Blog

Customers are Ready for an Insurance Makeover

Everyone knows Toms Shoes – and you likely have a pair or more in your household. I know we do! Toms Shoes began in 2006 with a simple model. For every pair of Toms that was purchased, a pair would be given to someone in an area of poverty, most often in third-world communities. Within a few years, a social backlash ensued when economists and on-the-ground workers considered that Toms may actually be creating a scenario where local shoe companies would be undercut by free shoes and labor would be reduced in areas that received shoes.

Toms was quick to respond by commissioning studies of its economic impact upon the communities it serves. To help alleviate concerns, it shifted its approach and began manufacturing in some of those communities, taking additional steps to be culturally conscious as well as philanthropic. For corporate executives in any industry, these changes might seem like unnecessary concessions. In reality, they are the new world order. Customers are driving companies to improve themselves and their service while at the same time proving that they are worthy of their patronage. Now, no one can ever accuse Toms of not listening.

The value and payback in listening to the customer.

Listening to the customer has never been more essential to sustainable growth than today. Today’s customers care about how they are served. They care about where they are served, when they are served, how they are served and who is serving them. They pay attention to changes in products and service. They voice their opinions and concerns in ways that they can be heard. One small voice can make a giant impact. Many voices can rewrite your business model.

Majesco is at the forefront of customer listening within the insurance industry. Our annual surveys and reports are designed to gather relevant customer thoughts and feedback, and communicate our findings to the industry to help insurers understand the changes and how they can shift to a new future that is reshaped by customers’ changing needs and expectations for insurance.

Majesco’s new report, Building a Business Model for the Insurance Customer of the Future, based on our third year of consumer research, provides insights on customer behavior changes and expectations. It explores customers’ interest in innovations and competitors with new insurance products and business models, and it takes a deeper dive into customers’ use and perceptions of insurance distribution channels. These findings make a direct connection between customer-driven model changes and long-term payoff. When insurers are convinced that listening will end in renewed growth, they will listen even more closely.

In our next three blogs, we invite you to listen along with us as we examine what customers are thinking about regarding their insurance choices.

Model perceptions: Are customers ready for the next new thing in insurance?

In Majesco’s new report, we found that consumer behaviors are rapidly shifting. They are using new technologies and adapting to an on-demand world and a shifting marketplace of options. But customers still have limited insurance options to cover their changing risk profiles, which is why a number of startups are seeing strong interest and growth. In addition to dozens of different preferences and channel options, we looked closely at customers’ willingness and interest in adopting new insurance product and service options. For example, we solicited customer opinions on:

- Autonomous vehicles

- Value-added services

- Social/P2P models

- Pricing based on new data sources

Are customers ready for autonomous vehicles?

Just because autonomous vehicles are slowly entering the market, doesn’t mean that the public has warmed up to them yet. The major shift that could happen in auto insurance products may be a moot point if customers aren’t willing to purchase the vehicles.

