Blog

Affinity Business Insurance: Imagination Applied to Program and Affinity Insurance

It’s a tale as old as Legos. (Okay, maybe older.) Traditional ideas need applied imagination to remain relevant.

In 1947, a traditional wood toy manufacturer in Denmark saw the possibilities of using plastic injected molding to produce interlocking, hollow bricks. They received a patent. The rest is history…only not quite. People were initially hesitant to purchase plastic toys. Wood and metal were traditional. At first, Legos didn’t sell particularly well.

Over time, however, Lego continued to innovate. They moved on from plastic bricks. They added gears, wheels, propellers — items that would facilitate the creative aspect of children’s fascination with motion. They added little people. Now children could build towns. They opened Legoland parks, where miniature worlds could come to life. Today, Lego sets are most often sold “model style,” in boxes that hint at what should be created. In a child’s hands, however, Lego components can add up to anything and it may not resemble the picture on the box. Imagination provides the model. I see this with my 9- year-old grandson who has been obsessed with Legos since he was 2. He loves putting them together and creates a world unto his own that comes from his imagination, something new and unique.

If only we all could keep that level of imagination to power innovation in our business lives! Great innovators desire to create something new and wonderful. With all the partners, solutions, technologies and data we have today – opportunity is at an all-time high. But as Vincent Van Gogh – an innovator in his own right famously said – “Do not quench your inspiration and your imagination; do not become the slave of your model.”[i]

In the realm of insurance, we speak a lot about innovation. Innovation is where it’s at. But are we slaves to our existing business model? Maybe we should also reach back into our childhoods regularly and recapture the idea that imagination is where innovation begins.

When you think about it, today’s market reach and product building might operate much like Legos. What can we create using the hundreds of unique technologies, data sources, partners, processes and possibilities placed in front of us? Can technology and improved real-time data give us what we need to produce parametric insurance products? Can we use what know about niche underwriting for groups to produce value-added on-demand and usage-based products? Will different partnerships provide new reach for growth?

For those insurers who are already in touch with the program and affinity group insurance markets, or those who are considering program and affinity products — can imagination help to meet market opportunities in innovative ways?

Last week, Majesco released its latest thought leadership report, A Roadmap to the Future of Insurance: Program and Affinity Business, written in conjunction with the Professional Insurance Marketing Association (PIMA). In our report, we use PIMA’s latest research initiative, Affinity 2030: Exploring Our Blind Spots for a Brighter Future, in conjunction with Majesco’s 2020 consumer research to paint a picture of the opportunity.

In today’s blog, we’re going to look at the opportunity in the light of examples.

- Markets — How are insurers currently viewing program and affinity business insurance to meet the needs of today’s markets? What examples can we find of the markets they are now seeking to reach?

- Products —How are companies pulling together the modern tools and components of product construction to imagine and innovate new, non-traditional product offerings?

Our research highlights the new markets, products and partners that insurers, MGAs and brokers should be actively pursuing in order to reach customers on their terms.

