Blog

Affinity Partnerships Insurance: New Partnership Models Take Program Business to the Next Level

On Tuesday, Amazon announced the launch of Amazon Pharmacy. This may not have been a great surprise. Two years ago, Amazon purchased PillPack, a prescription delivery service. Last year Amazon launched its own line of over-the-counter medicines. With the acquisition of companies like Whole Foods in the U.S and the backing of vehicle insurance through Acko in India, it is clear that Amazon has one thing on their mind — customers – owning the customer relationship (and wallet) across all aspects of their lives.

Give customers what they want, when they want it. Suggest what they might want when they need it. Keep track of customer purchases. Use customer data to get to know the customer. Grow offerings through an ecosystem of acquisitions and partnerships. Grow channels through association and partner programs. And all with a great customer experience.

AmazonSmile, for example, enrolls schools and non-profit organizations in a purchase-sharing initiative. Organizations encourage their donors to shop through Amazon in exchange for a percentage of the purchase. Is it philanthropic? Yes. Is it an additional channel of income for Amazon? Of course. Partnerships pay when both partners have something to gain through serving customers.

The insurance industry in general and the Program and Affinity business, in particular, has much to gain from the era of the ecosystems and partnerships. The customer is also our focus. The future of insurance will require us to redefine our products, partnerships and customer experiences based on the customer … not from an internal view of how we have always done business.

In this new era of insurance, market leaders are experimenting with new opportunities. They are establishing new strategic partnerships. They are offering innovative new products. They are experimenting with offering insurance when and where customers want it. Fortunately, both startups and traditional companies are experimenting, creating new models that will help address new expectations and drive growth.

In Majesco’s latest thought leadership report, A Roadmap to the Future of Insurance: Program and Affinity Business, written in conjunction with the Professional Insurance Marketing Association (PIMA), we take a look at the customer need. We then look at the opportunities that new technologies, partnerships and ecosystems provide, and we find some examples that will lead us forward. In last week’s blog, we looked at how opportunity maps can give us an edge in development. In today’s blog, we look at how startups and innovative established insurers are reinventing program business to suit customer behavior. We begin with the multi-faceted financial services company, Sofi.

Sofi

One of the best examples of a company looking at the customer across life, health, wealth and wellness is Sofi, a Fintech organization. Sofi started out as a student loan consolidator and provider, and has rapidly expanded to owning the entire customer financial services relationship – life, wealth, health and wellness. Sofi states its mission is “to help people reach financial independence to realize their ambitions. And financial independence doesn’t just mean being rich – it means getting to a point where your money works for the life you want to live.”

