Blog

Digital Insurance Solutions are “Just in Time” for Distribution Challenges

The insurance industry is obsessed with the idea of time. Insurers sell time-based products that prove their value over time. When consumers and business owners seek coverage, they are thinking in terms of time — envisioning security through the lens of a timeline. The customer may think, “This premium covers my home for another year,” or, “For the next 20 years, I’m covered by this life policy,” and now with parametric or on-demand insurance “This covers me for the time I am driving for Uber, renting my home out on Airbnb or for my camera while on vacation.”

Today’s customers have introduced new time requirements and pressures into the insurance equation because they are looking for solutions that meet their needs on their terms (when and how they need it), and with speed. There is the time to quote, time to underwrite, and time to purchase, which are all opportunities to lose or to gain the sale. Researching insurance is happening in odd hours, not always during the workday, and in different contexts, like when they are looking at new home to buy. Prospects are looking for 24/7 availability and real-time products that are meant for on-demand purchase and immediate use.

The challenge for insurers with this shift in time-based expectations is that not all distribution channels rise to these new demands and, in some cases, actually diminish speed and immediacy within the process. Insurers can feel trapped between the need for a faster sale and the desire for multi-channel engagement, including an agent relationship. How can the insurer avoid losing the “spare time” sale, while still fostering and supporting their valuable agency network? Can digital insurance solutions solve insurance distribution challenges?

Applying a Multi-Channel Funnel to Multi-Channel Consumers

Customer behavior and expectations, for both consumers and business owners, are forcing insurance companies to set up multi-channel distribution options to enhance customer engagement on the customer’s terms … not the insurer’s. As a result, distribution channel strategies, including how to support the traditional agent/broker channel, are a focus for transformation in the age of Digital Insurance 2.0, and they are foundational to an insurer’s ability to realize their digital insurance strategies for growth and innovation.

In fact, digital insurance solutions are arriving “just in time.” Many of them are mature and ready for use in a redefined distribution ecosystem where real time processes can meet and exceed expectations.

The critical question for insurers is … how do they effectively and rapidly shift to a multi-channel distribution world? To assist insurers in thinking through their distribution frameworks, Majesco recently published the thought-leadership report, Distribution in the Age of Digital Insurance 2.0: Expanding Reach and Options to Shift Insurance from Being “Sold” to “Bought”. In the report, we look at how Digital Insurance 2.0 systems and processes fit the mold of the ideal insurance customer journey. We also probe how insurers can begin to recast their vision for distribution with a model that capitalizes on both crucial moments and trusted relationships.

Insurance Distribution Challenges in the Digital Age

For most consumers and business owners, insurance is not a top-of-mind item, and it is likely only considered when an event occurs – such as buying a car or home, having a child, or starting a new business. In the age of Digital Insurance 2.0, the product-driven mindset of the past must be replaced with a focus on creating value across the customer’s life journey by adapting and meeting their unique needs at different life stages and life events, as reflected in Figure 1.

Figure 1: Engagement opportunities throughout the customer’s life journey

This is reinforced in our consumer and SMB research, which highlights that Insurance 1.0 products and processes are viewed by customers as complex, with offerings that are “sold” rather than “bought.” However, by tapping into a customer’s life journey based on different events, insurers can capture the moment of need and motivation to buy, changing the customer value dynamic and making it easy to do business with them.

