Blog

The Digital Strategy Gap: Are Insurers Strategic or Tactical?

Priorities tell a story.

For insurers interested in moving from Insurance 1.0 to Digital Insurance 2.0, priorities tell the story of how their life insurance digital strategy is or is not being supported with strategic efforts.

In recent blogs, we have been considering strategic priorities from all angles. We have been looking specifically at business, technical and market gaps that may be growing wider, causing insurers to struggle with their efforts to reach the peak of Digital Insurance 2.0. You can retrace our steps beginning here, or download Strategic Priorities 2018: The Digital Insurance 2.0 Gap.

If an organization wants to know its true direction, it need not look further than the places where it is planning and implementing its digital strategy. Experience has shown, however, that a digital strategy can mean very different things to different people and organizations.

Unfortunately, too many still think of it in terms of disparate tactical tools like customer or agent portals or mobile apps, which can provide some individual digital capabilities, but do not fundamentally change how the business works. A true Digital Insurance 2.0 business model requires an essential re-imagining of the business’ purpose (new model), and how all of its components work to accomplish that purpose, encompassing processes, technology and people.

In the Strategic Priorities 2018 report, we assessed insurance executives regarding their various levels of Knowing, Planning and Doing across digital initiatives. Deeper analysis of the survey respondents who rated digital strategy as a high priority suggests that there are strategic vs. tactical gaps in their digital views.

Is having a digital strategy important to insurers?

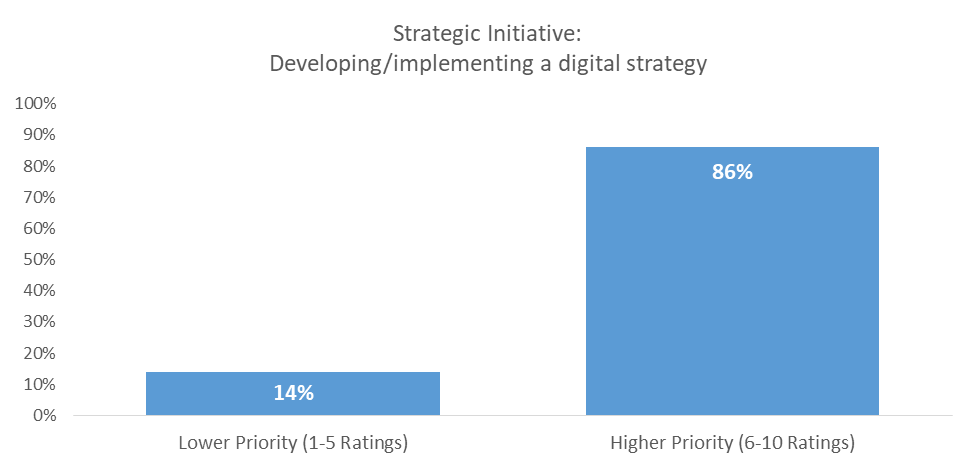

According to the Strategic Priorities responses, the answer is, “Yes.” For further analysis, we divided respondents into two groups based on their ratings to the digital strategy strategic initiative question: those who gave a lower a priority rating (1-5) and those who gave a higher priority rating (6-10). Overall, the results encouragingly highlighted that 86% were in the higher priority group (Figure 1).

Figure 1: Groups based on priority given to Developing/Implementing a Digital Strategy

To tease out the strategic vs. tactical thinkers within this large group we tested a hypothesis: Because a true digital strategy requires a holistic view of the entire business model, it would follow that those who think about digital strategy in a truly strategic way would also consider other strategic initiatives like new products, business models, data and analytics and new channels to be of high priority as well. If the hypothesis was true, this group would be consistent and give similarly high priority to these related strategic initiatives.

Interestingly, our analysis shows an inconsistency in priorities related to a Digital Strategy when viewed through the “strategic lens” of their ratings for all 13 strategic initiatives we asked about in the survey. We found two segments; a strategic one – which had high ratings for the strategic initiatives, showing consistency with their rating for digital strategy – and a tactical one, which had lower ratings for the strategic initiatives. We’ll discuss the initiatives in more detail below.

