Blog

Incumbent Insurers are from Mars and InsurTech Startups are from Venus: Panel Discussion Part 2

The “right way” for developing any solution has always been a matter of perspective. Every team develops its own philosophies based upon the background of the team members and their ultimate goals. Let’s consider two different teams and their approaches.

Team A has many years of experience that may give them an edge in finding a particular solution. They have built solutions in the past that might lend themselves to adaptability. They may grasp important barriers that they are likely to encounter along the way. They have allocated funding toward innovations and they want to innovate. They are willing to partner to get what they need. Their confidence and experience, however, may be a blind spot — they may not completely grasp the opportunities that lie outside of their experiences.

Team B has less industry experience, but they have a grasp of the necessity of the solution. They don’t completely understand the barriers that they may encounter, but they are optimistic that the technologies they may employ will change the nature of the game enough that those barriers may fade away. They are agreeable to networks and partnerships that will help them along the way. If they have a blind spot, it may be in underestimating the effort it will take to work within the confines of a slow-moving, risk-averse, regulated industry.

In last week’s blog, we started looking at these teams in detail. Team A is made up of insurer/MGA startups within the InsurTech space. Team B is made up of solution/data provider startups within the InsurTech space. Both teams are ready and willing to innovate, but they are seeing many of the same issues from different perspectives. Majesco recently surveyed these groups, with the help of Silicon Valley Insurance Accelerator (SVIA) and Global Insurance Accelerator (GIA). Our survey was designed to understand InsurTechs’ views of the industry, where and how they are entering, views of customer pain points, and what they have learned so far. We then took those results and shared them with four industry insiders.

Mike Connor, CEO, Co-Founder, Silicon Valley Insurance Accelerator (SVIA)

Ryan Hanley, CMO, Bold Penguin

Brian Hemesath, Managing Director, Global Insurance Accelerator (GIA)

Dr. Robin Kiera, Founder, Digitalscouting.de

The experience of our panel is unique. Our panelists are in daily contact with both sides of the startup equation, so they have the ability to share the valuable perspective from the center. You can listen to what they had to say in our latest webinar, Incumbent Insurers are from Mars and InsurTech Startups are from Venus.

In today’s blog, we’re going to look at:

- Which technologies do solution providers and insurer/MGA startups see as important to their business models?

- Are they a part of ecosystems or partnerships, and if they are, what kind of partnerships?

- Which internal and external challenges are most pressing?

