Blog

Listening to the Future: New Products Can Lower Business Risk

Risk vs. reward. Perhaps there is no more appropriate location to discuss it than Las Vegas, the undisputed home of risks and rewards. Next week, many of us will meet and chat at ITC 2024, filled with the excitement of game-changing technologies and insurance startups. At the same time, thanks to Helene and Milton, we’ll all have risk on our minds. How can we create new business operating models and apply new technologies in ways that will simultaneously protect our insureds and protect our organizations? Is there any way to find operational and fiscal safety in the midst of this unpredictable world? The future is bright, but is it innovative enough?

It is exciting to think about all that is happening in insurance technology, and it is clear that the innovative technologies ARE available that will help us manage or mitigate risk, protect people and property and still improve business outcomes. Insurers, however, may have to change their stance on their own ability to take risks. They need to rethink their business operating model and facets of it, from an outside-in perspective.

One of those facets is new, innovative products. New products have always come with the caveat that only experience can prove them to be profitable. Even though most insurers recognize the need to pursue new products in order to meet new risks and customer demands, while supporting growth, few insurers are truly prioritizing them to the degree that they need to be prioritized.

What most insurers don’t recognize is that we have entered a new era of risk that demands a new era of new product development. We can better predict risk and underwriting experience with improved data selection and AI/ML. We can more easily create products that can help assess and mitigate risk through telematics, smart devices, AI and GenAI. We can personalize products in order to improve their value, help customers reduce their risk and price fairly for that risk. In fact, data is currently proving that insurance business models that include innovative, robust product development can lower an insurer’s overall risk by improving their business outcomes and growth now and into the future.

The real risk for insurers is playing it “safe and doing what they have always done.”

New product and service innovations can lower risk (and improve competitive positions)

In Majesco’s recent thought-leadership report, Realignment in Insurance: Business Models, Products, Value-Added Services, we found that many insurers do have an optimistic view regarding future strategic activity around new products based on what they anticipate for the next three years. However, the challenges of today’s marketplace are keeping a stronger focus on existing, traditional products rather than the introduction of new, innovative products. This will have long-term implications for customer and revenue growth as changing risks, customer needs, and expectations continue to shift and therefore will shift what and from whom they buy insurance.

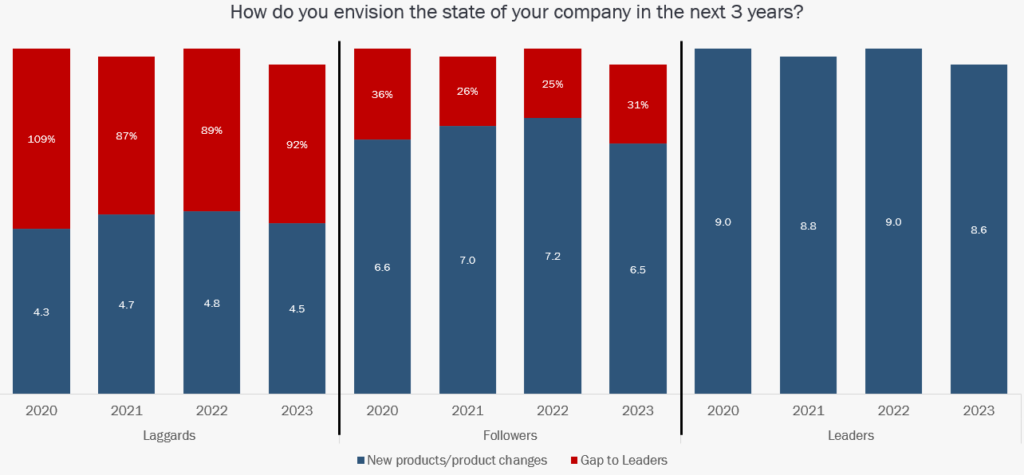

The lack of focus on new, innovative products is most acute with Laggards, with consistently high gaps to Leaders of nearly 100%. Followers are much closer to Leaders but have been unable to erase their gap over the past four years, as reflected in Figure 1, creating in many ways, a slow downward spiral.

Figure 1: Trends in expectations for new product development activity, by Leaders, Followers, Laggards

Whether it is a focus on getting rate changes approved for existing products and markets, determining where and when to enter, stay in, or exit markets, or the cost and time to create and launch new products due to legacy solutions, the decline in new products and product changes reflects a focus on managing today’s business at the risk of tomorrow’s.

