Blog

Insurance Affinity Programs: Mapping the Future of Program and Affinity Ecosystems and Partnerships

In the modern age of GPS, Google Maps and instant news, it’s hard to imagine that for centuries, civilizations were simply blind without maps. Even approaching the modern era, explorers, such as Lewis and Clark, faced their journeys with some level of trepidation and fear for what lay beyond the known world. The maps they had were largely blank, with vague lines indicating the best descriptions they could find from trappers and natives. It was up to them to operate in the dark while they made new maps.

Once we had comprehensive geographic maps, maps were still expensive and scarce. When U.S. hostilities broke out against Spain in 1898, the first map of the Philippines that President McKinley could locate in the White House was torn out of a children’s geography book. He had to wait on real maps to be delivered from the Coast and Geodetic Survey.[i]

In some ways, however, the scarcity of maps was at least some excuse for operating in the dark. Today, insurers operate with access to thousands of “map-ready” data sources. We have satellite imagery, geo-spatial data, radar to warn us of weather conditions, location data, pictures, expert demographic and geographic data, real-time IoT, telemetric and health data, social media, data related to corporate and consumer behaviors and trends and so much more!

How much more information do we need to create accurate maps of new opportunities and new markets? Too often companies still trek blindly forward into new markets as if they were unknown territories, or they stay away from new ecosystems, partnerships and opportunities because of lack of knowledge or fear of the unknown.

This is relevant and true for the Program and Affinity business. Why? Because though companies have had some success, they have been sticking to the tried-and-true paths of partnership, white-labeling and growth instead of shifting with market and customer trends toward the newer and hotter opportunities that are not only on the horizon, but are now clearly in our midst. While the opportunities exist, however, they may not be so easily understood. We need new maps. Insurers need to identify clearly those areas of opportunity so that they can chart a course in the right direction.

Spoiler Alert:

Using primary research from Majesco and our recent joint research with the Professional Insurance Marketing Association (PIMA), we have created maps that will assist you to chart a new course to capture new opportunities for affinity and program business growth.

You’ll find these maps in Majesco’s latest thought leadership report, A Roadmap to the Future of Insurance: Program and Affinity Business, written in conjunction with the Professional Insurance Marketing Association (PIMA). In our report, we use our joint research with PIMA and PIMA’s latest research initiative, Affinity 2030: Exploring Our Blind Spots for a Brighter Future, in conjunction with Majesco’s 2020 auto and life insurance customer research to expose blind spots and reveal the growing opportunities for affinity and program business growth. We’ll highlight some of these maps with you in today’s blog.

To better understand the maps, we need to first look at the foundational relationship between program and affinity business and ecosystems and partnerships.

Ecosystems & Partnerships

Given the nature of partnerships and ecosystems, insurers have choices. They can assume multiple roles, from owner of the customer and unifying platform, to orchestrator of the products and services, or provider of products and services. What they achieve will depend on their ability to enter the market while it is still contains uncrowded territories. Of course, this requires leadership with an appetite for taking informed risk, the ability to move quickly, capacity to build partnerships within and outside of insurance, and strong technology capabilities.

Partnerships & Integrations

What is clear from our multi-year research is that the expansion of partner ecosystems is beginning to separate the leaders from the pack. As we have seen with customer expectations, market boundaries are no longer as relevant as they used to be. Traditional silos are falling. Customers want to buy when and where and from whom they want. Technology is fueling new customer expectations, altering and expanding the traditional markets and channels through which insurance is sold, including retail, banking, gig or on-demand activities, automotive, transportation businesses, big tech and more. This creates greater value for the insurance industry to capture new revenue streams and gain access to a broader market through the multiplier effect.

