Blog

Program and Affinity Business is Hot: Five Trends That Prove It

In the US, in the late 1800’s and early 1900’s, as immigrants began to pour into the country, populating the countryside and the cities, they would congregate and create societies and organizations designed to socialize. These little communities would also use their combined resources to protect themselves and their own interests. It became highly common for immigrant organizations to develop committees who would care for those in difficult circumstances, far from their homeland, but not far from help.

Association dues would cover a wide range of protective measures, with additional “premiums” charged in the event that a family or individual needed a home rebuilt or needed medical attention or needed assistance due to the death of a loved one. The rise of affinity and group insurance, like everything else, grew out of necessity.

Affinity and Programs are more than a category. They are a principle.

Risk is a “given,” but so is affinity. Insurers recognize that family, community and relationships will continue to be beneficial to provide ways to help offer and sell insurance products. Affinity and programs aren’t just a “category” of insurance, they represent how people or businesses naturally come together within “communities” where insurance can meet their unique needs. People tend to group themselves. These groups provide collaboration, trust and commonalities. What remains is for insurers to uncover sprouting new opportunities from new communities for program and affinity business.

Program and affinity business are very much alike – insurance targeted to a particular “community” niche market or class, generally representing a group of similar needs or risks that require products designed and priced for those risks. It is a way to “personalize” the products and assess the risk within a common “community” rather than with the broader group.

We discuss the reasons that affinity and program business have the potential to grow in Majesco’s upcoming thought-leadership report, A Roadmap to the Future of Insurance: Program and Affinity Business, written in conjunction with the Professional Insurance Marketing Association (PIMA). In this blog, we set the stage. Why is it a good time for program and affinity products to consider looking in new directions for business growth? Let’s look at five key trends.

Trend #1: Program and Affinity business is growing.

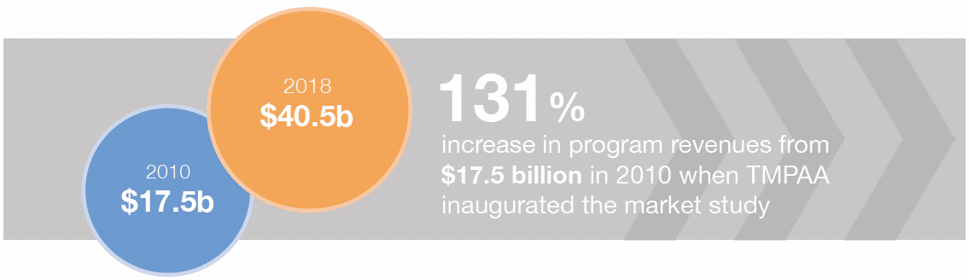

The Target Markets Program Administrators Association (TMPAA) has published a report every year since 2010. In the October 2018 report, TMPAA found that program premiums rose 131 percent between 2010 and 2018, with the size of the market growing double digits annually.[i] (See Fig. 1) Program business is poised to continue this pace of growth as administrators indicated plans to introduce more programs while carriers pursue expansion through new programs.

Figure 1: Growth in program business premiums

Many programs are often administered and marketed through Managing General Agents (MGAs) who bring their own value to the equation.

Conning’s 2019 research, Managing General Agents, The Super Model of the Insurance Industry, noted that MGAs play a valuable role in bringing new products to market faster than traditional insurers. The report notes that because MGAs tend to be leaner and nimbler, they can bring new products that address new or emerging risks to market more quickly. To address the issue of having sufficient loss data for underwriting, they work with multiple insurers and reinsurers who take slices of the risk, eliminating the potential of any specific insurer having to cover the entire risk.[ii]

These new risks include cyber, on-demand, Gig Economy, marijuana, renewable energy, vaping, transactional insurance, credit, active shooters, wildfires, climate risk and transportation.

Trend #2: New, innovative opportunities are popping up everywhere – providing fuel to accelerate growth.

Insurance distribution can no longer be limited to traditional methods. It must evolve to new digital models and partnerships that offer or embed insurance offerings within another engagement and purchase journey. Affinity and program business models, while experiencing strong growth over the past few years, will need to adapt and expand their view of partnerships, blending the idea of networking in the B2B realm with providing additional value to the B2C realm.