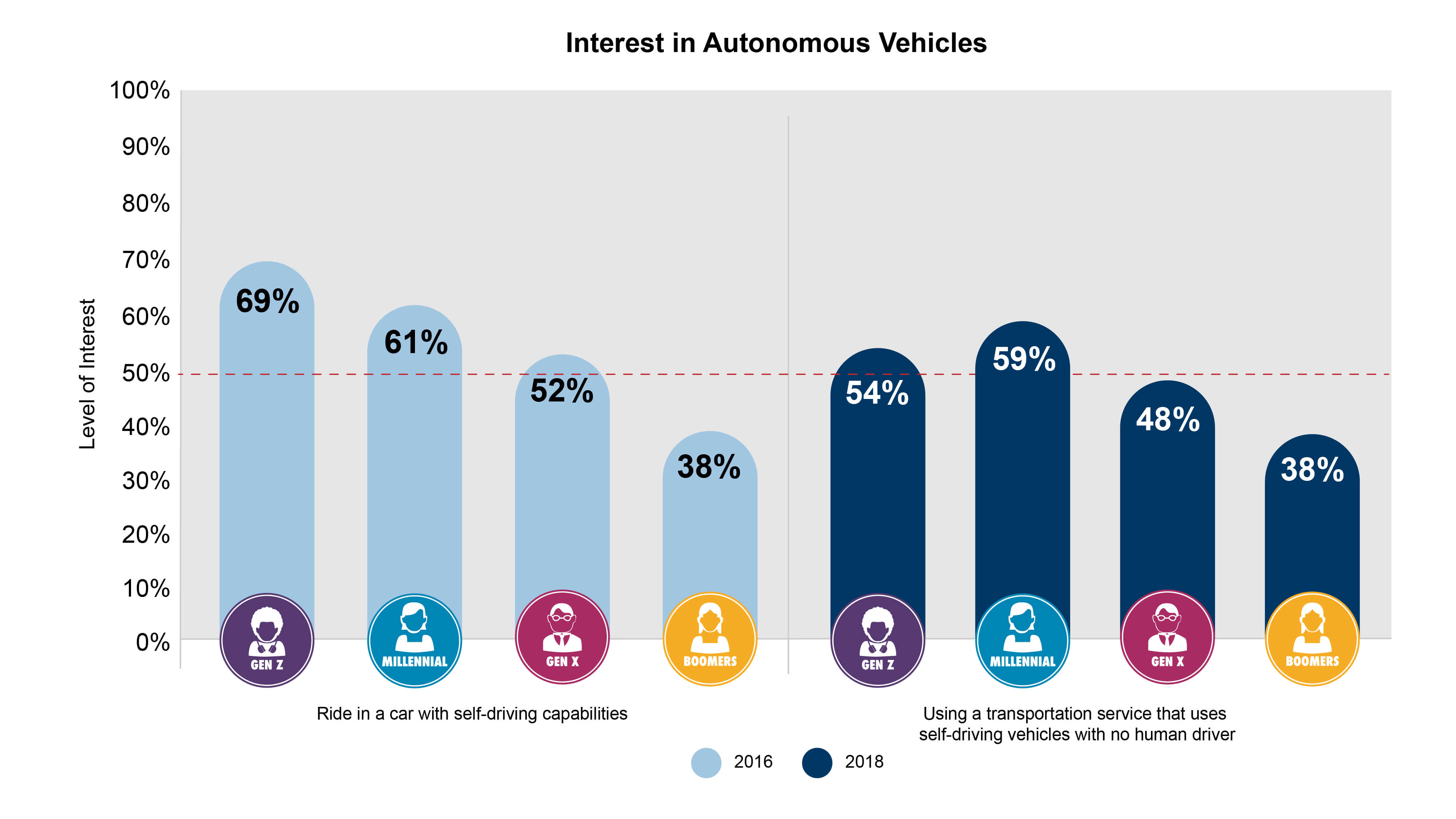

Majesco research did find, however, a generational trend in autonomous vehicle interest. Gen Z and Millennial interest in autonomous vehicles is fairly strong relative to Gen X and Boomers (see Figure 1). As noted in a recent Bloomberg article, the transition to autonomous vehicles presents a large, existential challenge to the multibillion-dollar car insurance industry because today’s auto insurance products are based on a driver’s likelihood of being in an accident, as well as actual crash rates. With more than 90% of accidents (and risk) caused by human error, taking the driver out of the equation will mean dramatic changes in product, pricing and customer engagement for insurers.[i]

Figure 1

Figure 1

Is there insurer value in adding value-added services?

Time is valuable. So, a value-added service is…well…double-valuable. It meets a customer need while saving time and perhaps even saving money. Insurers are certainly keen on being able to expand their offerings into new arenas, not only because of the expansion of their business and the increase of value from each insured policyholder, but also because insurance companies want to expand their brand footprint.

