Blog

Embedding a New Insurance Paradigm

As I was preparing for our Labor Day family backyard cookout this last week, I made a trip to the grocery store to get the items on my list…hamburgers, brats, buns, ketchup, chips, salads and the like. I started down the aisle (after sanitizing my cart, of course) and as I approached the meat case, I encountered a large and engaging display of Labor Day party essentials. It was on a raised platform, so it was impossible not to see it. It didn’t just have stacks of grocery items with prices called out on signs. Instead, it was like a life-sized Labor Day cookout display, complete with a Weber grill, bag of charcoal, grilling utensils, paper plates and cups, bags of chips, soda bottles and a table with a red checkerboard tablecloth.

It was a vision of a classic cookout experience. Underneath the display, the “ingredients” of the experience – the chips, charcoal, plates, buns, etc. – were conveniently stacked, and just past the display, the refrigerated meat case prominently showcased a sale on ground beef, hot dogs and brats. My shopping list lined up pretty well with the items in the display and I quickly added them to my cart without having to snake through the aisles to find each one separately. But the display also reminded me that I needed a bag of charcoal…not the most glamorous part of the cookout, but still an absolutely essential component to ensure its success!

While the charcoal was a must-have, it wasn’t top of mind and it didn’t make my shopping list. I would have gotten home and realized I needed it as we were getting things ready, resulting in a frustrating second trip to the store. But the store made it easy for me to remember it – and buy it – because they embedded it in the Labor Day cookout experience that was illustrated in their display. They essentially created an entire experience “ecosystem” that included all the key ingredients I needed. All I had to do was put them in my cart and check out. This is an effective strategy to both increase sales and create a satisfying customer experience. In fact, a 2014 study of grocery store shoppers found that products placed in promotional displays like this were seen by nearly twice as many store visitors compared to products stacked in the inner aisles of the store.[i] Greater visibility, especially within the context of an engaging experience, greatly increases the chances of purchases.

And this strategy is not limited to just retailers. Embedding insurance as part of another related offering is rapidly becoming a powerful marketing and distribution strategy, in effect removing insurance from the “inner aisles” and placing it in front of customers as they purchase other products or services. In an SVIA webinar I spoke at in August, we defined embedded insurance as a strategy that:

“Bundles coverage or protections within the purchase of a product, service or platform. That means the insurance product is not sold to the customer ad hoc, but is instead provided as a native feature.”

It’s an extremely effective way to overcome the decades-long burden that has plagued the industry: Insurance is sold, not bought. Embedded insurance completely changes this paradigm. With it, insurance is no longer sold, because it is bought as a part of something else.

Ecosystems are Foundational for Embedded Insurance

An important driver of the shift to embedded insurance is the rise of ecosystems. Swiss Re’s 2019 report, Digital ecosystems: extending the boundaries of value creation in insurance, noted that ecosystems can be structured into broad clusters, such as “Home & Stay” and “Lifestyle” on the B2C side, and “Build/Produce” and “Deliver” on the B2B side. Within these clusters, finer-grained domains can be defined, like “Mobility” or “Transport & Logistics.” Insurance fits within the risk assessment, management and mitigation aspects of these ecosystem domains, including mobility / transportation, property / housing and health / wellness / wealth.

In today’s interconnected world, insurance must play within these ecosystems, rather than simply as an industry unto itself. This differs from today where, in order to get insurance, the customer must use existing, traditional insurance players (channels, insurers, MGAs, reinsurers, etc.). It represents a fundamental shift from inside-out to outside-in.

As a result, insurers must reimagine the scope of what they offer to customers – to include not only the risk product, but also value-added services from a broad ecosystem and a compelling digital customer experience. Those that act on this new view will see new, innovative and exciting new business opportunities that reach and engage customers when and how they want. Here are some examples of companies – within and outside the industry – who are leading with an embedded strategy:

- Zipcar: Car share membership comes with insurance

- Microsoft and AXA/XL: The Microsoft platform you use to run your small business is bundled with cyber insurance at discounted price

- Mylo and Move Guru: Concierge provider for real estate brokerages to offer insurance to clients for home, renters, move, etc.

- bsurance: Provides buyer protection, bike, mobile device, boat charter deposit and travel insurance at point of sale.

- BMW/Wrisk: All new Minis sold with three months’ free insurance by BMW Group with Wrisk – a new Mini Flex Car Insurance product.

- Volvo: “Care” offers fixed monthly cost and no down payment for new Volvo car inclusive of insurance, tax, maintenance, servicing and repairs.

- Clyde: Extended warranties and accident protection insurance.

- Sure: Micro-duration life insurance coverage during air travel.

