Blog

Emerging Technologies Push Core Transformations Toward Platforms

Technology is at the heart of digital transformation. It is a catalyst for business change. It isn’t just about being a tech-forward insurer. It is about designing a business operating model that thrives on tech-infused capabilities. These capabilities fuel optimized operations, customer engagement, data capture, automated decisions and innovation. Technology is no longer a means to an end. It’s a means to an “unend” — a perpetual flow. Today’s technology used effectively is a healthy conduit for future innovation and data-smart processes, products and services.

As the industry rapidly shifts to the future of insurance – a digitally enabled world – technology is a crucial part of the DNA. In fact, insurers may need to think of themselves as technology companies providing insurance…rather than the old paradigm of insurers using technology. Unlike Henry Ford, insurance’s roots aren’t in tech development or use. We’ve had to grow and transform. Technologies have had to mature to become useful to us. Fortunately, now we have a host of mature technologies and many emerging technologies that are well on their way to maturity, if not already there. In Majesco’s latest thought-leadership report, “Insurance Digital Transformation: A New Era of Core Systems, Next Gen Technologies and Ecosystems,” we discuss these maturing emerging technologies and how insurers are turning to platforms to enable their use.

At the start of InsurTech in 2015 we talked about drones, IoT, AI, blockchain, autonomous vehicles and others as emerging technologies. These technologies are increasingly being embraced by all generational groups, especially Millennials and Gen Z. As a result, many of these technologies are maturing as key elements of the digital transformation of the insurance industry.

Drones make an excellent example. By 2018, commercial drones were in test use within some U.S. P&C carriers. They quickly made an impact and by this year, 2020, drones are in both regular use and testing by many more insurers. According to a recent report from A.M. Best,

“Drones are particularly valuable in catastrophe property claims, for which they can reach hard-to-access post-event sites.” And, “…rated companies have indicated that they anticipate great potential for drones with regard to speed, safety, the ability to obtain more accurate data, and customer retention. Drone benefits are no longer hypothetical; the industry may well scale drone usage through either internal resources or third parties.”[i]

This is even more interesting when one considers that drones aren’t a terribly high priority for insurers when compared to other technology priorities. They are a “maturing emerging technology” that is now completely understood. Most insurers who aren’t using drones (and that is still most of them), simply have too many tech priorities to sort out before they can capitalize on any of them. Their first and largest step must be toward core system transformation that includes platform use and a cloud environment. This opens the door to IoT devices, drones and a host of other data-heavy tech products and services.

A.M. Best acknowledges this insurance “fact of life”.

“The exponential growth of IoT devices in particular is providing insurers with new data, particularly in the form of telematics. Equally important, more advanced forms of machine learning are helping insurers make greater sense of both structured and unstructured data, which in turn is further accelerating how companies leverage Big Data throughout their operations. The key is to be able to manage, organize, and fully use that data through defined processes and structures, ensuring data accuracy and quality, that result in sound and appropriate decisions.”[ii]

Business and Technology Challenges and the Current State of Insurer Priorities

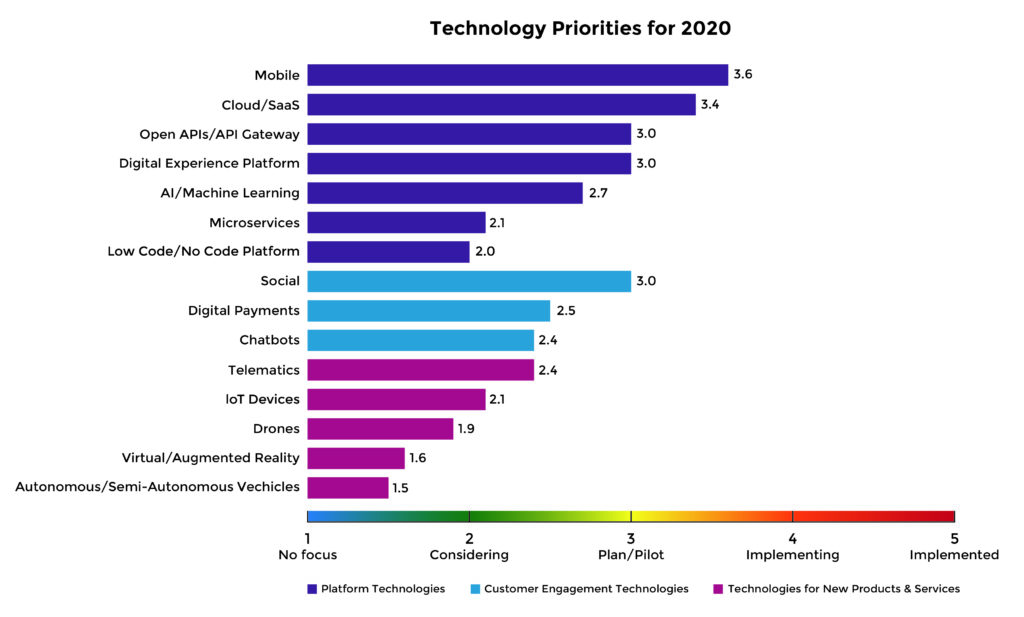

Our technology path is now clear. Insurers must experiment and embrace these technologies within their business models because IoT devices and data are going to revolutionize areas such as underwriting and claims. Fortunately, many insurers are beginning to do so, as reflected in Figure 1. Interestingly, platform technologies (represented in purple) lead in adoption with many customer experience technologies (light blue) in a consideration or planning/piloting stage.