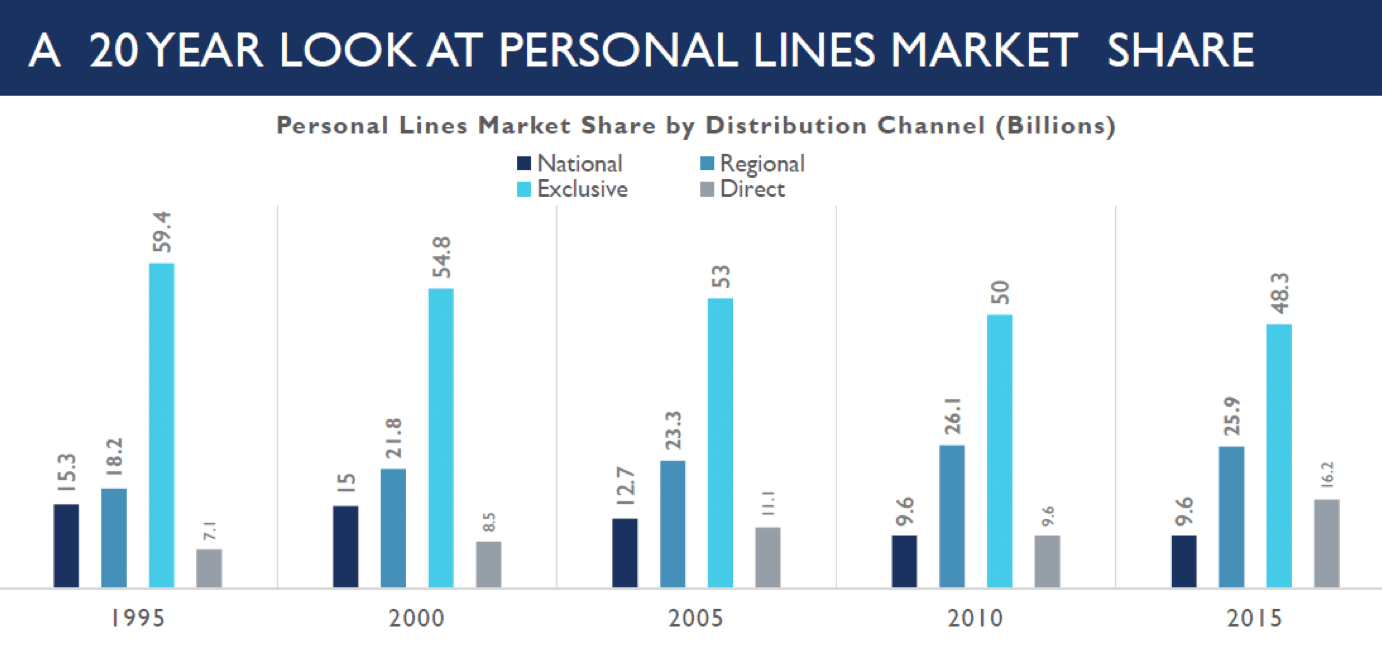

Reflecting the shift to digital, the market share of direct writers has been on the rise, especially in P&C personal lines. Based on the 2017 Market Share Report by IIABA, direct writers increased their personal lines market share by just over 9 percentage points from 1995 to 2015 (Figure 2), taking share primarily from captive agent writers. The Independent Agent (IA) channel still dominates the commercial lines market but direct writers are gaining a foothold with healthy increases in premium volume.[i]

Even though the direct channel is growing, agents are still dominant. As noted in the IIABA chart above, independent agents (represented by the National and Regional categories) wrote 35.5% of all personal P&C premiums and 83% of all commercial premiums in 2015. In the J.D. Power 2018 U.S. Independent Insurance Agent Satisfaction Study, however, they emphasized that insurers missed the mark in satisfaction and ease of doing business for the agent channel, scoring just 696 (on a 1,000-point scale) for personal lines and 686 for commercial lines, which are among the lowest scores for business-to-business relationships.[ii]

While insurers may have, for years, offered a direct channel, they are often not dynamic and personalized enough in nature to connect with prospects and customers at the time of motivation or to allow them to move between channels effortlessly. But changes in digital technologies, plus the introduction of new channel options are aligning with customer demographics, behaviors and expectations to dynamically reach motivated potential customers at the right time and in a multi-channel way.

Digital Insurance 2.0 offerings have an edge on Insurance 1.0 products, thanks to their simplicity, speed, tailored options, value-added services, and more. Plus, there are untold numbers of opportunities each year to reach individuals, families and business owners/leaders during times when their motivation to achieve financial security is high, making these offerings highly appealing.

The proliferation of smart phones and digital data sources is helping to connect with customers during these occasions. While traditional advertising is still essential to build brand familiarity and trust, social and mobile platforms are becoming increasingly useful at creating familiarity and trust through user reviews and targeted advertising. Data linked to social content consumption and creation also provide insurers with time-appropriate clues about life events that enable delivery of relevant and timely advertising messages about product and service offerings.

Purchase Ability — The Missing Link in the Customer Journey

Digital technology, data and the social/mobile phenomenon can be leveraged to connect with people at the point of interest and create more effective triggers that reach customers and prospects at the right time and in the right context, addressing both the Motivation and Trigger components of a purchase. However, the Ability component must also be addressed in order for the insurer’s desired customer behavior to occur. If a motivated customer or prospect is confronted with a siloed, complex, time consuming quote and application process, the insurer risks the loss of potential new business as well as damage to the brand.

Agents and brokers still have an important role to play in these processes, as they can help explain complex topics, providing valuable expertise and insight into the products that would best fit their customers’ needs. But in Digital Insurance 2.0, the agent channel must be supplemented and complemented with digital channels in order to meet customers’ growing demands for an integrated, consistent, multi-channel experience. In order for this to succeed, agents must have access to digital solutions to improve efficiency, effectiveness and job satisfaction … and they need to be more than a one-size-fits-all out-of-the-box portal. An EY survey found that 60% of independent agents said the availability of better tools affected their preference for partnering with certain carriers. The same survey also highlighted high levels of interest in specific digital tools from carriers.[iii] Just like customers, agents need a personalized digital experience too! Younger agents, especially, want digital capabilities that parallel their personal experiences and their customers’ experiences.

When a prospect clicks on an insurer’s social advertisement within the peak period of 1:00-7:00 AM, these new digital distribution and service capabilities are what must be in place in order to move that prospect down the path to a satisfying and successful purchase or self-service experience. On-demand tools and data-enhanced, personalized promotion can both be kick-starters for agent and customer relationship development.

In our next blog, we’ll take the conversation one step further, looking at the Distribution Ecosystem as a Differentiator for insurers that choose to pursue omni-channel distribution methods. Using Digital Insurance 2.0 precepts, insurers can use their distribution channels to improve levels of engagement, so that customers will quickly see the value of insurance before and during the crucial moments of consideration — then have the ability to purchase with immediacy. For a preview, be sure to download and read, Distribution in the Age of Digital Insurance 2.0.

[i] “2017 Market Share Report,” Independent Insurance Agents and Brokers of America, Inc., https://www.independentagent.com/Resources/Research/SiteAssets/MarketShareReport/default/2017-Market-Share-Final.pdf

[ii] Effler, Geno, “Property & Casualty Insurers That Most Satisfy Independent Agents Have Best Overall Financial Performance and Profitability, J.D. Power Finds,” J.D. Power, January 25, 2018, http://www.jdpower.com/business/press-releases/jd-power-2018-us-independent-insurance-agent-satisfaction-study

[iii] “The Agent of the Future,” EY, 2017, https://www.ey.com/Publication/vwLUAssets/ey-the-insurance-agent-of-the-future/$FILE/ey-the-insurance-agent-of-the-future.pdf