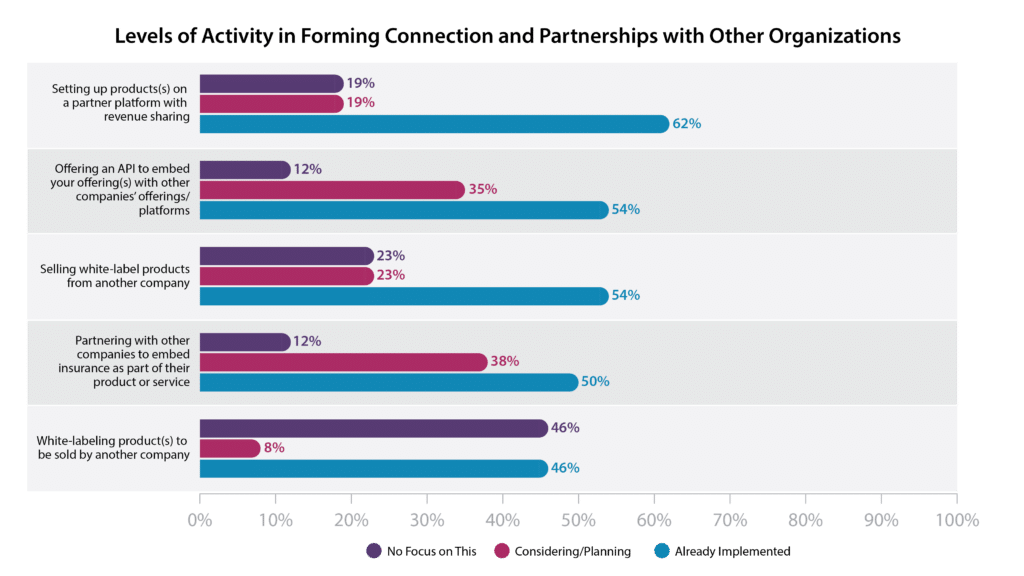

But is the industry growing their partnerships and ecosystems? Figure 1 reflects an active level of experimenting and growing partnerships. Selling a product on a partner platform with revenue sharing stands out, with 62% of companies saying they already do this. This likely involves selling (orchestrating) a product through another insurer who does not have that product – such as direct auto writers offering another insurer’s homeowners or renter’s product. Likewise, selling white-labeled products from another company (54%) or white labeling your own product to be sold by another company (46%) have been traditional ways of expanding market reach.

Two newer and more innovative options also stand out:

- Offering APIs to embed your product with another company’s offering or on their platform (54%). This is like the Amazon-Acko relationship recently announced in India where Amazon will be offering car and motorcycle insurance, supplied by Acko but sold through Amazon Pay.[ii]

- Partnering with other companies to embed an insurance product as part of their product or service (50%). This is like what Tesla and Ford are offering. When you add the levels of consideration and planning to these, the numbers jump to 89% and 88% respectively, outpacing even the traditional partnering and white labeling, suggesting a shift in the types of partnerships being used, and greater alignment of offering products where and when customers want them – shifting the model from a selling to a buying focus.

Figure 1. Levels of activity in forming connection and partnerships with other organizations.

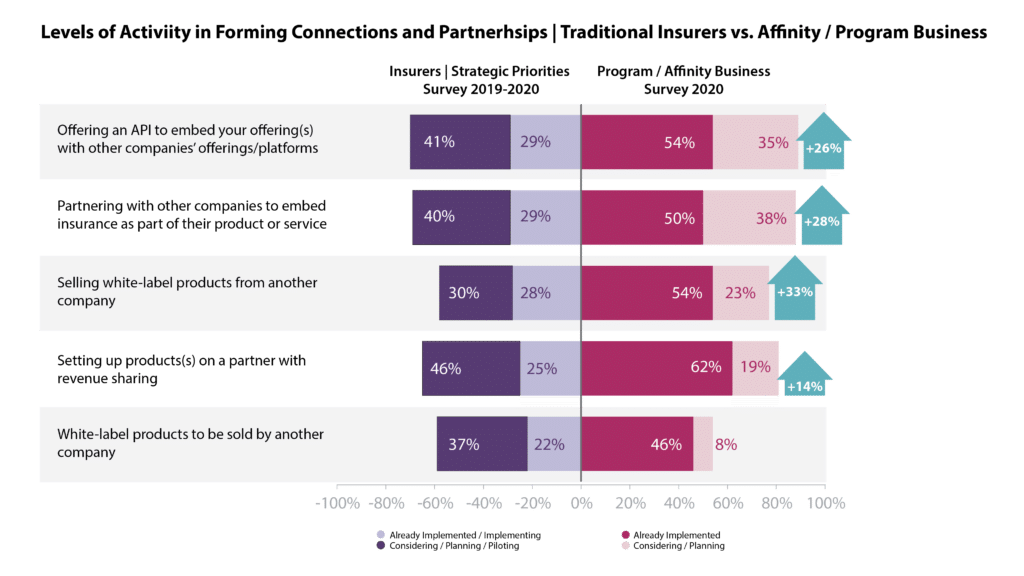

Comparing the PIMA/Majesco joint survey results to our 2020 Strategic Priorities results reveals that the companies with affinity and program business models are positioning themselves well ahead of “traditional” companies as leaders in strategic partner ecosystems, as reflected in Figure 2.

