Blog

Get the Data Basics Right, Part 1: People, Priorities and Processes

If you wanted to chart a course for “the perfect world” of insurance data collection and use, you would likely work in three stages. First, you would lay the groundwork by preparing the organization and its people and processes for a shift in how it governs and prioritizes its data and related projects. Next, you would create a Data Infrastructure with an Enterprise Data Warehouse that will unify and support the business’ data needs now and for the future. Last, you would construct a complimentary Analytics Infrastructure that will give business users enterprise-wide access to the data with a higher level of usability, security and trust. This would typify a Digital Insurance 2.0 approach.

At a high level, this sounds overly-simple. But in some ways, insurers are clamoring for greater simplicity in their data structure. They are mired in decades-deep data bogs, attempting to extract and connect siloed systems. It can be daunting. Barriers and hurdles are everywhere. Is the power data can provide worth the steps insurers need to take?

Yes! In our most recent thought-leadership report, Digital Insurance 2.0: Building Your Future on a Robust Data Foundation, we drive back to the great motivators for data transformation. We look closely at the incredible timing and amazing opportunities that have now arisen for data to greatly impact every area of the enterprise. New data sources, greater customer receptivity to data sharing, improved warehousing, security and usability are making data more appealing than ever.

The report also sets a course for change, with practical steps for surmounting barriers that will allow insurers to envision and create their perfect insurance data and analytics structure. In today’s blog, we look at these first few vital moves.

Many Sailors. One Captain. Many Destinations. One Map.

While many insurers have started and stopped numerous data and analytic projects, they must continue to push forward, but now in a well-thought out and strategic plan.

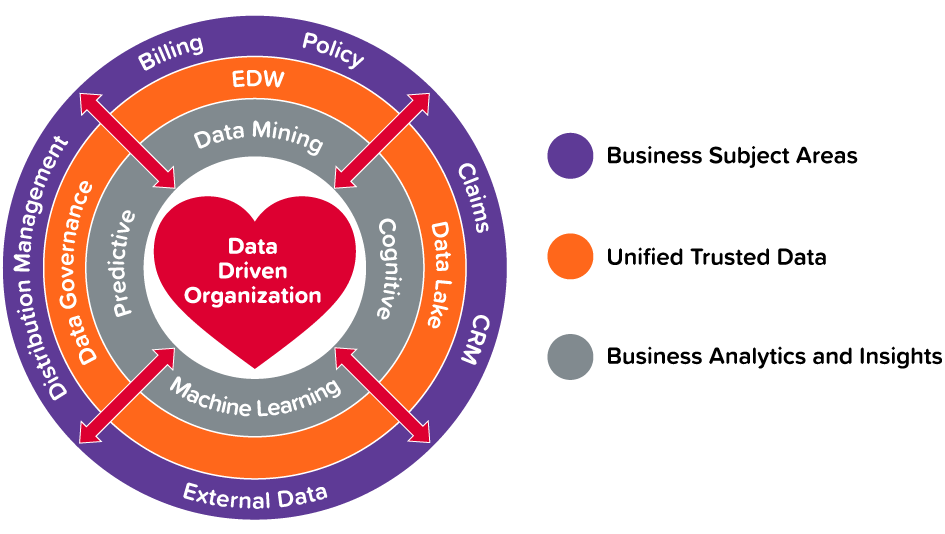

Too many data and analytic projects were either too encompassing (boil the ocean approaches), not tied to business objectives and goals, or didn’t have the right foundation. Integrating data across multiple systems is ripe with challenges as insurers address the quality of the data, the semantics of the data and who owns the data. Majesco believes that to enable a company to become data-driven, the right foundation begins with a 3-prong approach:

- An enterprise approach where the data is now owned and controlled at the enterprise level,

- An enterprise data governance committee, and

- A mature Enterprise Data Warehouse (EDW) based on a mature EDW data model

Figure 1: The Data-Driven Insurer

The data fiefdoms of the past must come down. As insurers move into the Digital Insurance 2.0 age, Data-driven insurers need to own and govern their data at the enterprise level. The best practices, definitions, decisions must be what is best for the enterprise as a whole, not the individual departments. Some insurers are already moving in this direction, hiring Chief Data Officers (CDO) that report to the CFO or CEO, and are part of the executive leadership. Data must be considered a corporate asset, driven by the business and made available in the best form to those that can benefit from it.

