separate purchase)

- White-labeling product(s) for sale by another company

- Providing access to 3rd party products or services via a website and/or app

- Cyber risk / data security

The zone of planning for leaders further reflects substantial leads over the other segments including:

- Gig economy

- cognitive/AI

- use of IoT devices

- digital payments

These strong responses to these technologies and trends reinforce the fact that Leaders are breaking with insurance traditional thinking and boundaries to redefine the future of insurance. How? By embracing the platform economy, developing and offering non-insurance products and services, expanding distribution channels and embedding insurance into other products and services.

Figure 5

Figure 5

The Crucial Leadership Link — Leaders Follow Through

In previous years, the survey results showed that insurers who saw strong growth in the past year were more likely to have engaged in higher levels of strategic activity, compared to companies with weaker growth. This focus and pattern continues this year. Both fast and slow growth companies were replacing their technology systems at near equal rates to modernizing their business, a foundational imperative for the existing business. However, fast growth companies stood apart in terms of optimizing and creating a new business, with a greater focus on strategic activities: they were 1.35 times more active in expanding channels, 1.88 times more active in developing new products, and 1.43 times more active in developing new business models.

What does this all mean? The most crucial trait of insurance leaders is — “Doing.” Leaders are able to move from awareness, through planning and into active change without getting sidetracked or bogged down by the many challenges facing insurance. Majesco recognized that insurance companies need innovative, rapid delivery solutions that can move insurers projects from knowing to doing quickly. We developed Digital1st InsuranceTM, a portfolio of solutions that make it far easier and quicker for insurers to both move into the future of insurance and move into the position as industry and market leaders.

For more insights on how insurers are facing the future, be sure to read Strategic Priorities 2019: Accelerating the Paths to the Future of Insurance.

[i] Tanguy, Catlin, et al, “Making digital strategy a reality in insurance,” McKinsey & Company, September 2016

[ii] Tanguy, Catlin, et al, Insurance beyond digital: The rise of ecosystems and platforms, January 2018