Current and New Targets for Program and Affinity Insurers

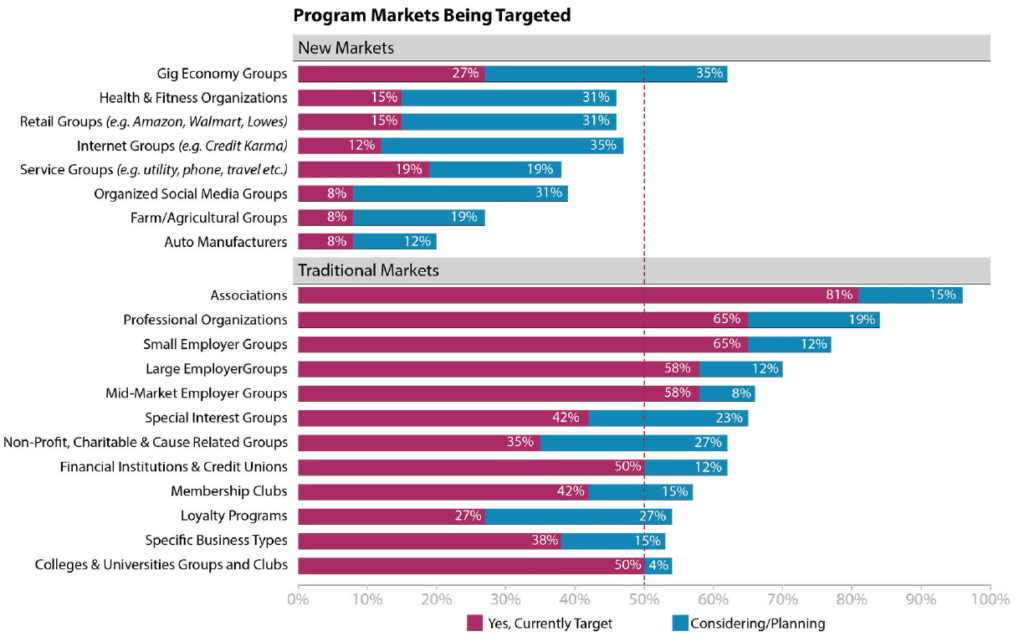

First let’s look at the partners that organizations are currently focused on for affinity and program business. From the research, the top three – traditional models – include associations (81%), professional organizations (65%) and employer groups – small (65%), large (58%) and mid-market (58%). The top traditional markets under consideration or in planning include loyalty programs (27%), non-profit charitable and cause related groups (27%) and special interest groups (23%). (See Figure 1.)

In contrast, while emerging markets have an overall lower usage, they represent the largest under consideration. The top three currently being used include Gig Economy groups (27%), service groups (19%), and two groups tied for third at 15%, including health and fitness organizations and retail groups. However, those under consideration or in planning include Gig Economy (35%), internet groups (35%) and three that tie for third at 31%, including health and fitness organizations, retail groups and organized social media groups. This fits well with our findings from last week’s blog, where we theorized that even though the methods will change, the concept of community will always be a factor in program and affinity business.

If organizations follow through with these plans, these emerging markets will jump ahead of many in the traditional market space – placing leaders in an advantageous position to drive growth and move well ahead of insurers not focused on affinity and program business.

Figure 1: Traditional and new affinity / program markets being targeted

Some imaginative and forward-thinking insurers are moving into emerging markets with new partnerships that will accelerate the customer experience, expand distribution reach and improve the ability to buy seamlessly at the point of need. Examples include:

- HODINKEE, a well-known resource for all things watches, formed HODINKEE Insurance Agency, allowing collectors to insure their watch collections online with Chubb.[ii] HODINKEE Insurance built a model and product that took the complexity out of insurance, streamlining the process and eliminating paperwork via any digital device.

- John Hancock announced the integration of their Vitality Program with Amazon Halo, allowing Hancock’s Vitality customers to use the Amazon Halo Band to earn Vitality points based on their daily efforts for a healthier lifestyle that should mean a longer life.[iii]

- Through State Farm, Ford vehicle owners will be able to opt-in to State Farm’s Drive Safe & Save program, which aligns premium to miles driven while also rewarding safe and good driving behavior with potential discounts. Opt-in offerings at the point of need are key to affinity and program success.

These companies and others are making the first mover, bold strategic moves in partnerships and an expanding ecosystem to expand their reach and presence to where their customers will be.

Current and New Products for Program and Affinity Insurers

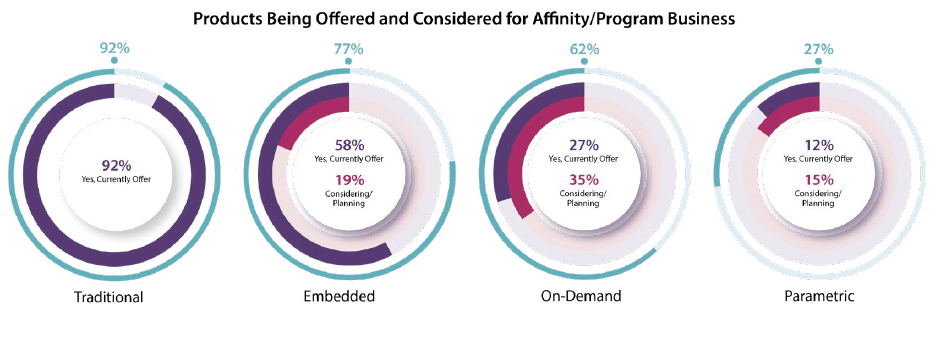

As expected, most of the currently offered program and affinity products are traditional (92%) – whole life, term, auto or homeowners. However, many insurers are currently offering embedded insurance (58%) with another 19% in consideration – raising this to a potential of 77% as noted in Figure 2.

