Blog

Engines of Growth: Building Insurance Business Models That Reflect Today’s Reality

If there was ever a time to let necessity drive the business, it’s now. The future won’t be captivated by yesterday’s achievements, and tomorrow’s plans won’t come to fruition without an insurance business model that understands there are different demands and expectations than the past. Business operating models need flexibility, scalability and the kinds of technology capabilities that are available … now. If only insurers weren’t still grappling with the complexities of their past!

It is a conundrum that most insurers are facing at some level. How much value do we receive from keeping our past technologies and the way we have done business in operation? If we choose to move on, how can we make sure that new business models reflect today’s realities and future possibilities, and don’t drag too much of the past into the equation? These aren’t easy questions to answer. Guidance is key. It may require some tough conversations and decisions. But they can lead to a much clearer path forward.

Before you can chart a clear path forward, however, it’s helpful to understand what the organization stands to gain or lose by its choices. Trying to keep your current business operating model may still yield positive results, for a time, but choosing a new one that embraces the realities of today’s market, customer expectations, products and use of technology can power a much-needed engine of growth that will outperform your current model for years to come. For an expanded view on how a new operational business model may help your organization improve its performance, be sure to read Majesco’s thought-leadership report, Realignment in Insurance: Business Models, Products, Value-Added Services.

The insurance business — pressurized.

Here’s an exercise: Make a list of pressures and stressors that are currently forcing your executives and teams to make tough decisions. Count them up. Do you have 10? 20? 50? How many are on your list that wouldn’t have been there 5 or 10 years ago? How can you cope with so many issues and pressures that are converging all at once? What gives?

In the short term, many may make incremental decisions that will tweak the business and can help profitable growth. Some of those decisions, however, have permanent and consequential results. Continuing to the same thing over and over again or putting “quick fixes” in place rather than dealing with the foundational issues only adds to the pressures building. It takes leadership and courage, but long-term thinking and a strategy provides the best framework for decision-making. In the case of business models, rethinking them to meet the demands of today and tomorrow will help avoid the operational issues that “quick fix” decisions can create that deteriorate operational results over time.

Leaders manage to tune out the noise and stress of the short term in order to take the future into account. This removes pressure’s influence and replaces it with clear facts.

What are the facts? Majesco’s Strategic Priorities research has shown the following:

- Increasing operational costs, lack of speed to market for new products, limited growth and profitability challenges highlight how current operational business models are falling out of synch, and the technology foundation must be re-tuned and replaced.

- Current business and technology frameworks no longer meet the challenges, demands, and opportunities of today’s dynamic and fast-changing world, let alone tomorrow’s.

- Legacy debt hasn’t stopped being an issue, it is only growing.

- Without a new business model and technology foundation — an engine for growth — insurers will struggle to find a profitable growth strategy, improve operationally, rapidly respond to market opportunities, and innovate with new products and services. It is also unlikely that they will please customers, employees, or distribution partners.