The traditional B2B2C affinity and program business concept offered insurance products through non-insurance organizations such as associations, non-profits, or employer groups. However, today’s buyers, particularly Millennials and Gen Z, do not necessarily associate with some of these traditional groups. They will look to buy insurance through other groups such as Gig Economy groups, health and fitness organizations, large retailers, auto manufacturers and more – where the purchase is part of another relationship or transaction. These are growing, innovative, non-traditional opportunities that must be captured.

Trend #3: The growth of digital platform technologies is leading to frictionless purchasing.

Are insurers establishing themselves with new partnerships and digital platforms that will capture up-and-coming buyers – when and where they are?

While the affinity and program business has seen significant growth the last few years, this is primarily due to a focus on traditional organizations. Majesco’s research with insurers and distributors in the affinity and program business space found a significant number of new opportunities for reaching the next generation of insurance buyers. We also found significant gaps between traditional partnerships and new, innovative partnerships that are increasingly important to be competitive in a rapidly changing marketplace.

This shift from our traditional models to new, innovative models is connected to today’s digital era of insurance shift. This shift is accelerating, and in many ways, redefining affinity and program business models – the B2B2C model – by leveraging next generation digital platforms and ecosystems to extend market reach based on customer needs and expectations. Success with these models is linked directly to insurers’ digital platform technology and expanding ecosystems of new partners.

In this new era of insurance, nearly every insurance process is rapidly becoming frictionless, including buying. If channels are easy to use with products that are easy to understand, then insurance has the opportunity to grow through a friction-free, multi-channel distribution system. The benefit of adapting to these channel dynamics is that we move from needing to “sell” people on purchasing insurance, to introducing insurance that is ready to be “bought” seamlessly at the point of need, creating a scalable, sustainable business model.

Some forward-thinking insurers are making bold moves to harness the power of digital technology and ecosystems that can support a new generation of affinity and program business. In our 2020 Strategic Priorities report, we highlighted significant gaps between Leaders and Followers (42%) and Laggards (45%), in embracing ecosystems and partnerships. Leaders are positioning to gain market advantage before competitors make their moves.

Trend #4: Affinity and program business in the UK is a sign of what’s possible.

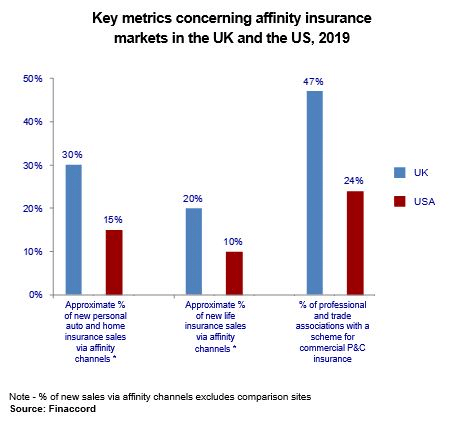

U.S. insurers should always look from the outside-in to identify what is possible. Research released by Finaccord in 2019 found more development of affinity and program business sales through partners in the UK than in the US. In the UK, nearly 30% of new sales for auto and home insurance are through these programs as compared to around 15% in the US. Likewise, about 20% of life insurance new business in the UK is through affinity and program business, nearly two times more than in the US at 10% as shown in Figure 2.[iii]

Finaccord credits the more active involvement in the UK of commercial entities, but this trend is almost certain to grow in the U.S. as well, as the continued rise of consolidation and retail ecosystem development will lend itself to a ripe arena for program business.

Figure 2: Affinity / Program business, UK vs. US

Trend #5: Younger buyers are open and expect new, innovative channels.

There is significant opportunity to accelerate and expand affinity and program business growth by leveraging new, innovative partnerships – broadening your ecosystem and ultimately market reach. The broader ecosystem will include additional channel opportunities that will be embraced by a growing generation of younger buyers.