Embedded insurance is an extremely effective way to overcome the decades-long burden that has plagued the industry: Insurance is sold, not bought. Embedded insurance completely changes this paradigm because it is bought as a part of something else.

Also encouraging was that on-demand insurance is currently offered by 27% of companies with another 35% in consideration – raising this to a potential of 62%. Only parametric is in the early stages, with 12% currently offering and another 15% considering, for a total of 27% potential.

Companies establishing partnerships and ecosystems to penetrate these markets are building strong foundations for growth as consumer and SMB interest and desire for these products continues to grow.

Figure 2: Products being offered and considered for affinity / program business

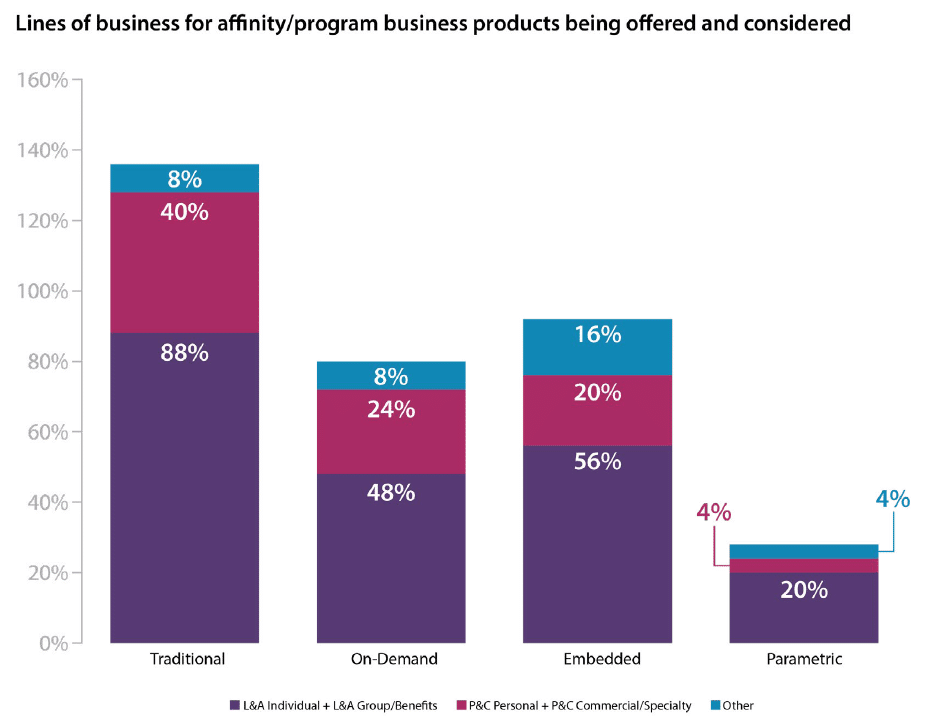

With regard to the lines of business they are offering in the affinity and program business, the companies surveyed had a higher focus on offering L&A and Group Benefits compared to P&C Personal and Commercial. The top focus was on traditional L&A products at 88%, as compared to 40% for P&C. Embedded insurance was second with L&A at 56% and P&C at 20% followed by on-demand products for L&A at 48% as compared to 24% for P&C, and 20% for L&A parametric products as compared to 4% for P&C. (See Figure 3.)

Figure 3: Lines of business for affinity / program business products being offered and considered

Economic and demographic shifts are accelerating the demand for on-demand products and services, offering tremendous growth opportunities. Insurers who are not experimenting and offering these types of products will lose valuable time to establish strong partnerships to reach the growing demand for these products. Consider the following market statistics:

- The sharing economy revenue is expected to increase by 22x between 2013 and 2025.[iv]

- Usage-based insurance market size could hit US $190 Bn by 2026.[v]

With the growing market interest in on-demand and embedded products, how do insurers’ and brokers’ plans for offering these products measure up? Are we being imaginative enough?

We compared our recent auto and life insurance consumer responses to the results of this survey, and found there is a significant gap between what customers want and what companies are offering. The impact of COVID will likely drive the interest in these products even higher, creating an even larger gap.

Innovative product offerings aimed at selling to groups

Some emerging leaders are introducing new, innovative product offerings geared to both common and uncommon groups. Note how each offering combines a bit of imagination with partnership and ecosystem thinking to meet a pressing, yet previously unmet need.