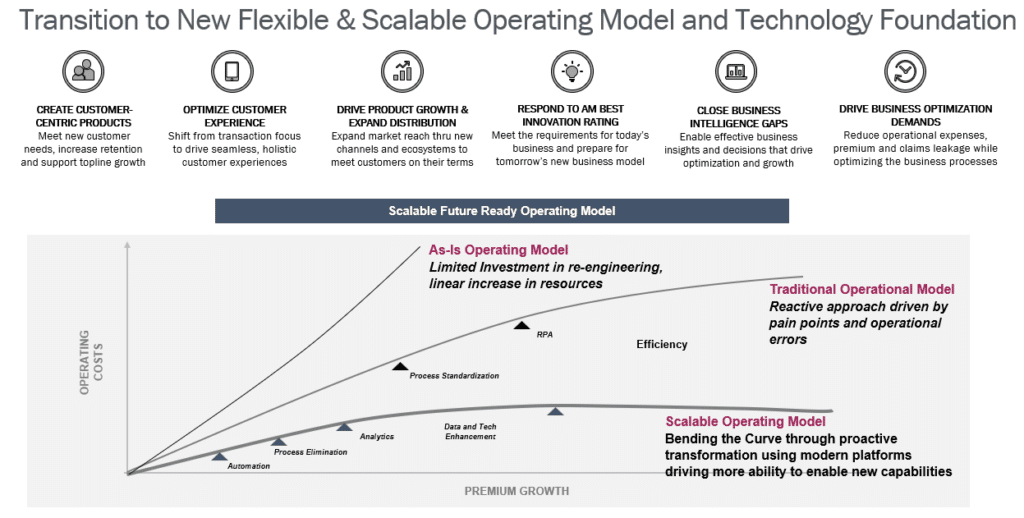

Most operating models were crafted over decades around a myriad of constraints and business assumptions and challenges. These constraints include redundant systems, manual workarounds necessitated by legacy technology, and teams locked into their current culture that limit what they can do. The operating model evolved to support this legacy construct, with layering in technologies over legacy with the hope to optimize. But the result is inefficient, unprofitable, and employee-constrained operations with a layered, complex technology foundation that has increased costs rather than decreasing them, as shown in Figure 1.

Risk vs. reward for new operating models

A 2020 survey of CIOs by McKinsey found that tech debt amounted to an estimated 20 to 40 percent of the value of an insurer’s entire technology estate before depreciation, which can be hundreds of millions of dollars of unpaid debt. Even more startling was that 60 percent of the CIOs surveyed believed their tech debt had risen perceptibly over the past three years – a period of accelerated native cloud adoption, advanced data and analytics and digitalization.[i]

Transitioning to a new operating model is necessary, but it presents two layers of risk. First, some will aim to create a new operating model, but then they will inadvertently allow legacy processes to leak into the new operating model and technology foundation. This counters the focus on meeting today’s realities and limits operational efficiencies, speed to market, enhanced customer experiences and more. Managing the transition to the new requires leadership and fortitude to challenge the old ways of doing business, which can be a significant test for most organizations.

Second, some will aim to create a new operating model, but may not take advantage of ground-breaking technologies, such as GenAI within business processes or next-gen cloud platforms that offer a new paradigm shift that enables agility and innovation in a fast-changing market.

Figure 1: Operating model impacts on efficiency and cost

Done well, insurers can reshape their business models and technology foundations to achieve scale, growth and real optimization. However, this can only be accomplished with a next-gen, intelligent technology foundation built on a robust cloud-native architecture, which is a must-have to compete in today’s marketplace. With the relentless market shifts and the fast-paced changing world of risk, next-gen technology paired with advanced embedded data and analytics creates a new foundation for operational optimization and innovation that can readily adapt and scale as change continues its relentless path forward.