Leaders’ view of New Products as a driver of company competitiveness is 18% and 20% higher than Laggards and Followers, respectively. This is reflected further with Leaders 2.2x to 3.4x more likely than Laggards and Followers to implement new products for new and existing markets. Leaders’ ability to rapidly develop, launch, assess, and refine new products gives them an edge in garnering market share, customer loyalty, and competitive advantage, putting others well behind and requiring them to spend more to catch up.

New products must take advantage of new technologies

This is highlighted in the auto telematic market between Progressive and Geico where there is a 10–20-year differential in experience. Berkshire Hathaway Vice Chairman of Insurance Operations Ajit Jain said during the company’s 2022 annual shareholders meeting that Progressive is far ahead of GEICO in using telematics, “There’s no question that recently Progressive has done a much better job than GEICO…both in terms of margins and in terms of growth,” Jain said. “There are a number of causes for that, but I think the biggest culprit is as far as GEICO is concerned…is telematics.”[I]

Furthermore, Insurance Journal also quoted Jain as saying, “Progressive has been on the telematics bandwagon for, I don’t know, more than 10 years, 20 years. GEICO until recently wasn’t involved in telematics. It’s been only the last two years that we made a very serious effort in terms of using telematics for segmentation and trying to match rate and risk.”[ii]

According to the Insurance Journal article, Progressive “outdistanced” GEICO on growth and profitability measures in the first quarter with Progressive reporting a 12% increase in written premiums and a combined ratio of 94.5, up 5.2 points from first-quarter 2021.

This is a perfect example of the business impact of focusing on today’s and tomorrow’s business. Telematics was tomorrow’s business when Progressive started, but has

quickly become today’s business.

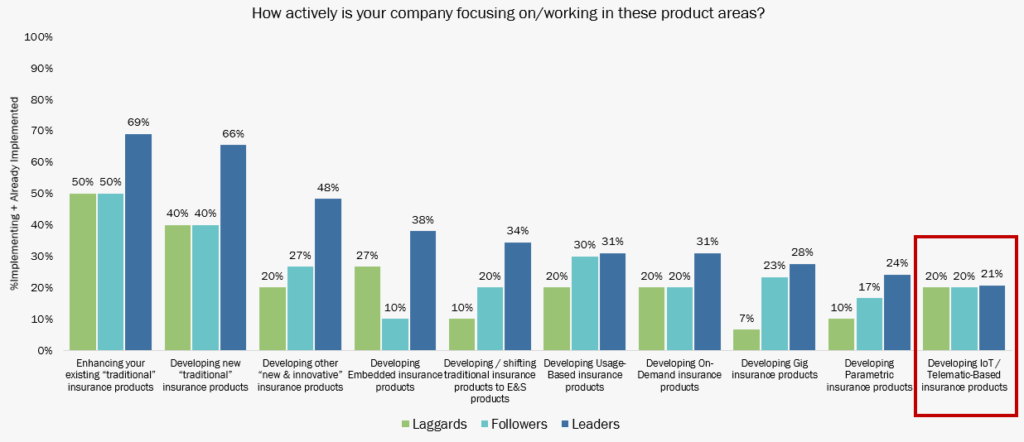

Unfortunately, that example represents the broader market and has only intensified due to rising risk and claims costs. Many insurers are primarily focused on existing, traditional products, either with enhancements or a new version of the product, as reflected in Figure 2. Leaders differentiate themselves. Leaders are ahead not only in traditional products, but also in developing other “new & innovative,” embedded, and E&S products by 1.4x to 3.4x higher than Laggards and 1.7x to 3.8x higher than Followers.

Most surprising is the low level of activity by all three segments in developing IoT/Telematic Based products, mirroring the example of Progressive. Given the dramatically rising costs for auto insurance, there is increased interest among customers in usage-based and telematic insurance to help manage or drive down insurance premiums.

Should this interest continue to accelerate, many insurers will be left behind while those with usage- and telematic-based products capture the market share, shifting premium from traditional auto insurance to these newer products. With auto insurance the largest book of business for P&C, this shift could be financially catastrophic for those who are Followers and Laggards.