To achieve this, carriers must focus first on 3 key basics: people, priorities and processes.

People

Historically, data and analytics teams have been very siloed and leaned heavily on either the IT/data team to set up data stores, data marts — or, extracts for their experts to use for their reports. The focus from an IT perspective was either on the database skills or the tool skills. The digital age has brought forth the need for the data scientist — someone who is not only knowledgeable and experienced with data and programming, but also has a strong business understanding and analytic acumen. Finding these three skills in one person is hard to do, and companies (inside and outside of insurance) have begun leveraging teams that bring these skills together. It is not enough to just understand the data or analytic technique, it is now critical to know how the insights uncovered impact the business. Not all business insights are created equally.

Processes and Priorities

Many companies cringe at the word “governance”. They feel it is heavy and gets in the way of business. The only way data governance should be truly heavy, however, is in its value and positive impact. Data governance must be right-sized so that it can be effective and efficient. It must be focused on the highest business priorities, reviewing projects to ensure that they are staying consistent with enterprise data standards, and pushing for opportunities to mature the data and analytics at the insurer. The processes put in place must be across the enterprise, but flexible enough to allow departments to follow the same best practices at a lower level. This is where insurers can truly achieve data mastery. There are many different directions in which a carrier can focus today. An insurer must make decisions on which of these could bring the most business value to the enterprise. Historically, departments have made these decisions and the selections of tools, such as predictive analytics and modelling, data visualization, operational reports and external reports. This has led to a plethora of internal solutions, but none connected or integrated. Data is the biggest asset any insurer has, and it must be owned, controlled and governed at the enterprise level or the data siloes in insurance will continue forever.

Data governance must be focused on the highest business priorities, reviewing projects to ensure they are staying consistent with enterprise standards, and pushing for opportunities to mature the data and analytics at the insurer.

Business users’ biggest complaint across most insurers is that they cannot trust the data and the reports that they are provided. They do not always understand the semantics underlying the report. The best and most common example is the earned premium report. Some carriers may have 8 or more internal definitions of earned premium. Mixing these data definitions in one report can lead to conflicting conclusions. A data-driven insurer addresses all of these issues through its data governance committee and the processes that allow the company to mature and take advantage of these efforts.

The data governance committee is essential for a data-driven insurer to take the next step of bringing the data together across the enterprise. It should be comprised of business process experts with data stewards who understand the data, but may not know the business processes from which the data came. Many past EDW initiatives jumped straight to trying to bring the data together without any understanding of the business value or meaning of the data. At the same time, the business cannot wait until every data element is fully mapped back to the process it is used within or from which it resulted. The data governance committee must be driven by the company’s goals and priorities to make decisions on which area to tackle first. It is the responsibility of this enterprise group to represent the enterprise and drive home the business value and best practices for everyone to follow.

The business is critical in this process, for as the data is defined, eventually trusted and integrated, it can be used in operational analytics and advanced analytics to provide key insight to the business processes in the outer layers. This is the real value of the data in the first place. The data cannot just flow inward to the analytics layer, it must flow back to the business processes to improve business decisions and the interactions with the customer. Thus, the data must be enriched, nurtured and enabled to freely, but securely flow back and forth for maximum value. This is the crux of a true data-driven insurer and certainly should be the goal of every organization aiming at a Digital Insurance 2.0 model.

With these three elements in place: people, priorities and processes — we will have established an effective data philosophy and culture that will serve the organization as it begins constructing its enterprise data warehouse.

In our next blog, we will focus on “Getting the Data Basics Right, Part 2: Data Infrastructure – Enterprise Data Warehouse.” For an in-depth preview, download and read Digital Insurance 2.0: Building Your Future on a Robust Data Foundation.