Technologies important for the business model

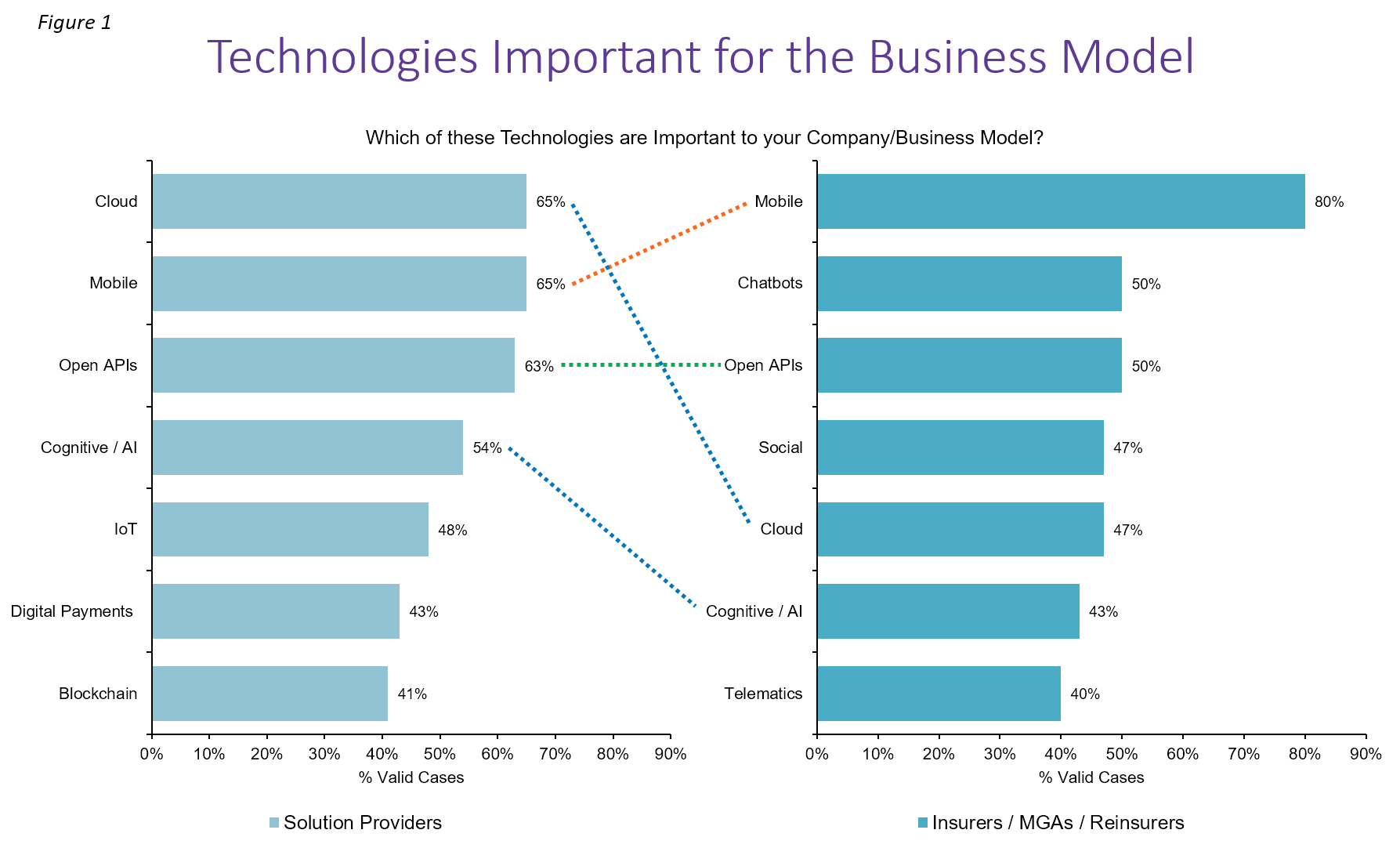

The Majesco survey results for this category were insightful for a number of reasons. Looking at figure 1 (below) it is easy to see the differences in technology priorities. Solution providers are looking at the technologies that will foster platform solutions and the insurers seem to be focused on those technologies that will simply digitize what they are already doing. Insurers/MGAs are looking more at targeted solutions, whereas the solution providers are taking a broader and more strategic approach.

“The Silicon Valley position,” said Mike Connor, “is that we see emerging technologies as a way of breaking existing models and bringing new capabilities to the marketplace. We have lived through what happens when you don’t follow technology [trends] as a technology provider. We have a deep DNA that is aligned with figuring out how we take advantage of this instead of getting rolled over by it. Insurers are caught in trying to keep their models sufficient and competitive. We are in the world of, ‘How do we create the next generation,’ so I think that is exactly the difference (in perspectives) that we’re seeing here.”

It is interesting to note the low priority of blockchain technologies within both camps. Though blockchain has potential to be important, the panelists were uniformly of the mind that it is still very early to see any significant development and that certain criteria would need to be in place for InsurTech data to be positively affected by blockchain integration.

Dr. Robin Kiera said that in Europe, there is research and development, but it is really early-stage…and that blockchain research in Europe is largely funded by Reinsurers. Brian Hemesath added,

“We always squint a little bit when we see an applicant come through that claims to be using blockchain. We always want to boil it down to ‘Why are you using blockchain?’ and it may be that they feel by using it they will be able to raise more venture capital.” Brian went on to say that, “Blockchain would be very useful within the Reinsurance market where you have complex deals and there is a lot of reconciliation. There are a lot of companies working together where they need to verify, validate and share data. We’re waiting to see that kind of reinsurance solution, but we haven’t really seen it yet.”