- Global Parametrics/Arbol – Global Parametrics, a parametric and index-based disaster risk transfer company, teamed up with Arbol, a technology-driven marketplace that uses blockchain and smart contracts to provide weather risk insurance coverage to smallholder coffee farmers in Costa Rica.[vi]

- Understory – Understory initially launched its Hail Safe product for auto dealerships last November but rolled it out to a significant number of additional states in April. The product coverage is triggered using Understory’s proprietary hail sensor. Understory partnered with international weather risk manager MSI GuaranteedWeather to bring the product to market.[vii]

- Pandemic Protector – In partnership with C.J. Coleman & Company Limited, a leading Lloyd’s and London market brokerage, One80 introduced a policy that provides non-damage business interruption insurance for loss of gross profit due to an epidemic and/or pandemic outbreak. The coverage is designed for companies of all sectors and sizes. With a low minimum premium, the customized policy provides broad coverage with a flexible definition of the epidemic triggers to meet insureds’ bespoke needs.[viii]

- Starr Gate – Starr Insurance launched a new kind of general aviation policy providing pilots who rent aircraft with unprecedented flexibility for their insurance needs through “high-definition underwriting” and usage-based pricing with a tool that can also improve a pilot’s skills.[ix]

In my next blog, we look at how ecosystems and partnerships can dramatically accelerate imaginative thinking by expanding capabilities and channels. We go into detail, looking at over 30 different channels that are both currently in use or are in the planning stages for some insurers. You won’t want to miss the list and what we see as the most viable channel options. For a preview, you can read the details today by downloading A Roadmap to the Future of Insurance: Program and Affinity Business. You can gain additional insights on trends within the Program and Affinity business by listening to our recent webinar, The Power of the Insurance Niche Market: Program and Affinity Business is Hot Hot Hot, a conversation with myself and PIMA Executive Director and industry expert, Ann Dieleman.

And finally, consider this quote from Theodore Levitt – “Creativity is thinking up new things. Innovation is doing new things.”[x] As we have noted in our 2020 Strategic Priorities report, there is a growing Knowing – Doing gap between Leaders and Followers (42%) and Laggards (45%), in embracing new partnerships. These Leaders are positioning to gain market advantage before competitors make their moves.

What’s your next move?

[i] https://www.success.com/15-inspirational-quotes-to-unlock-your-imagination/

[ii] Gomelsky, Victoria, “An Easier Way to Insure That Watch,” New York Times, September 9, 2020, https://www.nytimes.com/2020/09/09/fashion/watch-insurance-online.html

[iii] O’Donnell, Anthony, “John Hancock Integrates Amazon Halo with Vitality Program,” Insurance Innovation Reporter, August 28, 2020, https://iireporter.com/john-hancock-integrates-amazon-halo-with-vitality-program/

[iv] https://www.weforum.org/agenda/2019/01/sharing-economy/

[v] “Usage-based Insurance Market Size to Hit US$ 190 Bn by 2026,” Acumen Research and Consulting, https://www.globenewswire.com/news-release/2019/05/16/1826253/0/en/Usage-based-Insurance-Market-Size-to-Hit-US-190-Bn-by-2026.html

[vi] Evans, Steve, “Global Parametrics puts NDF capacity behind Arbol-powered weather risk pilot,” Artemis, April 15, 2020, https://www.artemis.bm/news/global-parametrics-puts-ndf-capacity-behind-arbol-powered-weather-risk-pilot/

[vii] Ben-Hutta, Shefi, “Understory launches hail insurance for auto dealers in five new states,” Coverager, February 13, 2020, https://coverager.com/understory-launches-hail-insurance-for-auto-dealers-in-five-new-states/

[viii] Moorcraft, Bethan, “One80 Intermediaries launches accessible Pandemic Protector policy,” Insurance Business America, August 26, 2020, https://www.insurancebusinessmag.com/us/news/breaking-news/one80-intermediaries-launches-accessible-pandemic-protector-policy-231807.aspx

[ix] “Starr Insurance Companies Launches Starr Gate, First-Of-Its-Kind, Usage-Based Aviation Insurance for Pilots Who Rent,” STARR Insurance Companies Press Release, May 26, 2020, https://www.starrcompanies.com/news/starr-insurance-companies-launches%20starr%20gate-first-of-its-kind-usage-based-aviation-insurance