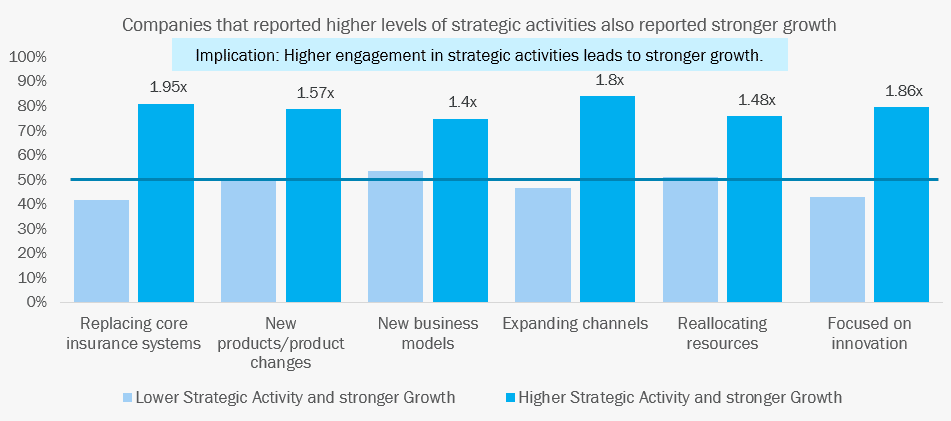

This new foundation requires investment across key areas and can greatly influence growth, as reflected in Figure 2. Our 2024 Strategic Priorities research found that insurers who are focused on and investing in replacing legacy core, creating new products, defining new business models, expanding channels, reallocating resources to the future business, and innovation initiatives, report significantly higher growth than those who do not make these a priority – from a 1.4x to 1.95x difference.

Figure 2: Impacts of strategic activities on growth

Competing in today’s marketplace requires speed to market for new products, channels, and experiences; a decrease in operational costs and total cost of ownership of technology; continuous innovation; and seamless and quick technology upgrades to keep the company at the leading edge. Modern business models use technology as engines of growth — opportunity generators that improve both inside and outside circumstances.

Choosing to invest differently and wisely for the future

Insurers’ long-held business assumptions and operating models were built supporting traditional insurance approaches for products, channels, pricing, and customer engagement based on past decades. But customers, competition, the types and severity of risks, and new technologies have significantly shifted from decades ago. A new reality has emerged and exposed the challenges of the legacy operating model and technology foundation in terms of decreasing profitability, higher expense ratios, higher loss ratios, fight to retain talent and maintain customer satisfaction, agent satisfaction, and more.

Insurers need to change the economics for loss ratios, expense ratios, risk selection, and risk prevention. It requires rethinking the business operating model and processes to leverage a wide array of amazing technologies, including Cloud, APIs, AI/ML, GenAI, IoT, and more. This will drive operational optimization and lay a foundation for innovation. It is future-focused, based in the reality of the world in which we live, and it represents smart investing, if smart investing can be defined as “that which will pay off in the future.”

Leaders are leading the drive for business model and technology foundation transformation

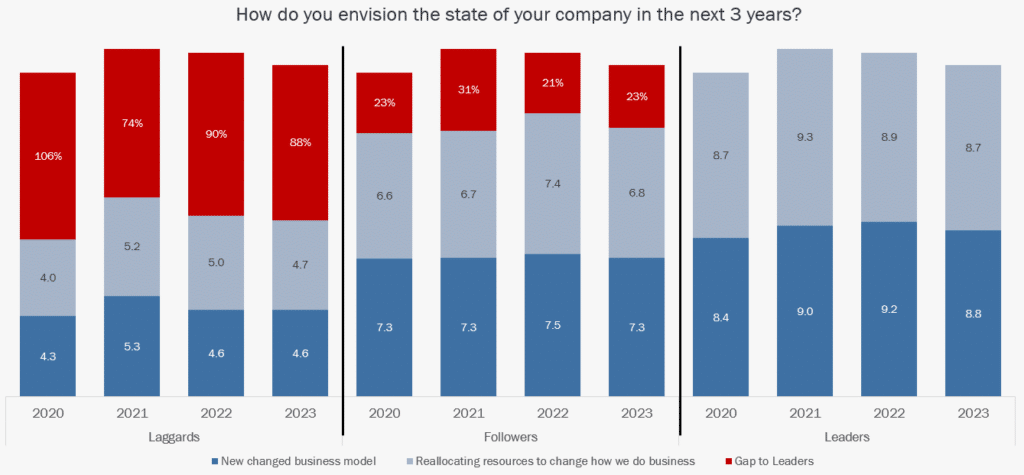

The implications from a lack of focus on these strategic activities is glaringly obvious when comparing Leaders to Followers and Laggards, as reflected in Figure 3 from our 2024 Strategic Priorities research, highlighting a significantly less optimistic outlook as compared to previous years. Laggards have consistently had an enormous gap to Leaders and have made no progress. Followers, whose gaps are smaller, are slightly growing or at best just treading water as compared to Leaders.