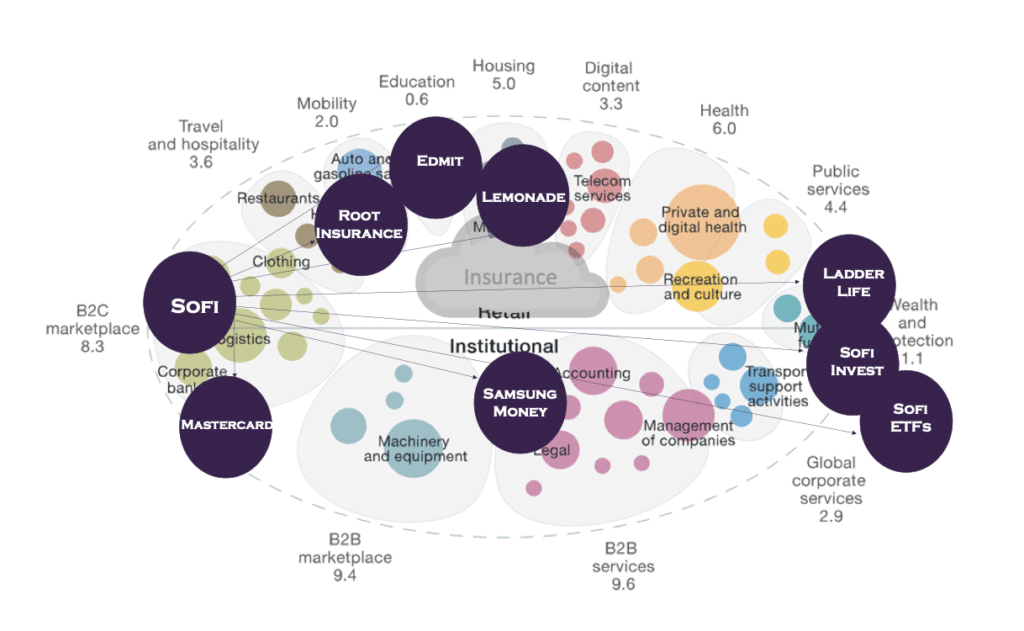

Sofi, because of their original focus on student loans, has been capturing the next generation of customers – Millennials, Gen Z and eventually Gen Y. They now have over 1 million members and 7.5 million contacts, where members may represent family units. They have provided over $30B in loans and have developed a sophisticated digital platform and ecosystem that enables the full overall financial wellness from life, wealth, auto, and home experience, represented in Figure 1.

This includes:

- They offer insurance through their ecosystem of partners including Ladder Life for life insurance, Lemonade for renters or homeowners insurance and Root for auto insurance. All of these are InsurTech startups that are focused on creating innovative new products and different digital customer experiences.

- They offer value-added services including career counseling, member rate discounts, unemployment protection program, member events, financial planning, referral bonuses, exclusive member discounts.

- They have expanded their ecosystem with MasterCard and Samsung Money to support digital payments.

Grab and Gojek

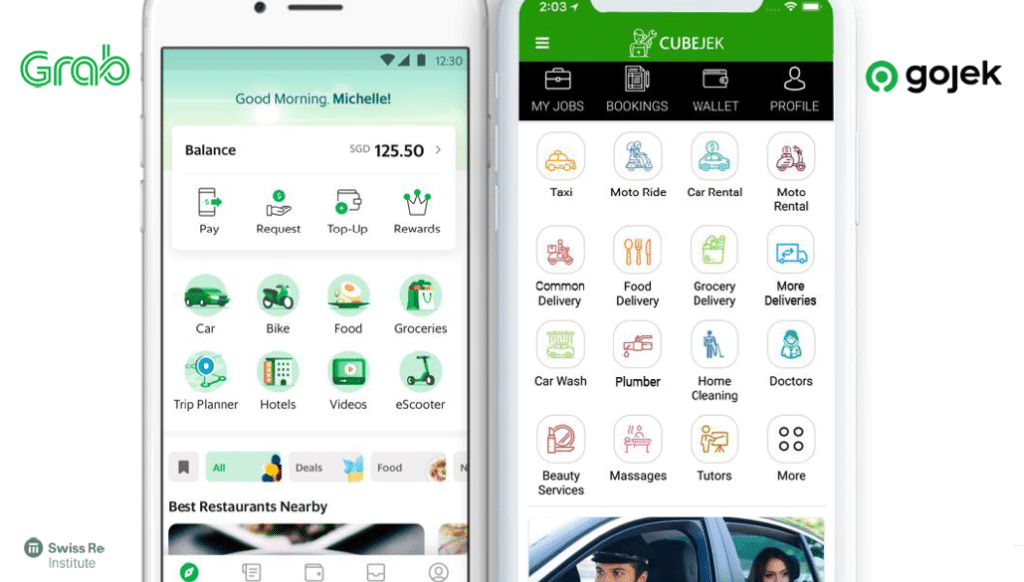

Grab started in Kuala Lumpur, Malaysia in 2012 and is now Southeast Asia’s largest mobile technology company. It connects millions of consumers to millions of drivers, merchants, and businesses. During COVID-19 it has become especially valuable to customers, strengthening their customer relationship and loyalty, thereby opening up future possibilities.

Gojek began in 2010 in Indonesia as a motorcycle ride hailing service. It has evolved to a suite of more than 20 services and is recognized as a leading tech company serving everyday solutions for millions of customers across Southeast Asia. Grab and Gojek are creating seamless experiences for customers while also providing a positive socio-economic impact for millions of their partners (drivers, merchants, service providers).

Phil at Home by AG Insurance

Safely and comfortably aging in place is going to be a great necessity for millions of people in the coming decades. As health awareness technologies arise, there is place for P&C insurers (using IoT devices to protect the home) to add value to those who choose to age-in-place – connected home and health all in one. (I discussed this in detail in my 2019 blog, Insurance at the Intersections of Protection and Prevention.) With more than 10,000 Baby Boomers retiring each day, this is a huge market opportunity.

