Blog

Even “Change” is Different Now. Your Strategic Planning Needs to Be Too.

As I look out my window and drive around my hometown of Omaha, it’s evident that Fall is approaching. Technically, it started last Tuesday according to the meteorologists. It’s my favorite time of year. I love the colors, sounds and smells of fall – burning wood from fire pits, corn harvesting and the smell of pumpkin everywhere! The changing of the leaves is a signal we all recognize. We’re still at only about 20% of peak fall colors but the move to a bright, brilliant 100% maximum is inevitable, as it always has been.

It reminds me of the old maxim, “the only constant is change.” But the funny thing about most things that change is that they were expected and predictable, following at least somewhat regular patterns. Even ancient civilizations knew this thousands of years ago; they could look at the stars and predict with amazing accuracy when the seasons would change, thus improving their odds of a successful harvest. Nowadays, there are a lot of other “changes” we’ve come to expect as Fall approaches. Students and teachers go back to school, football once again dominates TV on Saturdays and Sundays, hurricane season replaces calm conditions in the Gulf and the Atlantic. And in the insurance industry, leadership teams shift their focus to their annual strategic planning process.

This year, however, the transition of the chlorophyll in trees’ leaves from green to red and yellow may be the only change that is occurring as expected. School administrators, students and parents are struggling to find the right balance between virtual and in-person instruction while also keeping everyone safe (as many businesses are doing as well). Football is back, but the stands are empty and crowd noise is digitally pumped through stadium speakers, not organically through the lungs of thousands of fans. Hurricane season is like none we’ve seen since most people can remember. We’ve already gone through all 26 letters of the alphabet and have had to move on to the Greek alphabet for naming the storms.

And insurance industry leaders are still getting geared up to do their annual strategic planning. But with all of the changes to the “expected change” we’re seeing, the traditional annual planning process needs to change.

It’s Time to be Bold

I first made this point in my blog last week, emphasizing that the traditional planning process needs to exhibit much bolder thinking — and action. The unprecedented conditions created by the COVID crisis have accelerated to light speed many changes that were already moving rapidly before the pandemic. Most notable … the imperative to transform to a digital insurance business model leveraging an API-enabled, microservices-based cloud platform and ecosystem of partner services and capabilities. Digital has been in the top 3-5 strategic priorities for insurers over the past few years. We expect it to become the top priority now.

Last week I highlighted McKinsey’s research about the economic profit gap that has been widening between 23 industries they have been tracking since 2010, noting that those with future-ready, digital business models were in the top tier[i]. Unfortunately, insurance was one of six industries in the bottom tier. And, importantly, I emphasized that COVID is widening the gaps between the top and bottom tiers, as the impact of the pre-pandemic trends have become even more acute with the massive changes created by COVID. It is a similar gap we have seen widening between Leaders, Follower and Laggards from our Strategic Priorities research over the last 5 years.

McKinsey’s research showed that the companies who create the most economic profit pursue five bold moves. And with the rapid acceleration of changes occurring right now, considering bold moves like the ones suggested by McKinsey in your strategic planning is now more important than ever:

- Dynamically shift resources between businesses: Reallocate at least 60 percent of surplus generated over a decade. This means invest in your own business – both for today’s and tomorrow’s business to ensure you have a future.

- Reinvest a substantial share of capital in organic growth opportunities: Be in the top 20 percent of the industry by strategic reinvestment relative to new business premiums. Typically, that means spending 1.7 times the industry median. Based on most industry analyst assessments, historically the average investment in IT by insurers has been 3-4% — that just keeps you even at best. Look at increasing this to 5-9% or more to leap ahead.

- Pursue thematic and programmatic M&A: No individual deal is larger than 30 percent of the market cap, but the total value of deals over a ten-year period is greater than 30 percent of the market cap. State Farm’s acquisition of GAINSCO is a great example of this bold move…something brand new for this almost 100-year-old company known for its steady, conservative nature. We expect to see more M&A over the next 12-24 months.

- Make game-changing improvements in productivity: Reduce costs in line with the top 30 percent of the insurance industry. This is where next generation cloud-enabled core platforms that embrace new technologies are positively impacting operational effectiveness and efficiency — particularly with a pay as you grow model.