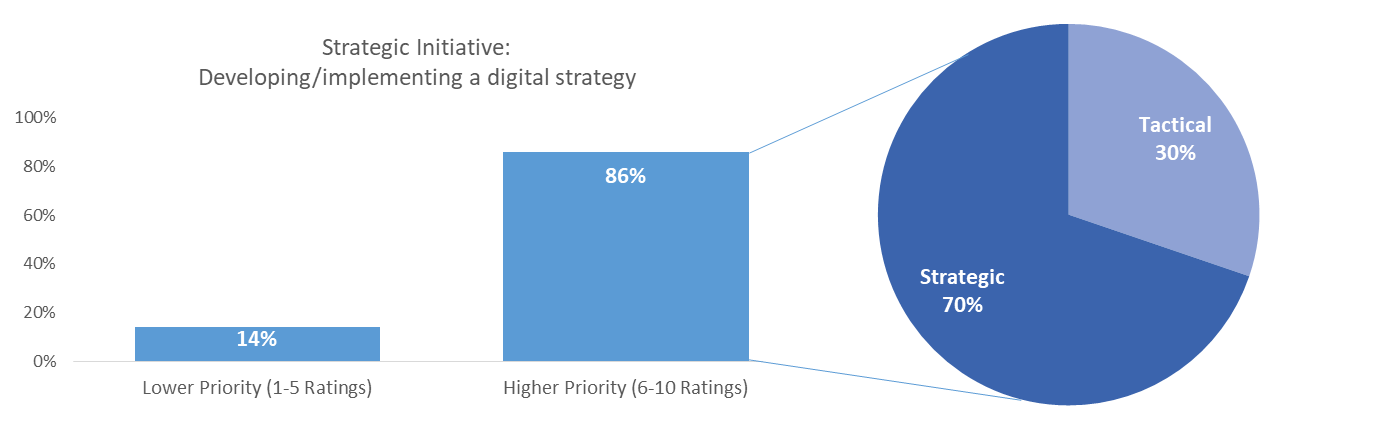

Encouragingly, over two-thirds (70%) of the Digital Strategy group fell into the strategic segment, yet disconcertingly nearly a third (30%) were inconsistent between their ratings of a digital strategy and the strategic initiatives that are necessary for a true, holistic digital strategy (Figure 2). Taking this even further, if you add the lower priority group (14%) to the tactical segment of the higher priority group (30% of 86%), this means that 39.8% of those surveyed aren’t truly on a path to holistic digital strategy.

Figure 2: Strategic and tactical segments within the “Higher Priority Digital Strategy” group

