Blog

Powering the Insurance Platform with an Online Ecosystem

In today’s platform economy, insurers are looking to provide products and offerings that are designed to meet customer needs and expectations but may involve components originated outside their enterprises. The main objective is to design a product and service with a seamless customer experience to meet their needs as well as win their hearts by bringing together the best capabilities, both internal and external. Customers are less concerned with the origin of these capabilities as long as they are designed to solve their needs, meet their expectations and are packaged under a brand they trust.

The race to Digital Insurance 2.0 is well underway and digitization is one of the top priorities at most insurers globally. Digital companies like Amazon, Uber, Netflix, Apple and others are raising the bar for customer engagement. As we discussed in our report, Cloud Business Platform: The Path to Digital Insurance 2.0, insurers seeking digital excellence must develop a strategic approach that is nimble and flexible enough to adapt to rapid industry change. The insurance industry is facing permanent changes in customer demographics and behavior, new digital technologies and a shifting of market boundaries. With over $22 billion of funding across over 1,475 InsurTech companies — innovative business models, products and services are leading the way to Digital Insurance 2.0 with an ability to continuously innovate the product, service and customer experience with an ever-increasing array of offerings that don’t dilute the core offering.

Insurance Platforms are often touted as enabling solutions that will accelerate innovation and technology adoption while improving customer experience. Unfortunately, many insurance platforms are designed around internal capabilities and do very little to easily consume external capabilities seamlessly and instantaneously. As such, there is a need for an online marketplace that can help insurers consume a wide variety of capabilities. These capabilities are ‘on tap,’ allowing insurers to quickly select and use them to build tailored solutions with seamless experiences that will address customer needs.

The Majesco Digital1st unit, a digital business unit of Majesco, has been envisioning an online marketplace where insurers will have access of broad array of insurance related niche capabilities as a service with an ability to subscribe to them with pay-per-use pricing, bind them together seamlessly to design differentiated offerings for their customers … all without needing to contract individually with multiple vendors. With the announcement of the Majesco Digital1st EcoExchange®, we are starting to execute our vision which will provide access to innovative capabilities to all segments and sizes of insurers at their fingertips.

Making it as easy as buying a song from iTunes

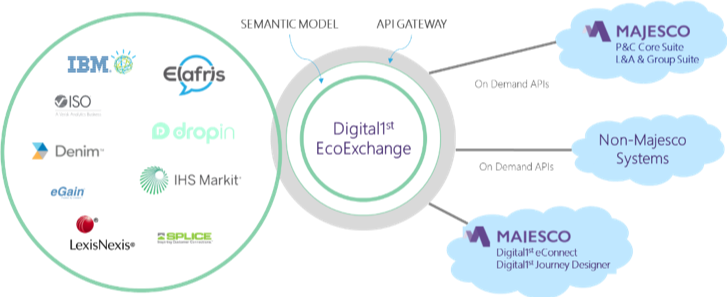

Majesco Digital1st EcoExchange® is not a repository of code accelerators. It is a service hub with data, core and InsurTech services ready for consumption through a common semantic layer over the cloud. It enables customers to “find and bind” innovative insurance capabilities from various providers to their targeted solutions without complex IT integration and exhaustive vendor management processes. Unlike other online marketplaces, the EcoExchange allows customers to subscribe to capabilities as a service and integrate services with their specific digital solutions.

Partner Community

Majesco launched the Digital1st EcoExchange with diverse and innovative services available from various technology and services partners. Many innovative apps from smaller partner companies may not be well known by insurers due to lack of market reach, but the Majesco Digital1st EcoExchange® greatly expands and improves visibility and marketability of these and all partner apps. Because various standards of service quality exist among diverse services, a platform such as the EcoExchange plays a critical role in providing a common medium where only the best have been selected for distribution. These are robust, standardized services that enable quick deployment as well as interoperability for quick and seamless solution builds.

On-demand Subscription

For many insurers, it’s a big disappointment and a challenge to see innovative services claiming to help improve customer experience, operational efficiencies or improve many business metrics for underwriting, claims etc. that require significant investment and effort for contracts, integration and deployment.

What if you could subscribe to the services on-demand, pay only when you use, start using it immediately after subscribing and do it all without any paperwork? That is exactly what the Majesco Digital1st EcoExchange® is designed to facilitate. Partners offering their services for online purchase will allow insurers to digitally subscribe and test instantly without any code download or any development work. Insurers using Majesco Digital1st platform apps enjoy reduced complexity by using a simple drag and drop process to integrate with their own system or they can, just once, build a common adapter to the EcoExchange from their third-party systems to integrate all current and future services.

Easy to Switch

Many partner apps may overlap in functionality (e.g. Email, Credit Report, Police Report, Satellite Images etc.), but have other unique capabilities. Historically, when insurers switched between partners for the same type of service, they would have to refactor the service call and spend resources and effort in re-enabling the service with the new partner. With Majesco Digital1st EcoExchange®, the effort for switching apps is greatly reduced due to the semantic layer to standardize the data exchange, regardless of partner.

Reliability

Leveraging various partner services can create different operational and quality standards. To counter this, Majesco Digital1st EcoExchange® apps go through quality, performance and security review before they are made available to insurers. Partners are recommended to publish information about quality of service so insurers can assess them before subscribing to their apps. Additionally, Majesco Digital1st EcoExchange® provides real-time, online status for subscribed apps and sends notification to partners and insurers in the event of app degradation or inaccessibility.

Winning in the Digital Era

The digital era shift is realigning fundamental elements of the insurance business. These alignments require insurers to make major adjustments in order for them to survive and thrive. Insurers seeking digital excellence must develop a strategic approach that is nimble and flexible enough to adapt to rapid industry change. The key to winning customers in the Digital era requires insurers to know and adapt to the changing needs and expectations of their customer segments and personalize products and services to build competitive advantage.

This is no easy task. It requires insurers to build robust, adaptive customer-centric solutions with deep integrations of innovative and compelling capabilities in seamless manner. The path to Digital Insurance 2.0 will be built on a new generation of digital insurance platforms like the Majesco Digital1st EcoExchange®. The time for plans, preparation, and execution is now — recognizing that the gap is widening and the timeframe to respond is closing on the path to Digital Insurance 2.0.

Looking forward, we think that Majesco’s Digital1st EcoExchange is going to have a tremendous impact upon the insurance industry. We anticipate that it will connect insurers, agents, brokers and service providers to the technology and data they need — resulting in improved insurance offerings and services that will benefit customers and society.