Note especially where Cloud/SaaS is on the scale of priority. It sits with all of the rest of the capability gatekeepers at the top of the priority list. Insurers know that these technologies, such as Open APIs, Digital Experience Platforms, and Mobile, are the bridges that must be crossed before some of the most important tech benefits can be unlocked.

Figure 1

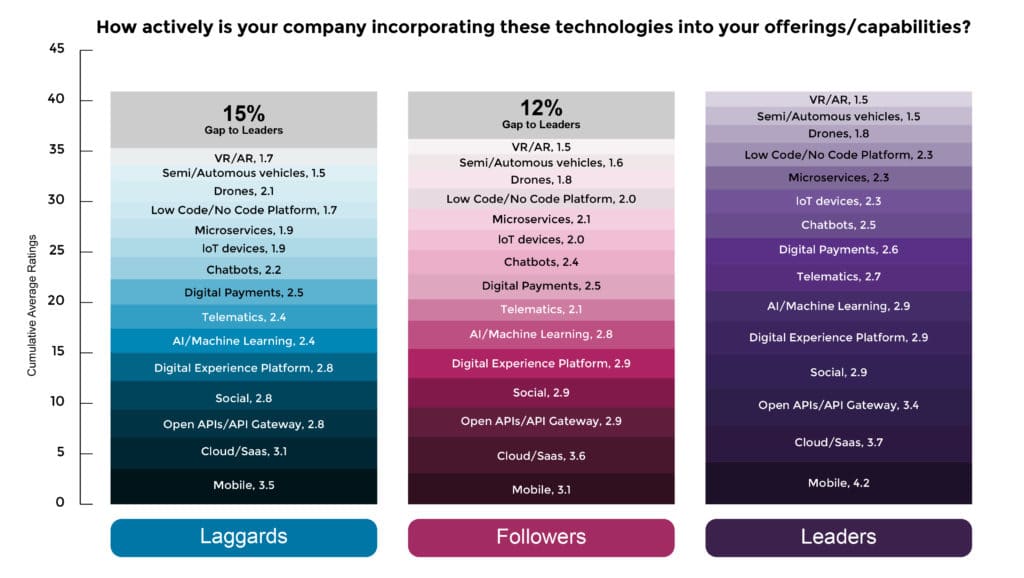

Figure 2, below, introduces a new wrinkle. It isn’t necessarily valuable to look at the insurance industry in aggregate. We need to glimpse what is occurring between those insurers who lead and those who follow and lag, particularly in a time of rapid change. When you look at the data based on Leaders versus Followers and Laggards, there is only a 12-15% gap between the groups overall. However, there are significant differences (reflecting the largest gap) between key platform technologies including: Mobile (35%), Cloud (19%), Open APIs (21%), Telematics (29%), AI (21%), and Low Code/No Code (35%) – reflecting an average gap of 27% overall. This represents a significant gap, given the pace of adoption by Leaders, placing Followers and Laggards at risk in competing in the new platform economy. Platforms, however, have caught many insurers off guard, particularly those that have spent millions modernizing their core with on-premise solutions, as previously noted.

Figure 2

The Push Toward Platforms

Platform-based business models are poised to radically change insurance. Insurers are redefining their strategies around platforms that are technically and architecturally different than what we traditionally called “modern” solutions. They must be cloud, open API, microservices, data, AI and ecosystem enabled solutions. These strategies lay a new foundation of infrastructure, data and applications, that will enable new business models, products and experiences that the industry will need to compete in a broader way to “own and retain” the customer relationship. Many incumbent insurers and InsurTech startups are already changing the rules of insurance with the powerful capabilities of cloud-based platform businesses, such as looking more broadly at providing mobility solutions versus just auto insurance or providing wealth and wellness capabilities versus just life insurance. As Gartner has noted, “The world’s 25 largest insurance companies are investing in digital platforms and ecosystems to enable new business models beyond traditional insurance.”[iii]

Platforms are the foundation to think bigger in a digitally-engaged world. Once a platform foundation is in place, insurers will find themselves ready to compete in a whole new way. When change occurs, they will be ready to draw upon the power of the platform to make rapid course corrections and innovate to compete in a new digital era of insurance.