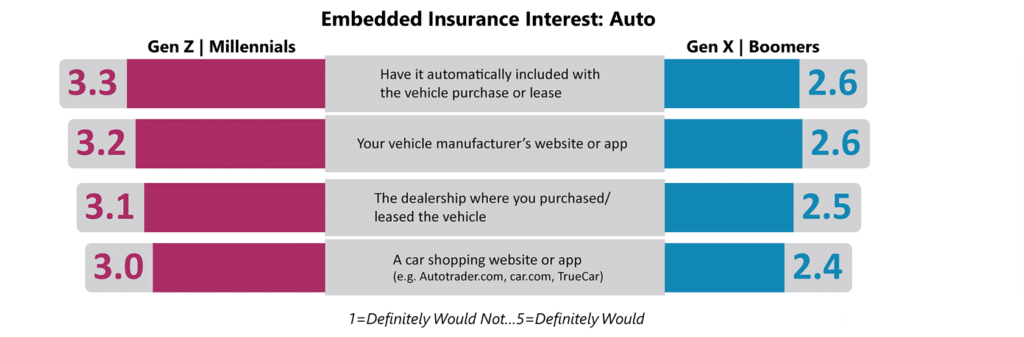

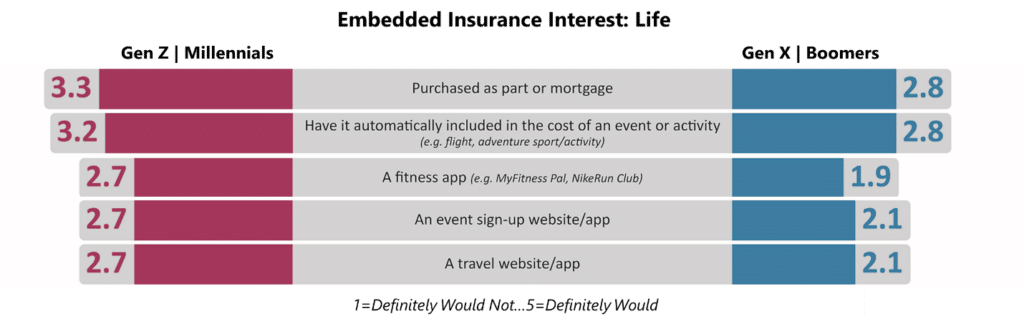

Customers, especially Gen Z and Millennials, are a growing fan base for embedded insurance, as we found in our latest primary research with auto and life insurance customers. Although the traditional purchase methods from agents/brokers or direct via an insurer’s website are still the most popular channels, there is strong interest in purchasing insurance included as part of another product or service (see Figures 1 and 2). But why do customers like this approach? The answer lies in the psychology of simplicity.

Customer Psychology Drives Simplicity

Embedding insurance is all about understanding what the customer is trying to do, then making it easy for them to do it. We found the Fogg Behavior model to be a very useful framework for understanding why insurance has had its “sold not bought” reputation. The model illustrates why embedded insurance is so effective at overcoming this reputational issue. Several InsurTech startups have used the model to redefine how they will offer insurance and engage their customers – with success.

There are three factors in the Fogg Behavior Model that embedded insurance addresses:

Motivation — Q: Why should customers want to buy insurance? A: The customer is already buying another product or service, so no “new” motivation is required to purchase insurance later.

Ability — Q: Is it easy to buy? A: Yes, insurance is either automatically included or is listed as a convenient add-on.

Prompts — Q: Is there a compelling reason or trigger to buy right this moment? A: Yes, the prompt to add insurance occurs simultaneously with the purchase of the primary product/service being bought.

Embedded insurance successfully passes with flying colors all three of these tests. Embedded insurance is easier to buy, creates a better customer experience, contributes to insurer growth, and helps close the large protection gap of the uninsured or underinsured.

How Do You Adapt Your Business Model with Embedded Insurance?

Although my grocery store manager probably didn’t use the same terms, they realized that the Labor Day holiday had an associated “Labor Day cookout ecosystem” as a micro-sub-set of the Lifestyle ecosystem. They created a platform (literally, it was on a platform) that bundled / embedded all the related products anyone would need to create a successful family backyard get together. As a result, they created a very satisfying experience for me (and undoubtedly other customers) and very likely created a nice bump in their sales.

For insurers, it’s a bit more complex, but the principles are the same. Given the nature of ecosystems, insurers can assume multiple roles, from owner of the unifying platform, to orchestrator of the products and services, or provider of products and services. What insurers achieve will depend on their ability to enter the market while it is still an uncrowded “white space.” Of course, this requires leadership with an appetite for taking informed risk, ability to move quickly, capacity to build partnerships within and outside of insurance, and strong technology capabilities.

It requires operating with a two-speed strategy: speed of operations to optimize the current business to retain and grow the existing customer base; and speed of innovation using a next generation cloud-based insurance platform with advanced digital and data/analytics capabilities and third-party services delivered via APIs that will enable innovative companies to create speed to value, unique customer engagement, a “test and learn” platform for minimal viable products, and value-aligned, optimized costs.

But most important is a clear vision of the customer’s expectations and journey combined with the ability to assemble a broad ecosystem of partners, products, services, data, and technology that empowers the customer to accomplish all of their needs in a holistic, satisfying way.

We believe that embedded insurance will be a standard in the future of insurance. Will you be ready to meet this new standard?

[i] Pak, Olga, et al., “Optimizing stock-keeping unit selection for promotional display space at grocery retailers,” Journal of Operations Management, December 2019, https://www.researchgate.net/publication/338008948_Optimizing_stock-keeping_unit_selection_for_promotional_display_space_at_grocery_retailers