Blog

How to Reduce Your Loss Ratio Using Risk Insights

Loss control surveys play a vital role in helping underwriters to assess and price risk by generating insights about potential risk exposure.

However, while these surveys provide valuable information, most carriers are only able to look at 5% – 10% of their policies due to budget and workflow constraints. In many instances, these surveys are often ordered based on an underwriter’s gut feeling or after suffering losses of a certain type.

Majesco is focusing on integrating AI, machine learning, and data analytics into all aspects of loss control. A great example of this would be our breakthrough Risk Insights tool, part of Majesco Loss Control 360, which enables carriers to cost-effectively and efficiently review more new business and renewals by answering two vital questions:

- Does this property require an inspection?

- If so, what type of survey should be performed?

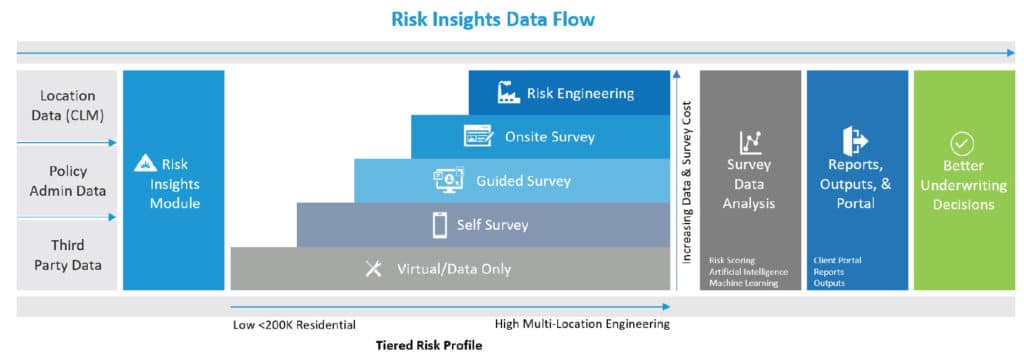

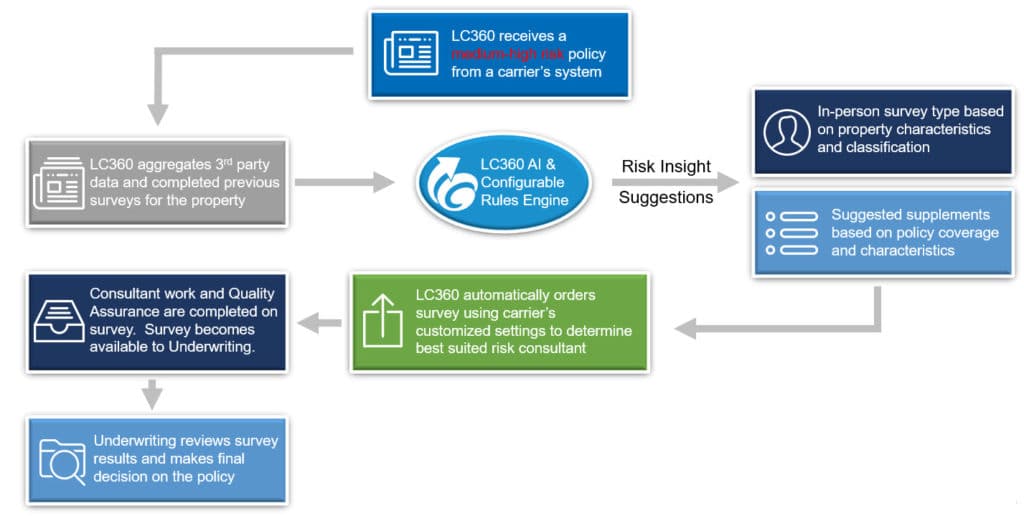

Risk Insights can answer these questions by taking your underwriting guidelines and factoring in external data sources (e.g. natural hazard data, aerial imagery, etc.) to recommend the most efficient survey methods based on a tiered risk profile.

If a survey is required, Risk Insights will recommend one of the following survey types based on a the policy’s level of risk and its complexity:

- Virtual/Data Only

- Self-Survey Video

- Guided Survey

- Onsite Survey

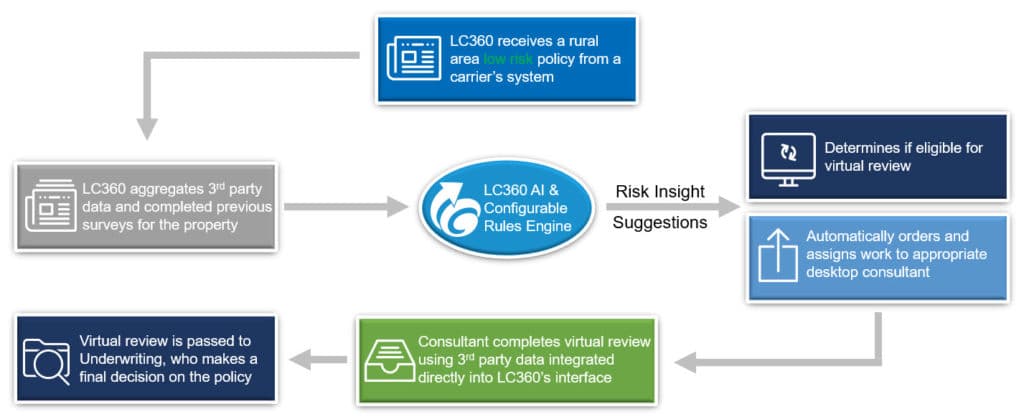

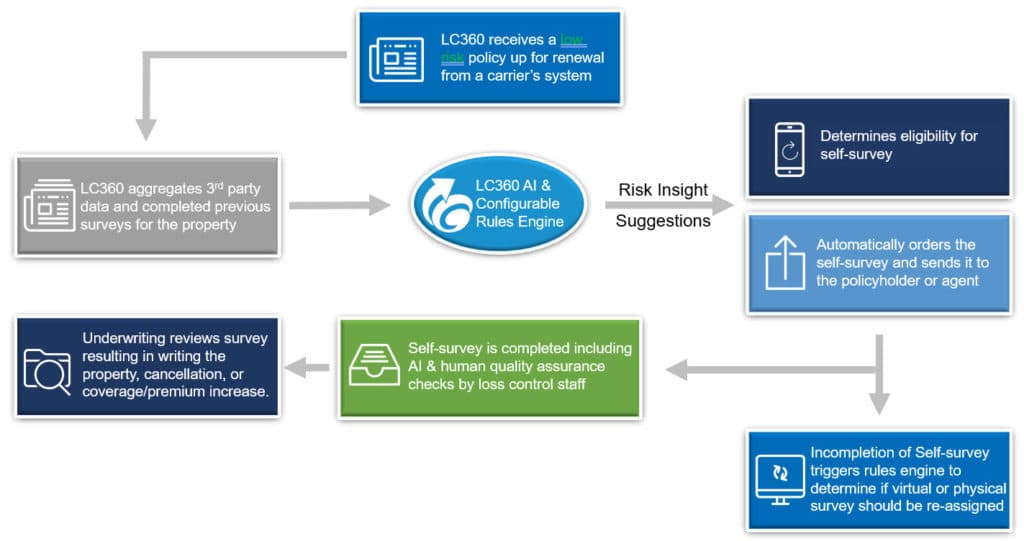

Users may also dig deeper by combining survey types. For example, if there are potential issues identified during a self-survey, carriers may order an onsite survey to investigate further. Along with determining the type of survey, Loss Control 360 workflow can also be customized within its P&C survey management platform to route surveys based on a staff member’s level of expertise. By automatically identifying policies that require a survey along with recommending the most efficient survey type, Risk Insights can help carriers to review more risks and drive down losses by creating more efficient workflows like the ones below.

Sample Workflow: Virtual/Desktop Survey

Sample Workflow: Policyholder or Agent Self-Survey

Sample Workflow: Physical Survey

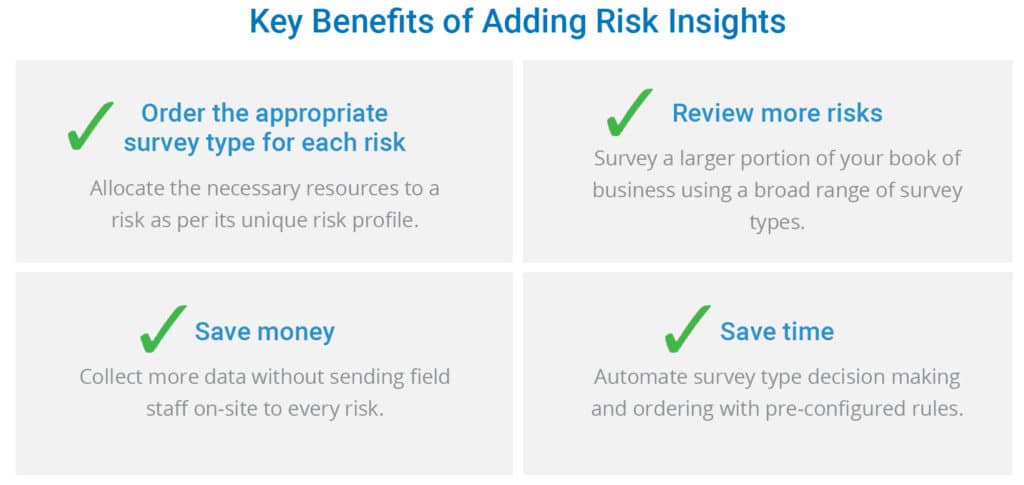

Along with creating a more efficient workflow, some of the other benefits of Risk Insights include its ability to:

- Improve carriers’ loss ratios by gathering information on a broader range of policies

- Stretch loss control budgets by pinpointing where onsite surveys are needed most

- Reduce redundant data entry by pre-filling vital underwriting information

- Proactively identify and mitigate potential issues in residential and commercial properties via AI photo labeling (e.g. Electrical Panels, Sprinklers, Sump Pump, etc.)

Risk Insights is just one example of how Majesco is integrating AI, machine learning, and data analytics into all aspects of loss control and why 6 out of the top 10 carriers worldwide use Loss Control 360!