- Positively increase underwriting margins: Improve underwriting capabilities to be in the top 30 percent of the industry by gross underwriting margin. Insurers must look to new sources of data and advanced analytics to create dynamic, real-time, continuous and fluidless underwriting that is more highly automated, allowing your valuable underwriters to focus on the complex.

This bold approach to strategic planning is something we’ve emphasized for the past couple of years in our Strategic Priorities research. The two-speed strategy we derived from this research aligns closely with McKinsey’s five bold moves:

- Bold moves 1 and 2 align with Speed of Innovation – Build a new business model to meet the demands of the next generation of customers, introduce new products and services and channels.

- Bold moves 3, 4 and 5 align with Speed of Operations – Modernize and optimize the existing business by replacing legacy systems with next-gen cloud, API and microservices enabled core systems in the cloud to engage customers and channels more effectively to keep and grow today’s business.

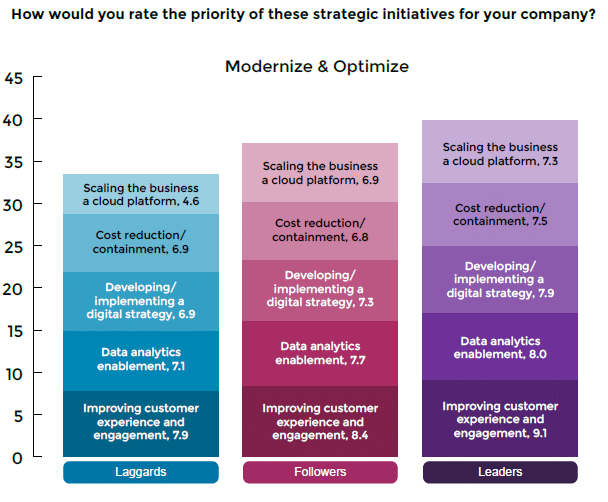

Our research highlighted the growing gaps between the Leaders, who are more boldly positioning themselves for the future of insurance, and the Followers and Laggards whose chances of becoming irrelevant are real. Leaders continue to distinguish themselves from the other two segments with their stronger focus on strategic initiatives that support the two-speed strategy. As seen in Figure 1, all three segments are focused on the foundational aspects for modernizing and optimizing the existing business – which is good. While there are gaps, they are relatively small and can be addressed.

Figure 1

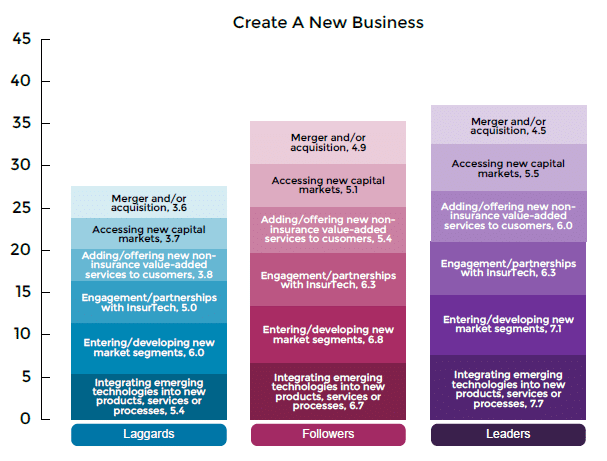

However, with regard to speed of innovation and creating the business for the future, the significant gap between Leaders and Followers with Laggards is striking, as seen in Figure 2. Leaders and Followers are well-ahead of Laggards with their plans and active development for channel expansion, entering new markets, adding value-added services and integrating emerging technologies.

Figure 2

Crises Create Opportunity

Even before the additional disruption that COVID has created, we emphasized the opportunities for creating new value that crises create. Last year we highlighted a December 2018 Boston Consulting Group (BCG) article on creating value from disruption describes how some companies successfully navigated disruption— earning the title, “thrivers.”[ii] It stated that successful reinvention requires making a large bet—one that can overcome the drag of the old way of doing things.

Making that big bet requires leadership, confidence and expertise to eliminate the “knowing – doing” gap. We see big bets being made in new business models, products and services from both InsurTech and incumbent insurer leaders who are “early responders,” capturing customer and market attention.