The gap between traditional and affinity / program business companies ranges from 14%-33% higher in offering the different options to partner and reach new markets – whether through APIs (26% higher), embedding insurance (28% higher), or selling white label products from another company (33% higher).

The gap underscores why affinity and program business companies are poised to take leader positions in a rapidly shifting landscape of customer expectations.

Companies who are not actively engaged in building a partner ecosystem through affinity and program business are losing out on a significant growth engine and will find fewer opportunities for partnerships the longer they delay as the “whitespace” of today is captured by these new leaders.

Figure 2. Traditional Insurers vs. Affinity/Program Business — Levels of forming connection and partnership activity

New Partners and Channels: Putting Products in the Path of Purchase

For decades, agents and brokers have long been the channel of choice for P&C and L&A insurers. Our research clearly notes that customers still see them as a viable and important option … but that they also seek a broader multi-channel option. This multi-channel expectation is driven by a number of factors, but especially customers and partner ecosystems.

Customer expectations are shifting to a multi-channel world, challenging insurers to provide channel options and choice, whether directly or through partners. Multi-channel distribution options enhance customer interactions on the customer’s terms … not the insurer’s.

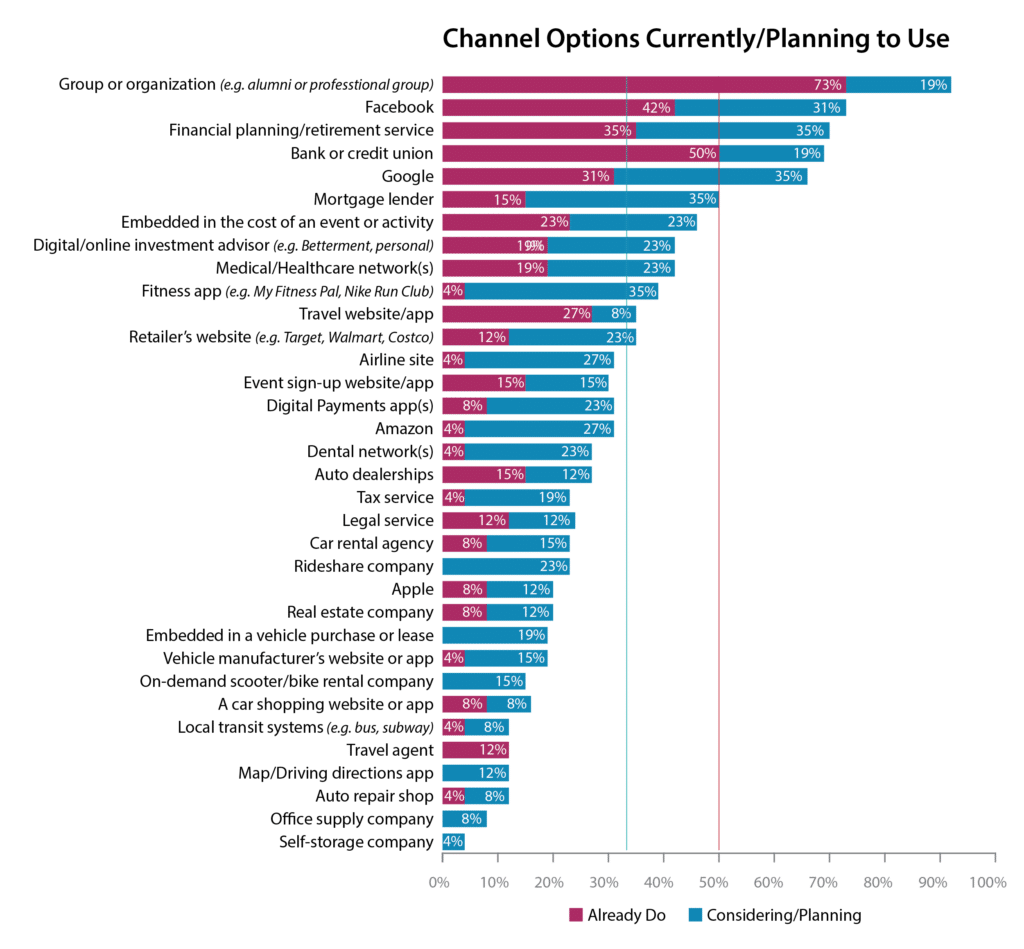

We asked the companies surveyed to indicate how actively they were working with a broader range of channels – the same ones we asked customers about in our life and auto insurance research earlier in 2020. The results and contrasts were quite interesting, as depicted in Figure 3.