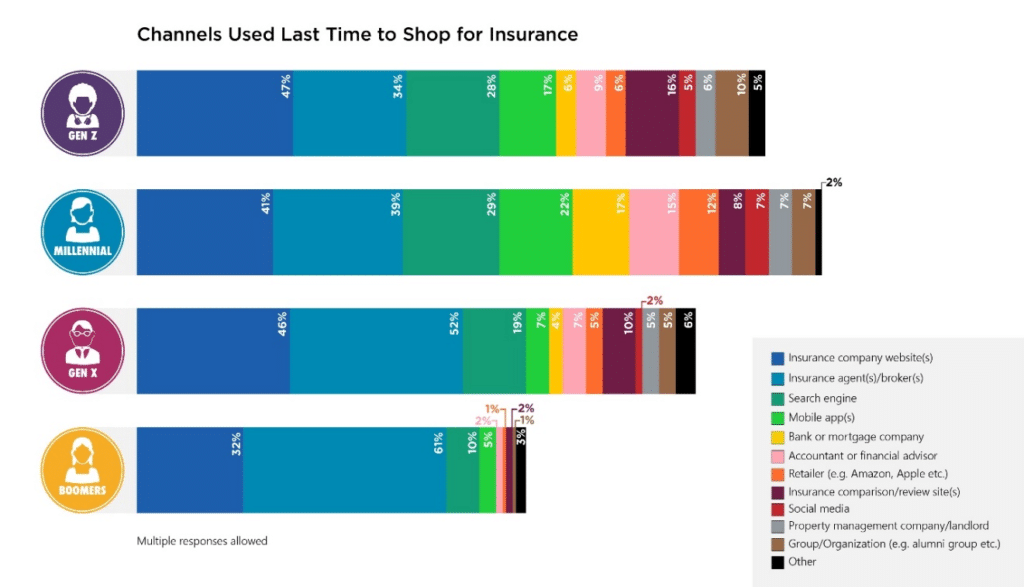

This is highlighted in Figure 3 from our 2019 consumer research that showed the strong interest, particularly the younger generation, in new, alternative options that affinity and program business can leverage.

