Blog

Insurance’s Next Step: Real Core System Innovation

Today’s shared resources and the cooperative efforts that fuel digital transformation started with yesterday’s data processing.

In the age before computers, insurance companies had paper files for everything. Large insurers were sitting on mountains of paper, including policies, file folders, signatures, payment and claims records. Every scrap of data was on paper, in duplicate, thanks to the IBM Selectric typewriter, the carbon copy, heavy-duty ballpoint pens and a lot of hard pressing.

Then there came data processing. Data processing didn’t solve the paper problem, but it solved a host of other insurance issues, such as keeping track of policyholders and policies, terms, valuations, and claims. Curated data-enhanced learning. It helped to manage the industry’s growing pains.

One fascinating aspect of the data processing era was that most insurers didn’t own the computers that made the computations. They rented time on them. Sometimes they shared computers or they relied upon outside data processing companies to do the work for them. This aspect of the business — sharing technology — grew out of fashion with the largest insurers as infrastructure systems grew and business systems were internally developed and customized with new functionality to compete and differentiate. What started as a cooperative effort ended in a “space race” of sorts. The company whose systems could do the most, could (in theory) compete the best.

Mainframe systems and the customized business solutions on them, however, grew unwieldy. Mergers and acquisitions created headaches for the business and IT. “If we unify multiple mainframe environments, how do we handle the seven business systems? Do we consolidate or run simultaneously?” For many insurers, a software vendor made sense. In effect, this was a return to the sharing model. Companies would band together under the umbrella of a software company that could would develop and manage their business system needs and workloads. This method has been proven to be highly efficient and valuable. Insurers receive the collective knowledge, expertise and development funded by multiple companies. They also enter into a dynamic relationship where the community of users shares best practices as well as stories about their experiments, jointly finding answers to insurance’s great dilemmas. You can still witness the value of these relationships first-hand when you attend a Majesco conference, product council or tune into one of our frequent podcasts or webinars. Sharing successes, and even failures, is instructive, and can even be exciting.

A New Phase for Insurance Systems, Technologies and Ecosystems

So, what’s next? Is there a natural segue from this Software vendor-led community of excellence into a higher level of cooperation that still leaves room for the best ways to compete? The answer is, “Yes.” The opportunities on the horizon are going to carry insurers into a whole new realm of competition based upon flexibility, speed, creativity, uniqueness and market readiness. Interestingly, it will still involve sharing, to an even greater degree.

Last week, Majesco released its latest thought leadership report, Insurance Digital Transformation: A New Era of Core Systems, Next Gen Technologies and Ecosystems. In the report, we look at the tremendous changes that are still needed and on the horizon for insurance. We’ll discuss some of these challenges at a high level in today’s blog — to see if there is a natural progression from the past, through today’s hurdles, and into the future of insurance.

It helps to briefly analyze where the industry currently stands.

While the insurance business model has been resilient over decades, today’s disruptive digital era shift is highlighting not only its cracks and challenges, but also numerous game-changing opportunities that can extend insurers’ value proposition to their customers.

The traditional insurance value chain is changing and becoming more complex including:

- Large brokers and MGAs are designing and launching new, innovative customer-focused products

- Insurers are expanding and managing direct to consumer channels to capture customers

- Reinsurers are entering the direct insurance market by designing and launching innovative new products and business models

- Expanding new distribution channels such as marketplaces, and partnerships with embedded insurance are increasingly important

- The barrier to entry is lowering with a continued flow of new entrants

- Insurance is expanding to focus on risk avoidance, mitigation, offering value added services and advisory services

We are seeing the redefinition and value creation revolution for insurance, based on platform technologies, next-gen technologies and growing digital ecosystems that provide new data sources, innovative capabilities and interesting value-added services, all of which create a multiplier effect.

While many insurers have been modernizing their core systems over the last two decades with “modern core systems” implemented on-premise, the rapid emergence of platform technologies like Cloud, APIs, microservices, artificial intelligence, machine learning and more are causing insurers to shift again. It has been four short years since the emergence of InsurTech and the rapid growth of platform-based business models. Insurers need to examine and redefine their strategies around core system platforms, next-gen technologies and ecosystems that are technically and architecturally different than the on-premise “modern core” solutions of the past.

To succeed in the future of insurance, insurers must prioritize these and capitalize on the tremendous value that they can deliver, in terms of digital transformation, innovation, and a foundation for growth.

Insurance Industry Digital Transformation

The insurance industry is in the midst of a time of immense change. Many insurers are actively embracing change through new business models, technology investments, and partnerships.

However, many others are challenged to upgrade core platforms and digital capabilities at the same time that they are exploring new strategies, technologies, partnerships, and investments. Those that lack a core system platform will find it increasingly difficult to innovate and venture into new spaces.