InsurTech and Ecosystems: Accelerating the Transformation

The lightning-swift advances in customer expectations, shifting boundaries and competition, technology and ecosystems are challenging insurance to run even faster just to stay in place, let alone get ahead. The demands of agility, speed and innovation are dramatically different today than in the past. To navigate successfully to the future of insurance, insurers need to embrace InsurTech and Ecosystems … with a focus on enhancing customer expectations, demands and needs. In this changing marketplace, future leaders will not be those with the biggest inventory or proprietary products and services. Rather, they will be those that have access to a vast and growing global inventory of products and services that enable insurers to retain the customer relationship and interactions rather than lose them.

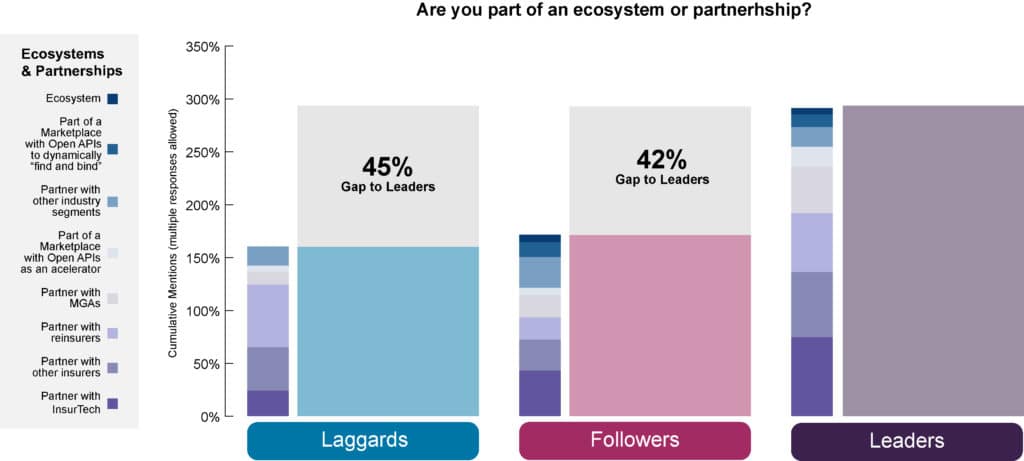

Based on our research, unfortunately many insurers are not looking at ecosystems and partnerships in this manner, or at all, as reflected in Figure 3. Both Followers and Laggards are well behind Leaders by 42% – 45%, a significant gap. This is putting them at risk, particularly since challengers from outside the industry, are also entering the industry to manage the customer relationship and transactions.

Figure 3

The lack of movement in adopting platform technologies is holding them back. A platform and ecosystem approach is radically different than what insurers have done previously, and it requires platform technologies like cloud and APIs. In our research, we found that multi-line insurers (those with both P&C and L&A/Group business) were significant leaders in adopting and using APIs. In particular, we found that:

- Multi-line insurers lead in offering an API to embed their products into other companies’

- offerings or platforms, by nearly 36%

- They lead in partnering with other companies to embed insurance as a part of their product or service, by 36%

- They lead by 13% in setting up products on a partner platform that shares revenue

- They lead by 46% in engaging and partnering with InsurTechs.

- They lead by 21% in integrating emerging technologies into new products and services

What many insurers don’t realize, is that it isn’t difficult to quickly begin the journey to ecosystem participation and platform use. Majesco, for example, has developed a quick-launch methodology and a cloud-based framework for rapid adoption that includes all components necessary under its Cloudinsurer® solutions and Majesco Digital1st Insurance™ , which contains Digital1st Platform™ and Digital1st EcoExchange™.

Digitalization is revolutionizing how we create customer value – within and across companies and industries – and has been elevated as a top priority in light of today’s current pandemic experience. Ecosystems comprising a network of various businesses that provide some type of value – channel, service, data or more – begin to redefine how we need to rethink our businesses and, ultimately, our customers. While this is good, we need to broaden our perspective to rethink how we want to create a customer experience around broader topics such as mobility, financial wellbeing, health, lifestyle, and more.

In our next blog, we’ll look in depth at how innovation is related to expanding digital ecosystems and we’ll look at A.M. Best’s recent views on how ecosystem participation is vital to insurer expansion and growth. To see three of Majesco’s recent insurance innovation case studies, be sure to read Insurance Digital Transformation: A New Era of Core Systems, Next Gen Technologies and Ecosystems.

[i] Finnegan, Hopper, Imsirovic, Varvaro, Ermakova, et. al, Special Report: The Advent of Innovation, A.M. Best, March 20, 2020

[ii] Ibid.

[iii] “Innovation Cues From IT Investments of the World’s Largest Insurers,” Gartner, August 27, 2019