Figure 2: Types of products Leaders, Followers, and Laggards are focusing on

Services, including risk-lowering services, can boost insurer offerings

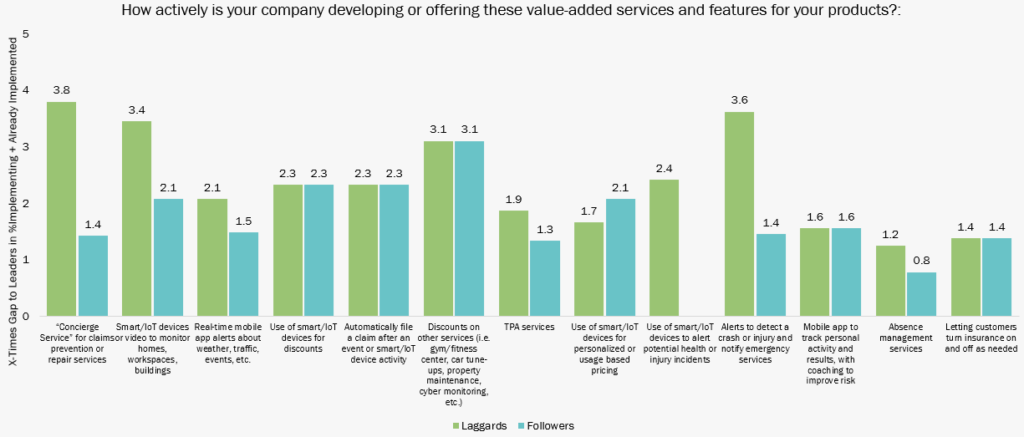

Regarding value-added services, Leaders are 2x to 3x more likely than Laggards to offer a majority of the array of services we surveyed. This includes concierge claims service (3.8x), smart/IoT devices for discounts (2.3x), monitoring homes/workplaces (3.4x), providing health alerts (2.4x), discounts on services (3.1x), and alerts to detect crashes and notify emergency services (3.6x). Additionally, Leaders are over 2.1x to 3.1x more likely than Laggards to offer bundled product offerings.

Figure 3: Types of value-added services Leaders, Followers, and Laggards are focusing on

While insurers overall express an optimistic view of new product development over the next three years, prioritizing existing products remains dominant, putting them at risk of not meeting the risk and customer demands that are only growing. This is acutely evident for Laggards who consistently fall significantly behind Leaders, and Followers who remain close but struggle to catch up. And catching up can cost more.

This is where Leaders stand out. They recognize the shifting demands and focus on both existing and new products, bundled products and value-added services that keep them relevant and competitive. They adapt and dually focus on today and tomorrow.

In today’s rapidly changing risk environment and marketplace, transformation must be more than just legacy system replacement. It must be a burning platform for a strategic change of both the operating model and technology foundation that will adapt to rapid market changes, innovate, and tap into market opportunities to grow the business. Doing one without the other does not work. Just look at the last 20 years of transformation initiatives that did nothing but replace technology and kept our operating models the same which now is creating real operating model challenges, risks, and unsatisfactory business outcomes.

Playing it safe by innovating against risk

The insurance industry’s core business model that includes premiums, underwriting, billing, claims, reserves, and capital is not changing. But the operating model and how we think about the operating model needs to be reinvented.

When we talk about new operating models and NextGen technology foundations for insurance, we must acknowledge how difficult it can be to make new moves, while in the same moment, we must recognize they are necessary. This is why leadership, strategy, realigned priorities, and reallocated resources to enable the execution of the priorities is so crucial. Using next-gen technologies effectively with a new operating model requires choosing those that will impact the business and profitability when they are used holistically together.

Every aspect of the insurance business is being redefined within the context of the future … not the past. Insurance companies must truly transform and reinvent themselves as technology-forward companies that can deliver personalized products and services to meet new customer and agent expectations and keep in step with market leaders. They must address the risk of staying the same and invest in themselves. Insurers have the capital that could be reallocated to investing in the future. It is doable.

Headed to ITC 2024 next week? Come meet us! You’ll find Majesco at Booth #1732 and you are invited to join us at one of our three sessions, beginning with the Main Stage Session: GenAI — Revolutionizing and Optimizing Insurance Operations with Intelligence, from 8:15-10:00 am on Wednesday, October 16. You will hear how we are helping insurers rethink their business operating model and technology foundation to succeed in this new era of risk and insurance.

Come see what GenAI is doing in Majesco solutions. Schedule a meeting with us, or check out our demo schedule to find out more about your specific areas of interest. Not going to ITC? Register today for Majesco’s upcoming webinar highlighting the Majesco Fall ’24 Release with new applications of Majesco Copilot, the insurance industry’s first GenAI solution.

[i] Lowery, Lurah, “Berkshire chairman notes Progressive ahead of GEICO with telematics; GEICO sees Q1 underwriting loss,” Repairer Driven News, May 4, 2022, https://www.repairerdrivennews.com/2022/05/04/berkshire-chairman-notesprogressive-ahead-of-geico-with-telematics-geico-sees-q1-underwriting-loss/

[ii] Sclafane, Susanne, “State Farm Still Wins: Buffett Talks Auto Insurance at Annual Event,” Insurance Journal, May 3, 2022, https://www.insurancejournal.com/news/national/2022/05/03/665585.htm