The big question about the future of the industry is, “How rapidly are we adopting core system platforms? Next-gen technologies? Ecosystems?” These and many other questions need to be addressed by insurers quickly, in order to learn and prepare and take advantage of the window of opportunity.

Current State of Insurance Technologies

Customer risk needs and engagement expectations are changing significantly, forcing the insurance industry to rapidly move from practices and technologies of the past to new platform, next-gen and ecosystem-based technologies and business models that will carry them into the future of insurance.

Many insurance leaders are investing in these technologies to ensure that they remain or become leaders in the future of insurance. As customer, market and technology trends continue to disrupt and challenge insurance, understanding the current and future state of insurance and how investment in these technologies will determine success becomes increasingly crucial.

Understanding where you are relative to the market leaders is the foundational step in setting

your strategies and priorities. In our latest report we look in detail at participation levels. How many insurers are still holding onto legacy or mainframe or non-platform core systems?

Core Systems: Platform versus Non-Platform

What we have found in recent Majesco primary research behind the new core systems report and the Strategic Priorities report, is that nearly all companies are on some level, still dealing with legacy, non-platform systems. Over the last decade or more, core system modernization and transformation has been painful and expensive, often running over several years and costing tens to hundreds of millions of dollars to create an on-premise custom-configured environment. These on-premise core system implementations added layers of portals for customers and agents, as well as an array of complex integrations to leverage data sources or integrate with other systems, both internal and external.

One of the greatest new alternatives for insurers comes from platform technologies, such as Majesco P&C Core Suite, Majesco L&A and Group Core Suite and Majesco Digital1st Insuranceâ, that transform modern core systems into platforms by leveraging microservices, API, cloud computing, artificial intelligence, machine learning, pre-configured content and new data sources, other next-gen technologies and digital ecosystems. By using these technologies, insurers can shift from being the ‘owners of complex systems’ to become the ‘owners of greater technical agility and flexibility, digital fluency, innovation and speed to value’ required for today’s pace of change.

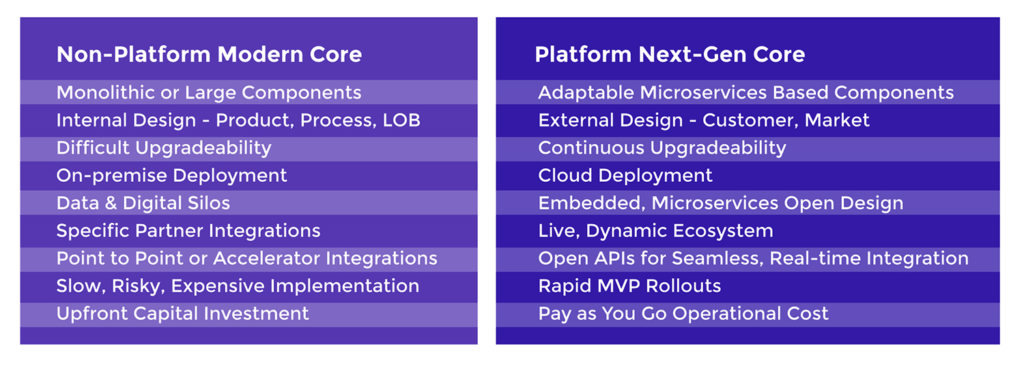

This shift from non-platform to platform is significant and defined as follows:

- Platform: Cloud-enabled, API and SaaS-based solutions or next-gen that are cloud-native, API and microservices solutions.

- Non-Platform: Old monolithic legacy and modern on-premise solutions.

Figure 1 outlines the key elements of this shift that together support a new digital era of insurance that is dramatically different than the past.

Figure 1

Taking Core System Transformation to the Next Level

Transformation is important to modernize and optimize the current business and meet a new standard of customer experience for your current business. Core system transformation has been underway for the last two decades at differing paces, with P&C leading the charge and L&A and Group just beginning, primarily with modern, on-premise solutions that are Non-Platform solutions.

In the digital age, however, transformation must be much more than just legacy replacement. It must be a burning platform for strategic change that includes the implementation of a cloud-enabled or cloud-native, SaaS-based Platform solution. This will provide a richer foundation upon which to adapt to rapid market changes, innovate and tap into growing ecosystems that reach new customers and channels. Ironically, it is this sharing of cloud services, ecosystems and the use of plug-and-play digital technologies that will enable insurers to differentiate themselves with unique products and services.

In the coming weeks, we will look at the percentages of carriers that are moving into platform solutions. We’ll see how many carriers, split by lines of business, are still wrestling with one or multiple homegrown legacy solutions. We will also consider how startups are using their flexible capabilities to disrupt incumbent insurers through an unbundling of products, services and technologies.

Do insurers have anything to fear, or can they use the power of platform technologies, the value of shared ecosystems and a new vision of core system development to thrive and compete?

For a preview of our discussion, be sure to download, Insurance Digital Transformation: A New Era of Core Systems, Next Gen Technologies and Ecosystems.