The top 3 traditional channels already used were what you would expect to see, such as groups or organizations (73%), financial planning services (35%), and banks or credit unions (50%).

The top 3 new channels being used, such as Facebook (42%), Google (31%) and embedded in the cost of an event or activity (23%), were surprising and encouraging. (Though we suspect Facebook and Google may be via marketing ads rather than real partnerships.)

When you look at the chart overall, what is visually telling is that only 18% (6 of the 34) channels or partner options are measured at 50% or more in interest (companies already doing and considering / planning combined) — revealing a very narrow use of channels that substantially limit reach and revenue opportunities. Only 12 of 34 (35%) show a third or greater activity … re-emphasizing the constrained approach by companies and a wide-open field for those who dare to be creative in establishing a next-generation partner ecosystem. Companies with constrained plans are leaving the door wide open to competitors within and outside the industry.

Figure 3. Channel options that are in use or are under consideration and planning.

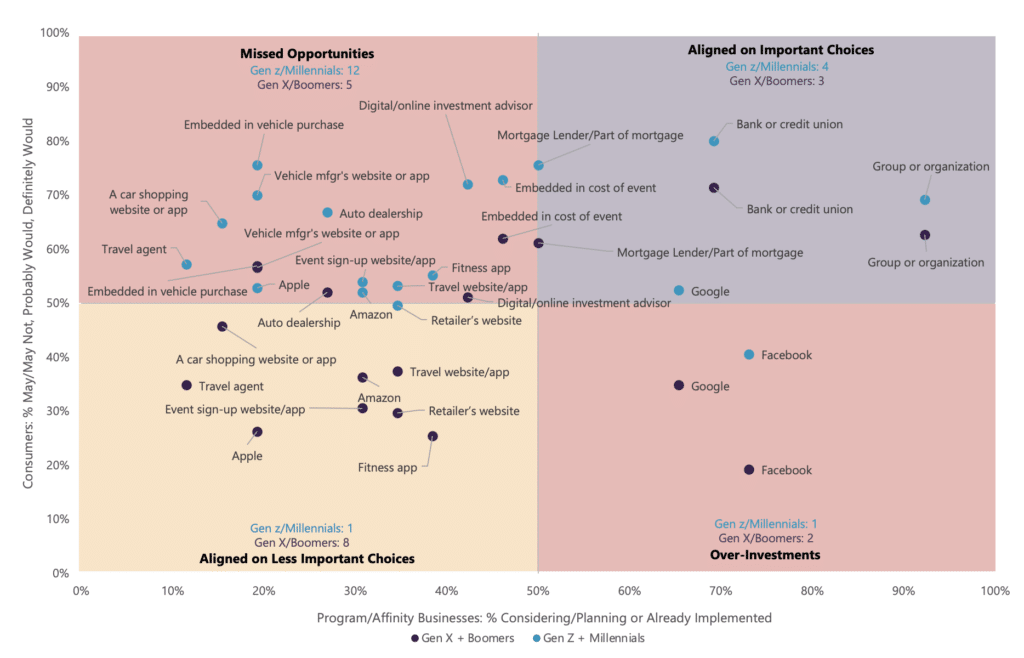

Compared to what consumers feel about these channel options, the gaps between providers and customers become painfully obvious, as depicted in Map 1. Key findings:

- Nearly 67% (12 out of 18) are missed opportunities with the younger generation in the upper left quadrant, whereas only 28% (5 of the 18) are missed opportunities for the older generation. This highlights how business assumptions and models are not adapting to the younger generation, which will dominate buying within the next four years, leaving many insurers “flat-footed.”

- Companies are aligned on only 7 channels of importance to consumers, 4 for the younger and 3 for the older generation, highlighting a limited reach for both generations.

- In contrast, insurers and consumers are aligned on 9 channels of less importance with 1 focused on the younger generation and 8 for the older generation – areas that are not as strongly viewed by customers.

- Finally, three channels have over-investment by insurers, one for the younger generation and two for the older generation: Google and Facebook.

The key insight from this chart is that for insurers to reach customers, particularly the next generation of buyers, on their terms via a wider array of channels, they must aggressively develop strategies and execute plans to move these channels into the top right quadrant of alignment.

Today, there are so few channels in that top right quadrant, underlining the unmet need and expectation that correlates to limited growth in the affinity and program business market. So, while we have seen strong growth over the last five years, the growth potential is appreciably more … but only with strategies and plans to do so.