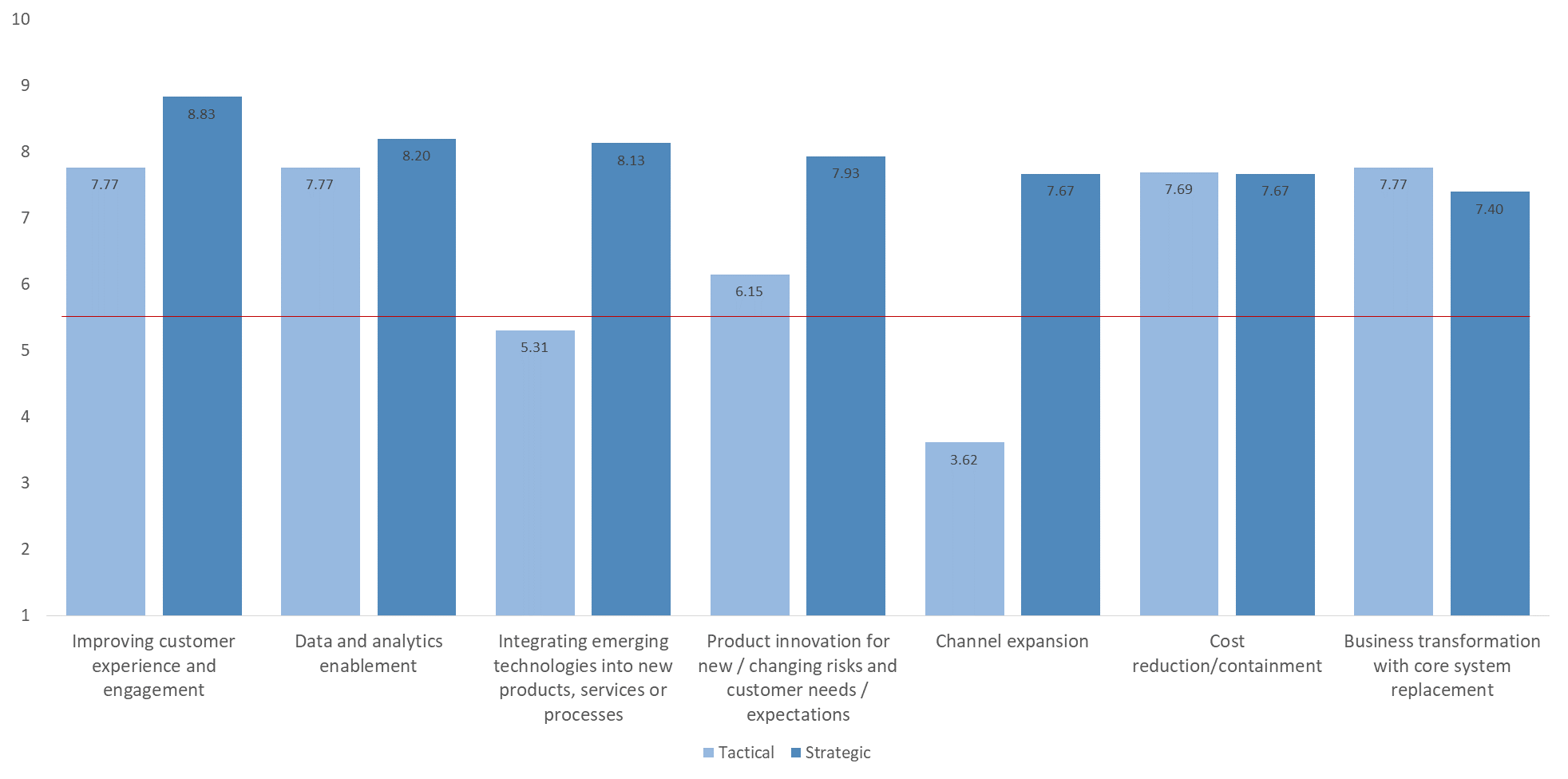

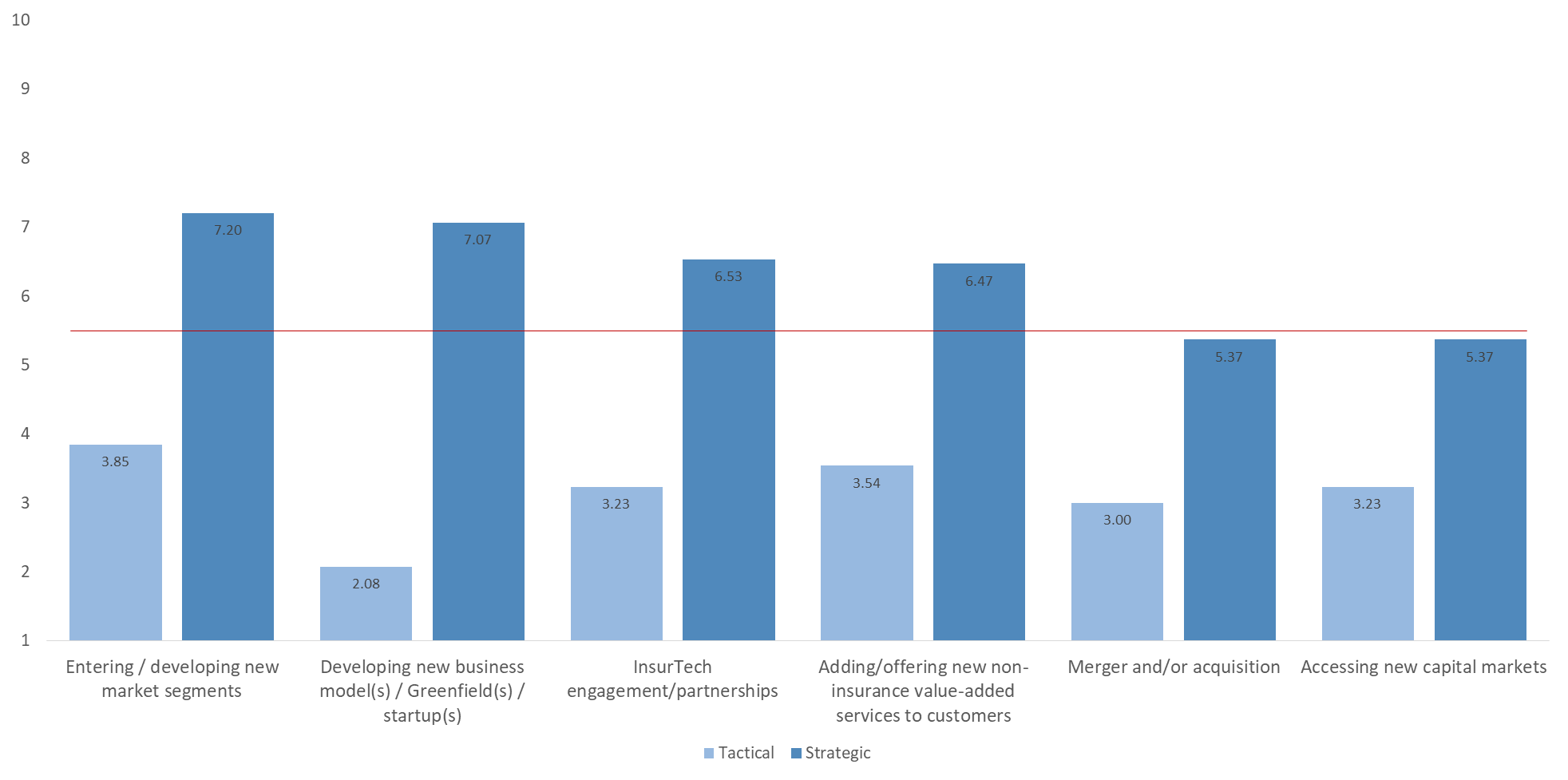

Even more important, the significant gaps in priorities between these two segments across these initiatives highlights the stark discrepancy in thinking about which components of digital strategy are important to each group (Figures 3 and 4). In fact, only two initiatives show very little difference in priority, cost reduction/containment and business transformation with core system replacement – elements that are foundational for modernization and optimization of Insurance 1.0 and set the stage for Digital Insurance 2.0.

The large gaps in the other key initiatives (and the high ratings by the strategic segment on them) expose significant potential weaknesses in the tactical segment’s ability to make the shift to Digital Insurance 2.0. These include: developing new business models, channel expansion, entering or developing new market segments, InsurTech engagement, offering new non-insurance value-added services, integrating emerging technologies into products, services or processes, and product innovation. Two other initiatives, merger/acquisition and accessing new capital markets also show large gaps, even though they are rated lower by the strategic group.

Figure 3: Gaps in strategic initiative priorities between Strategic and Tactical segments (1 of 2)

Figure 4: Gaps in strategic initiative priorities between Strategic and Tactical segments (2 of 2)

Is a digital strategy gap very consequential?

With the gap clearly identified, the question now arises, “What is the possible impact? Is it really that consequential?”

Analysis of surveys like the 2018 Strategic Priorities study point out high-level issues that should challenge and give executives food for thought. But the details of this research should send an alarm due to the potential consequences within the details.

A great example would be in developing new business models, which the tactical group considered a very low priority. A tactical digital initiative might involve creating new digital methods of transacting the same or similar business. The problem with this is that today’s market and demographic disruptions are calling for new business models that offer much more, requiring insurers to launch new efforts along a fresh course of market opportunity.

If insurers can successfully run their traditional businesses (Insurance 1.0) while developing new digital business models (Digital Insurance 2.0), they will march into the future with agility and shift-ability. If they do not, they are threatened with eventual decline and extinction.

Another example might be something as important as integrating emerging technologies into new products or services, which our strategic group considered a very high priority. Though the gap isn’t quite as wide, it is still eye-opening to consider that this universal need is not garnering universal priority.