Mike added that “unless you can bring an ecosystem together,” it would be difficult for a startup to tap into the big value of blockchain. It is a “big company” game that would require widespread adoption as ecosystems evolve.

Ecosystems and partnerships

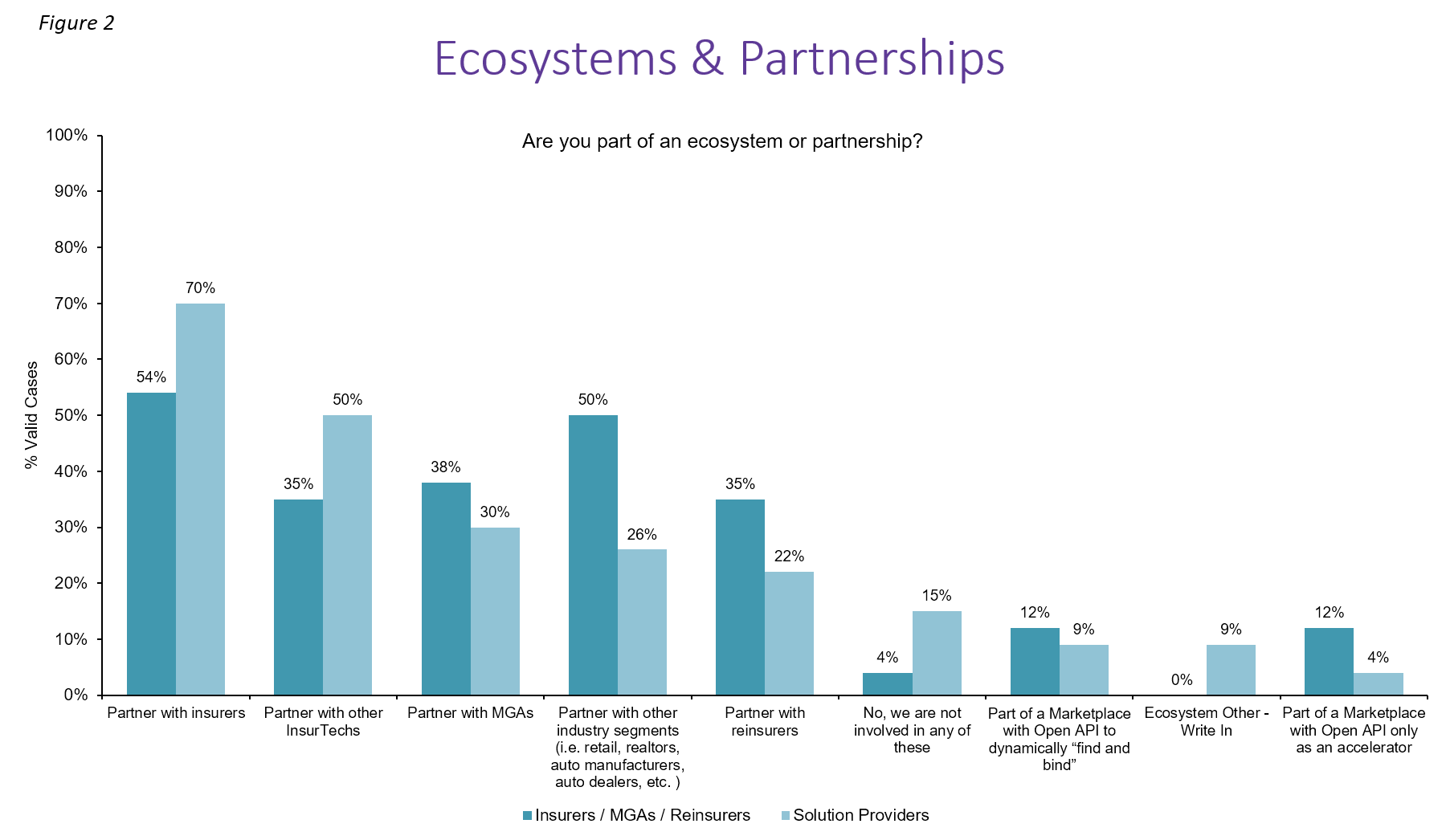

Surprise! Insurers/MGAs/Reinsurers startups are partnering at high levels with other insurers in order to accomplish their business goals. They are also partnering (50%) with other industry segments to bring their products to market. InsurTech solution providers are (no surprise) partnering at high levels, but they are partnering at especially high levels with other InsurTech companies.

Ryan Hanley quickly brought up an important detail. The sheer number of InsurTech solutions is making it difficult for insurance companies to choose whom to partner with.

“They are wondering, ‘how do we prioritize?’ A lot of middle-market carriers are struggling with how they prioritize X technology versus Y and then once they’ve decided on that, which partners do they bring in?”

Robin mentioned that the European scope of partnership seems to be a bit different. Traditional industries and traditional insurers seem to be developing the most viable partnerships. The InsurTech startups’ most viable partnerships seem to be within neighboring industries, where they are copying many of the principles of traditional players.