Map 1. Alignment analysis between opportunities and customer channel preferences by generation.

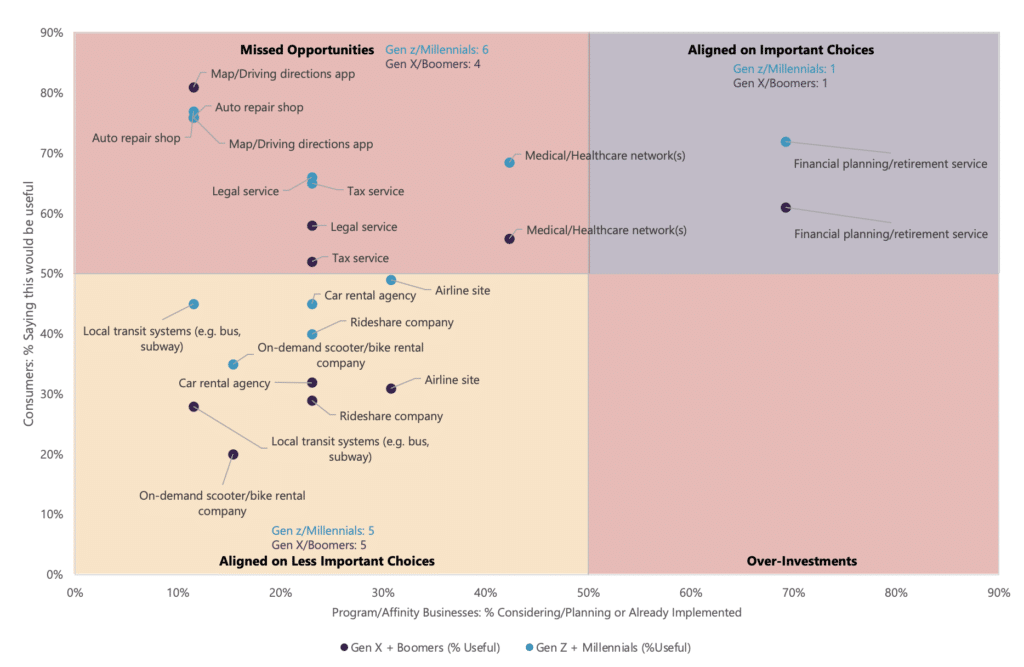

We also compared companies’ and customers’ views of other products that could be offered as part of an experience for either auto or life, part of a broader customer experience concept in the Auto and Life surveys. We show those results in Map 2.

- We found 45% (5 of 11) were missed opportunities for each generational segment.

- Only one (10% or 1 of 11), financial planning / retirement service, was aligned to customer expectations of both generational groups.

- For customer choices of less interest, companies were aligned on 45% (5 of 11) of them.

The key insight from this chart is that customers have a broadening expectation of types of products and services that want to be offered – but which insurers are misaligned to – particularly for missed opportunities that could have significant enhancement of customer expectations. This insight emphasizes the potential of new partnerships and revenue options beyond traditional insurance risk products that will strengthen customer relationships and engagement.

Map 2. Perceived usefulness of product offerings within an ecosystem-style app.

This brings us back to the idea of paths of purchase and maps.

The usefulness of any map is in the path options and direction it provides. If insurers can identify relevant paths within customer lifestyles and purchase patterns, then partnerships can be formed to place innovative and necessary insurance products and services along those paths.

In our next blog, we’ll discuss how crucial it is for the insurance industry to embrace a multi-channel approach to program and affinity development. We’ll also look at some of today’s innovators for inspiration. Which new leaders are using their knowledge of the changing customer landscape to reduce insurance gaps by placing insurance at the point of need – offering a path of opportunity and growth?

You can tap into more insights on insurance the affinity programs business by listening to our recent webinar, The Power of the Insurance Niche Market: Program and Affinity Business is Hot Hot Hot, a conversation with myself and PIMA Executive Director and industry expert, Ann Dieleman. You also can gather the latest program and affinity group insurance trends in one place by downloading, A Roadmap to the Future of Insurance: Program and Affinity Business.

[i] Morgan, H. Wayne, William McKinley and His America, p. 293, Kent State University Press, 2003

[ii] Singh, Manish, Amazon-backed Indian Insurtech Startup Acko Raises $60 million, September 15, 2020, https://techcrunch.com/2020/09/15/amazon-backed-indian-insurtech-startup-acko-raises-60-million/