As noted in the BCG article, those who wait will need to make bigger and potentially riskier bets to gain parity with the “early responders.” As “early responders” gain growth momentum, the “knowing –doing” gap grows, leaving followers and laggards with dwindling options and relevancy in fast-changing market.

With the arrival of COVID-19, McKinsey is doubling down on the urgency to be bold in order to seize the opportunities and avoid the threats created by the pandemic, as highlighted in their July 2020 report, The Great Acceleration:

“In times of crisis, however, the burning platform is clear, leaders are often in military-command mode, and pre-crisis budgets have become obsolete. Resources are easier to reallocate when no one needs to be convinced of the need for a rapid response and the individual targets set before the crisis no longer apply.”[iii]

Need Some Bold Inspiration?

There are many companies that didn’t need a crisis like COVID to motivate them to reinvent their insurance business model, which can serve as examples and inspiration for the types of bold moves the rest of the industry needs to build into this year’s annual strategic planning. Consider these nine different business models and some of the companies that are playing in these spaces:

- Social Good & Transparency: Lemonade, Hedvig

- Peer-to-Peer: Friendsurance, Guevara

- Affinity/Program Business: Aon, QBE

- B2B2C Ecosystems: PingAn, Allianz

- Embedded Insurance: Nationwide + Toyota, Acko + Amazon

- Digital Platform: Spire, Generali, Pie Insurance, Trov

- Parametric: Munich Re and Farmers Edge

- Membership/Subscription: BOXX Insurance, Zipcar

The innovators creating these new businesses come from all segments, including traditional insurers, greenfields and startups, and outside industry entrants including automobile manufacturers, “Big Tech” and more.

Auto manufacturers are leading with embedded insurance and subscription models, which our primary research has shown to be growing in popularity among insurance customers. The interest in purchasing insurance from Google, Amazon and other Big Tech is also growing, as evidenced by our research and other sources as well. In fact, Capgemini reported that policyholders’ willingness to buy from these companies reached 44% in April 2020, from only 17% in 2016.[iv]

These companies are leveraging an outside-in, customer-first approach with cloud-native digital platforms and ecosystems to create a true customer experience, not just a “machine” to execute insurance transactions. The rapid ascent of these outsiders with their digital business models should be motivation enough for insurers to make bold strategic moves – starting with this year’s annual planning.

Make Your Bold Move Now

Change, as we have known it, has changed. It is faster, deeper, wider and more powerful than we’ve ever been used to before. The ways we’ve analyzed and adapted to change in the past, namely, through the annual strategic planning process, won’t cut it in this new environment.

Your strategic planning needs to be bold enough to match the velocity and magnitude of the changes we’re facing right now. In this year’s annual plan, it will no longer be sufficient to allocate most of your resources to maintaining the status quo of your current systems and processes. Look at our Strategic Priorities 2020 report to see where you are compared to others as you prepare plans. Consider accelerating areas that you are behind to close the gap.

Resolve to boldly allocate your resources to a true two-speed strategy: Modernize and optimize your existing business with next-gen cloud, API and microservices-enabled core systems; and build a new business model with next-gen technology to meet the demands of the next generation of customers.

Are you ready to make a bold change?

[i] DiAmico, Alex, et al., “How to win in insurance: Climbing the power curve,” McKinsey & Company, June 18, 2019, https://www.mckinsey.com/industries/financial-services/our-insights/how-to-win-in-insurance-climbing-the-power-curve

[ii] Farley, Sam, “Facing Disruption? The Need to Reinvent? Better Move Fast.” Boston Consulting Group, December 4, 2018, https://www.bcg.com/publications/2018/facing-disruption-need-to-reinvent-better-move-fast

[iii] Bradley, Chris, et al., “The great acceleration,” McKinsey & Company, July 2020, https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/the-great-acceleration

[iv] Violino, Bob, “Coronavirus drives more consumers to consider big tech for insurance,” DigitalInsurance, September 22, 2020, https://www.dig-in.com/news/coronavirus-drives-more-consumers-to-consider-big-tech-for-insurance