Internal and external challenges

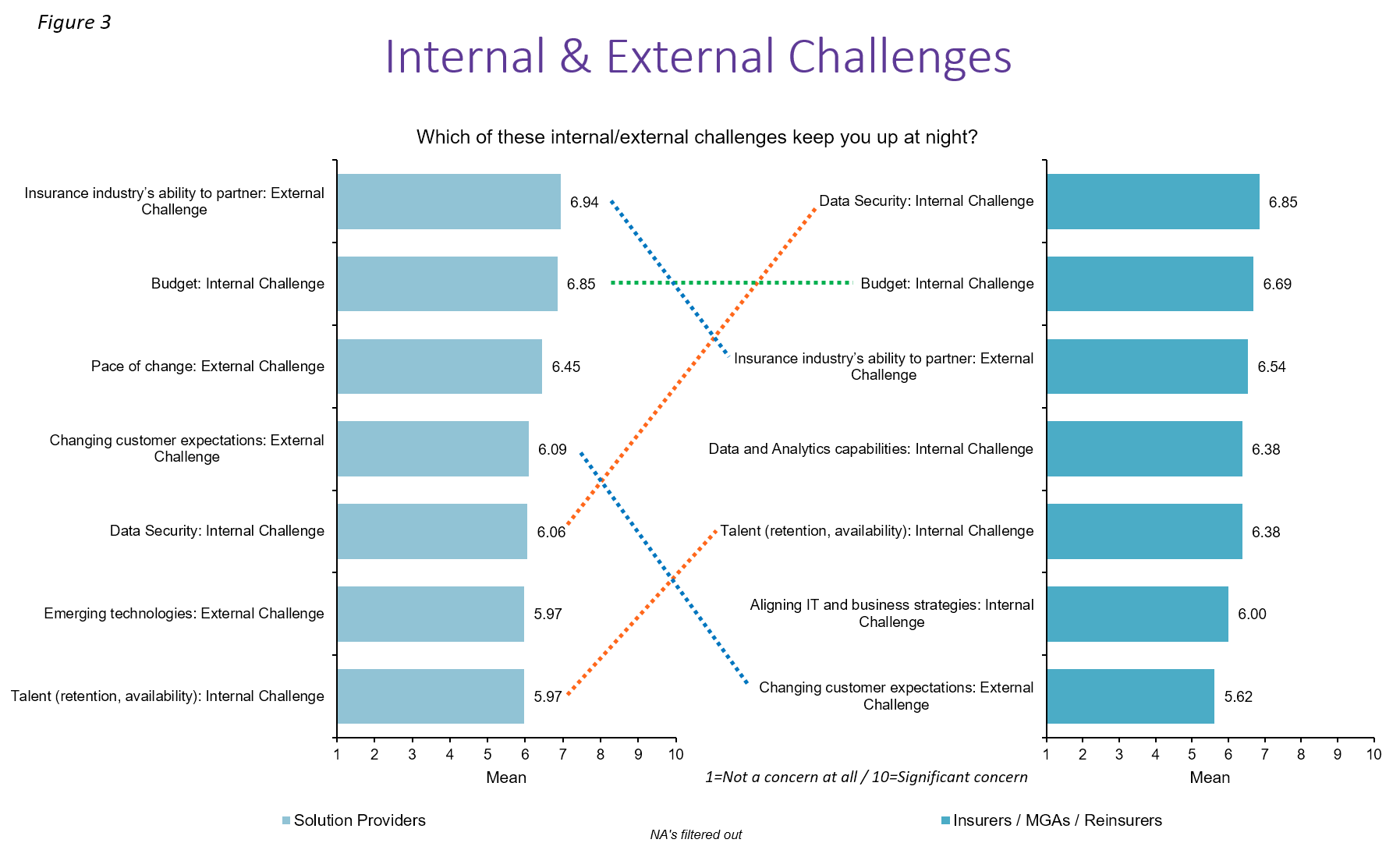

Despite solution providers’ high level of partnering with insurers, the insurance industry’s ability to partner tops the list of challenges they say they are facing. (See Figure 3, below.) It is a major issue for some of the innovative InsurTechs. In contrast, the insurers/MGA startup, felt that data security, an internal challenge, was their greatest.

The industry’s inability to easily partner could be a major stumbling block for industry innovation. If it takes innovators too long and too much funding to work through the procurement process, then they will lose momentum.

“Startups are often 3-4 people prepared to build and learn and fail and build and learn and fail,” said Brian. “Large insurance companies aren’t built that way. They aren’t able to understand one another. As an example, look at the info security questionnaire at some insurers, with 200 questions. A startup will fail that with flying colors. They are trying to innovate, not be prepared for enterprise opportunities. The incumbent companies that have been successful [in partnering] have created a point position within the organization that will hold the hand of the startup through the procurement process. This graph (above) is excellent at portraying what we accurately see in our world.”

“This is the Mars vs. Venus relationship,” said Mike. “Unless you have sold into an enterprise, you don’t understand how complex it is. On the insurance company side, in many cases, they are just forming their decision-making process to work in this world of innovation.”

“We counsel both InsurTech startups and insurance carriers — ‘When you come to the table, please be as excruciatingly honest as possible in where you are in the decision-making cycle, who is involved, and what your expectations of this relationship are. If those things don’t match up, please let each other know immediately.’”

Mike went on to talk about the challenges as related to partnerships,

“One thing I believe is that if you, as a major incumbent carrier, do not learn how to partner and work collaboratively in the industry and to engage multiple partners to build the kind of business you’re going to need to survive in the future, you’re going to die. But help is on the way.”

That help is the consolidation of innovations within ecosystem models. These will act as the bridges to allow Mars and Venus to work together with fewer hurdles on the front end. Mike said that ecosystems, such as the one that Majesco provides via Digital1st EcoExchange, with pre-screened and integrated InsurTech solution providers, can help insurers to tap into innovations without having to go through separate decision and agreement processes. He sees that as a growing trend, where ecosystems will allow companies to have some security in knowing that the underlying innovations work because they are already in place. This also ties back to Ryan’s comment regarding the difficulty of vetting innovative partners from so many choices. Sometimes simply using innovations requires an innovative method for plug and play.

For access to the full discussion, including comments surrounding the likelihood of GAFA companies working within the insurance industry, please visit the Majesco website and view the webinar today.