Figure 3: Channels consumers used to shop for insurance

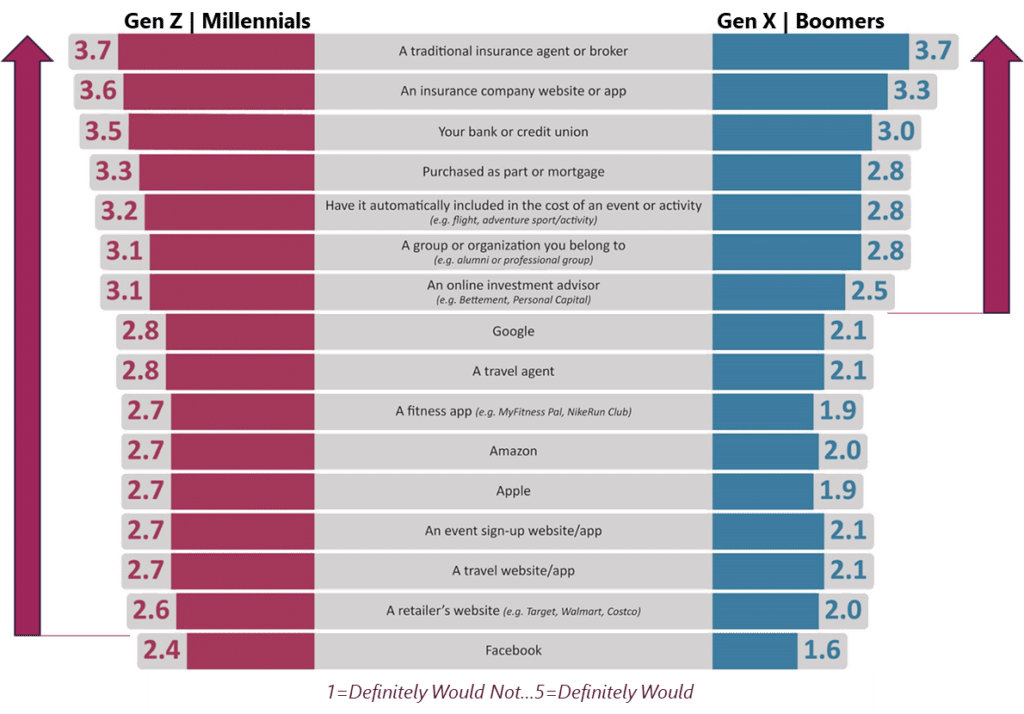

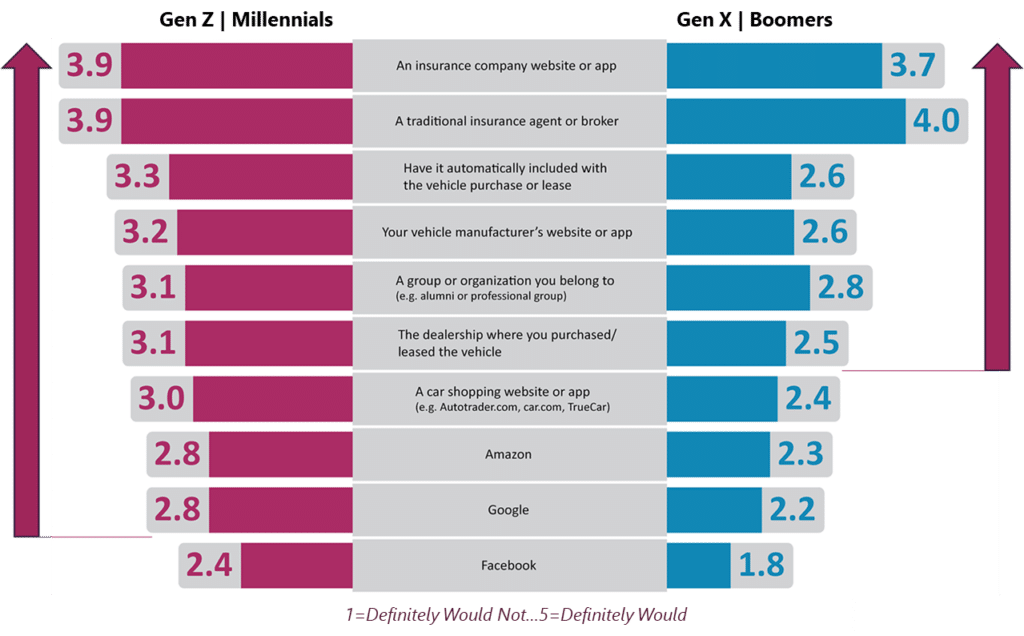

We did a deeper dive into this data in our 2020 consumer research, specifically for life and auto, as represented in Figure 4 and Figure 5. These charts show that both generational groups are open to new channels, but the younger generations outpace the interest of the older generations anywhere from 10%-40%.

Figure 4: Consumer interest in life insurance purchase channel options

In auto insurance, 9 of the 10 channel options show 50% or greater interest by the younger generation as compared to only 6 of 10 for the older generation.

Figure 5: Consumer interest in auto insurance purchase channel options

The bottom line is that today’s affinity and program business is just scratching the surface of opportunity, particularly in terms of new partners. They need to adapt and expand their view of partnerships. The desire and expectation of a wider range of options and the untapped market potential underscores the need to consider how and where companies must reach and interact with the younger generation, and to be there with timely engagement and purchase prompts.

This is why partnerships and an ecosystem are very strategic in helping insurers expand their reach and presence to where their customers will be, offering the multiplier effect to growth. The benefit of adapting to this new market dynamic is that we move from “selling” insurance to “buying” insurance and in the process creating a scalable, sustainable business model to accelerate growth.

In our next blog, we will consider markets and products, comparing traditional program and affinity targets and emerging markets. Where are the gaps in current offerings that may provide insurers with targeted expansion? How will new digital platform offerings help carriers to quickly shift channel opportunities within their program and affinity business strategies?

For a preview, tune into our Webinar, The Power of the Insurance Niche Market: Program and Affinity Business is Hot Hot Hot!. Then, next week, download our new thought-leadership report, A Roadmap to the Future of Insurance: Program and Affinity Business.

[i] “Program business revenues jump 12% to $40.5B in 2018,” Target Markets Program Administrators Association, https://www.targetmkts.com/component/k2/item/2574-program-business-revenues-jumps-12-to-40-5b

[ii] “Managing General Agents, The Super Model of the Insurance Industry,” Conning 2019

[iii] “Affinity insurance markets: the UK and US compared,” Finaccord Press Release, November 18, 2019, https://www.finaccord.com/Home/About-Us/Press-Releases/11-18-2019-12-00-00-AM