AG Insurance in Belgium, with an offering called Phil at Home, is an example that uses home IoT to support the elderly staying at home and being safe. They use smart technology to safeguard their clients and their home while providing access to a range of services including home repairs and maintenance, food delivery, medication reminders, and more. The concept is a creative utilization of traditional P&C and life & health with regard to protection and services. It epitomizes the focus on a customer-first approach, rather than a product approach. In today’s COVID-19 environment and with the increasing cost of nursing home care, this option provides a unique value to their customers.

Imagine Now – Smart Insurance for Families by Generali

A number of years ago, the concept of a single insurance policy that would adapt as you went through life was an idea discussed by a number of different companies. But the idea could not be done due to the old mainframe, analog systems prevalent back then. Fast forward and the idea has morphed and emerged as a reality. Imagine Now by Generali in Italy offers a single policy that meets the needs of the family, including facets of home, accident, health and pet protection – all wrapped into a digital service. Services such as connected home, pet, health and security were delivered via an app, helping to manage common, high-level family needs over the lifetime of the policy. This concept is radically different – approaching the need from the customer point of view, not from our long-held traditional insurance point of view.

Allianz TravelSmart App

Buying travel insurance via a travel app is now just the basics. How can insurance advance the customer experience? Allianz, a pioneer in travel insurance, is taking it to a new level by shifting from a policy transaction to provide a broader customer experience — driving engagement, value and loyalty. Travelers receive recommendations on where to go, safety and security alerts (using geo-location from the mobile phone) and other valuable services that will improve the experience while reducing risk. It is a great example of thinking beyond the traditional “risk policy” to a broader customer relationship.

The New Program and Affinity Business: A 4-Part Strategy

Future market success is increasingly dependent on multi-channel strategies as part of a broader ecosystem, including how to support the traditional agent/broker channel and new strategic partnerships. These are crucial to insurers’ ability to maximize growth strategies today and in the future. Insurers must master the science and art of making relevant and timely digital connections with customers who are motivated by life events and make it easy and satisfying for them to complete the insurance purchase process. To make this transition and capture the real growth potential of affinity and program business insurers must:

Embrace a strategic multi-channel approach to reach customers on their terms. The viability of the insurance industry is vitally connected to demographic trends, market trends, customer opinion and adoption of new technologies. If insurers lose touch with our customers, both current and future, insurers will lose business. The result is a porous market, where engagement is everything and the relationships between businesses, customers, channels and partners is crucial. Insurers unprepared for a new dominant insurance buyer may find they are no longer relevant after this major shift.

Innovate and create new affinity and program business models. Insurers need to proactively rethink the traditional business model and product assumptions for affinity and program business to meet a broader customer need and expectation that adapts and changes in real-time based on customers’ needs and behaviors.

Embrace innovative partnerships, ecosystem development and connections. Insurance companies increasingly are competing in a new paradigm beyond their brand, product, price and distribution – the latter being primarily agents. This new paradigm uses innovative approaches and value creation by transitioning from vertical market boundaries to porous market boundaries – or ecosystems. Leveraging these ecosystems, leading companies are rapidly developing innovative business partnerships that drive growth through embedding of products in other businesses, revenue sharing, white labeling, and new channel options.

Realize that next generation business platforms are mandatory. Insurers must align their strategies around next generation core system platforms, digital experience platforms, next-gen technologies and broad ecosystems that are technically and architecturally different than the on-premise “modern core” solutions of the past. The heart of the insurance platform is an orchestration of next gen technologies including cloud-native computing, microservices, APIs, low / no code, new data sources, artificial intelligence (AI) and machine learning (ML), coupled with an ecosystem of partners that provide innovative or complementary products and services. Digital experience platforms create the ability for constant touchpoints with customers in simple ways by plugging into capabilities that enable cost-effective growth while bringing insurance coverage closer and more personalized to the customer. This creates tremendous potential for both penetrating existing markets and reaching or creating brand new markets.

Channel expansion is a trait found in insurance leaders

In our Strategic Priorities research from earlier this year we found Leaders – those focused on new channels, partner ecosystems and technology – are well out ahead of Followers and Laggards. Leaders are expanding channels at a staggering rate of 20% more than Followers and 60% more than Laggards – expanding market reach and the ability to acquire and retain customers and revenue.

How does your business strategy align to what leaders are doing? What is your multi-channel strategy? Will your technology support your strategy? What specific plans can you take to improve your odds of success? Tap into additional affinity partnerships insurance insights by downloading, A Roadmap to the Future of Insurance: Program and Affinity Business.