Figure 3: Trends in expectations for new business model development and reallocation of resources to change how they do business, by Leaders, Followers, Laggards

What’s the difference?

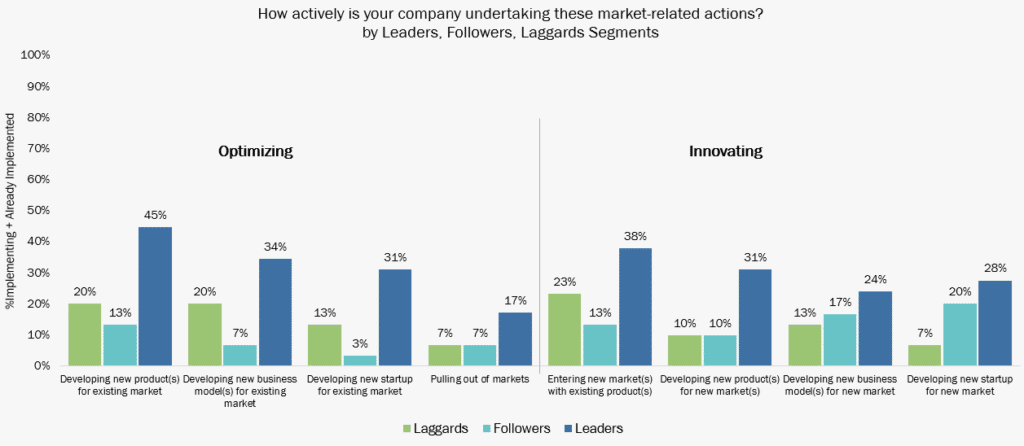

Leaders keep a dual focus on both optimizing the current business and innovating to create the future business, highlighted by their significant leads over Followers and Laggards in Figure 4. Shockingly, Followers assume the role of Laggards in Optimizing, with an average gap to Leaders of 5.1x, which is influenced by an enormous gap of 9.3x in Developing new startup for existing market.

Figure 4: Level of engagement in market-related activities, by Leaders, Followers, and Laggards

Leaders’ focus on innovation is reflected in their budgeting priority on funding business transformation and innovation initiatives, which is 45% to 55% higher, respectively, as compared to Laggards. Furthermore, Leaders are 2x to 3x more likely than Laggards to increase their budgets for optimization, transformation, and innovation initiatives.

Shifting model mentality

While insurers express optimism for the next three years, there are still major disparities between Leaders, Followers, and Laggards. Leaders’ steadfast commitment to both optimizing the current operation and innovating for the future underscores their resilience and competitive edge. Any insurance operation will benefit by keeping these perspectives in mind:

- Understand why the organization is reacting. Do decisions reflect a short-term reaction or focus on financial pressures or a long-term focus on positive opportunities for the years ahead?

- Understand where technology investments are being applied. Are they shoring up the past or building a foundation for the future, underpinned by a business model built to last?

- Internally promote the clear, positive links between business model development, competitive position, and profit. Share Majesco and McKinsey findings, among others.

A new insurance business model is just as relevant as ever. It is an engine for growth that will pay dividends by accepting the realities of today’s world instead of making today’s customers conform to insurance’s past. We all know it isn’t easy to change the course of an established insurance company. The end results of trying, though, will remove a lot of what weighs insurers down and keeps them from enjoying the freedom to expand, scale and grow.

Are you ready to turn your business model into an engine for growth? Find out more about how Majesco is transforming insurance through our informative webinars, such as Unleashing the Future: Transforming L&AH Insurance with Intelligent Core and Building the Intelligent P&C Core: Empowering Architecture with Embedded Analytics & GenAI, or uncover more reasons for business model change through our upcoming webinar, Unlocking MGA Success: Insights from Industry Leaders.

[i] Dalal, Vishal, et al., “Tech debt: Reclaiming tech equity,” McKinsey, October 6, 2020, https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/tech-debt-reclaiming-tech-equity