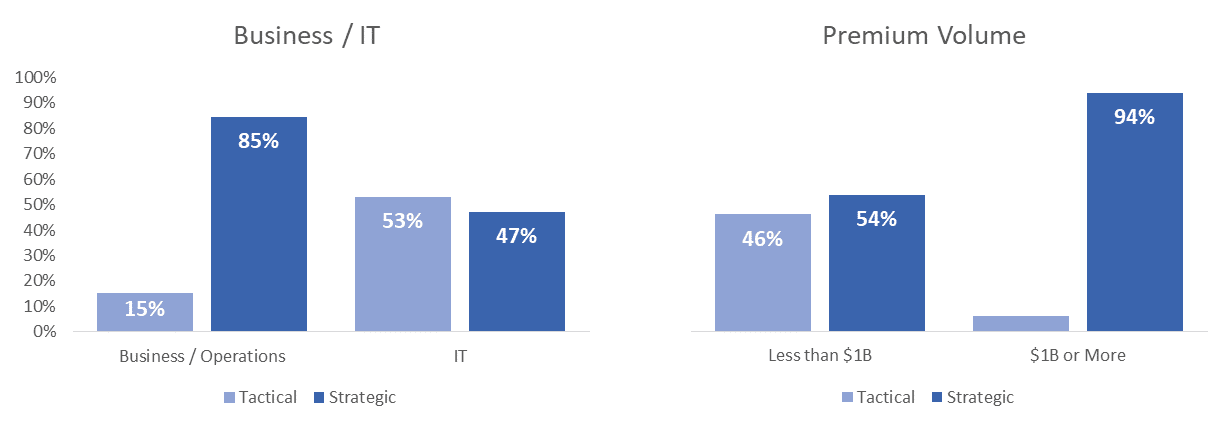

Consistent with the gaps seen earlier between the business vs. IT and large vs. mid-market segments, larger proportions of business and large insurer respondents fall into the strategic segment.

The stark difference between business and IT further demonstrates the significant gap (nearly 50% difference) between them both strategically, but also in shifting from Insurance 1.0 to Digital Insurance 2.0 (Figure 23). This gap could become the “Achilles heel” for insurers, impacting their ability to agilely shift to the new market dynamics that are defining the next generation of market leaders.

Similarly, a significant gap between large and mid-market insurers further highlights the mid-market’s vulnerabilities and the need for them to step up their thinking to determine how they can best support the shift to Digital Insurance 2.0 with their limited resources.

Figure 5: Profiles of the strategic and tactical segments

Why is a strategic focus on digital strategy important? Because with the level of change and disruption, history shows that a large percentage of companies will not survive. Cisco’s CEO John Chambers noted in a 2015 speech that digital technology could render 40% of companies in the world today irrelevant in 10 years[i]. This would certainly corroborate our findings that roughly 60.2% of insurers are prioritizing properly and 39.8% seem to be in a dire position of market risk.

Do insurers need attitude or aptitude to survive and arrive at Digital Insurance 2.0?

In summary, what Majesco found through the digital strategy survey, is that attitude may be more important than aptitude, simply because it can launch the first step, kind of like street smart vs. book smart. A tactical approach to digital development will unfortunately give insurers a few digital capabilities, but leave the bulk of their business far shy of the Digital Insurance 2.0 goal line. Yet, if insurance executives can effectively prioritize digital initiatives in a more holistic manner, they will then quickly gain or seek the aptitude needed to execute on the strategy.

Insurers must aggressively seek the path to innovate and grow their business built around a new digital model that will capture the next generation of customers with new engagement models, products and services. Insurers must take a digital-first and customer-first approach by reinventing their business model to drive growth.

Every day, Majesco lends our digital aptitude and attitude to a host of forward-thinking insurers who are entering the digital realm with confidence. We would love to have a conversation with any who are considering the move to Digital Insurance 2.0.

For a closer look at the details behind insurer strategies and priorities, be sure to download Strategic Priorities 2018: The Digital Insurance 2.0 Gap.

[i] Bort, Julie, “Retiring Cisco CEO delivers dire prediction: 40% of companies will be dead in 10 years,” Business Insider, June 8, 2015, http://www.businessinsider.com/chambers-40-of-companies-are-dying-2015-6