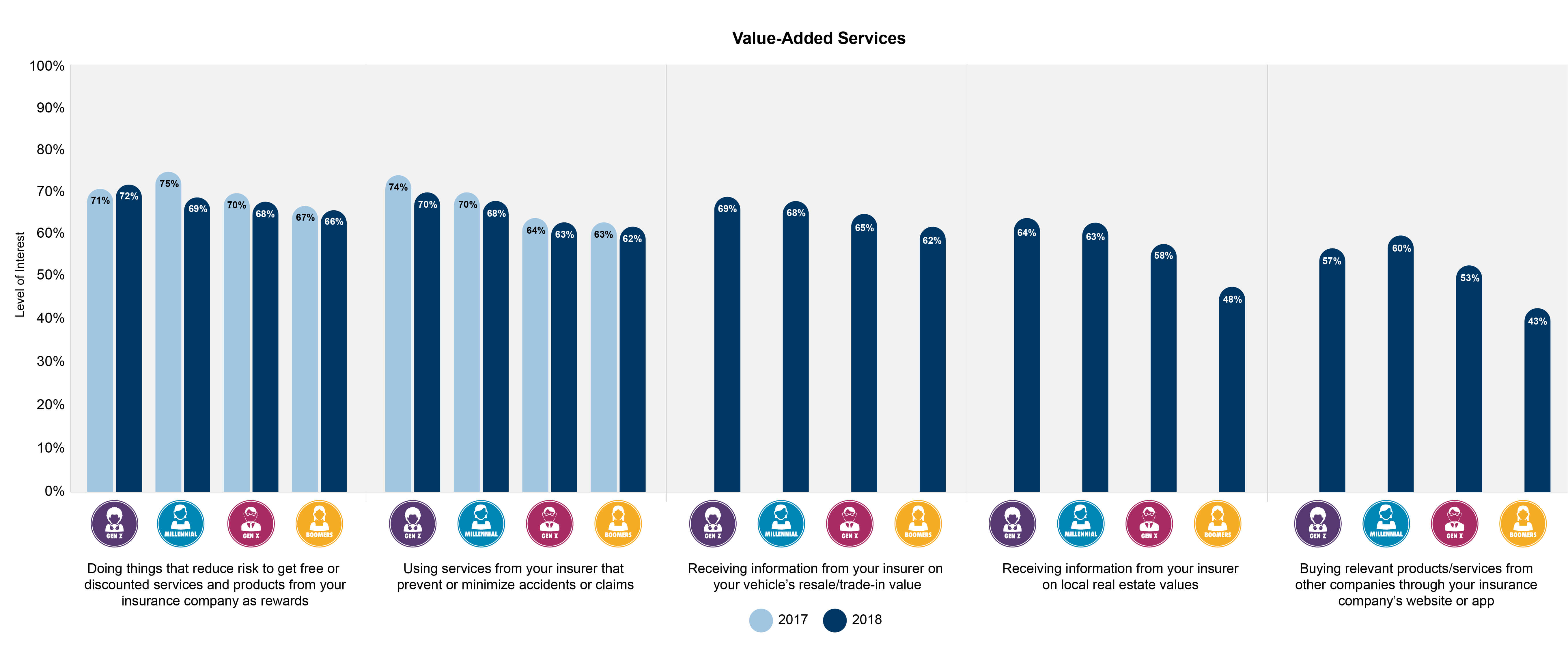

Majesco sought to confirm that customers felt that broader insurance offerings and value-added services appealed to them as well. What we found was that customers DO find value-added services from their insurer appealing. Well over 50% all generations except Boomers would consider 5 different potential offerings we asked about in the survey (see Figure 2). The most popular offerings are related to customers’ financial well-being, including getting discounts, reducing claims, and getting information on the value of cars and homes.

Figure 2

Figure 2

Though we found some differences in the level of interest in value-added services between Gen Z and Millennials when compared to Gen X and Boomers, the numbers were remarkably close. All generations share a moderate to high level of interest in purchasing or receiving additional services from their insurer. For insurers, these are extremely positive signs and offer great opportunities. If they choose to pursue model changes that will include more value-added services, they will be making good investments in their own value to customers.

Do social/P2P models really matter?

Companies like Toms and Lemonade have been paving the road to social involvement products. Gen Z and Millennials show strong interest in the social good model of distributing post-claims money to charitable causes. They are also most likely to consider other social or peer-to-peer business models for sharing costs/rebates (e.g. the Friendsurance model) or for networking.

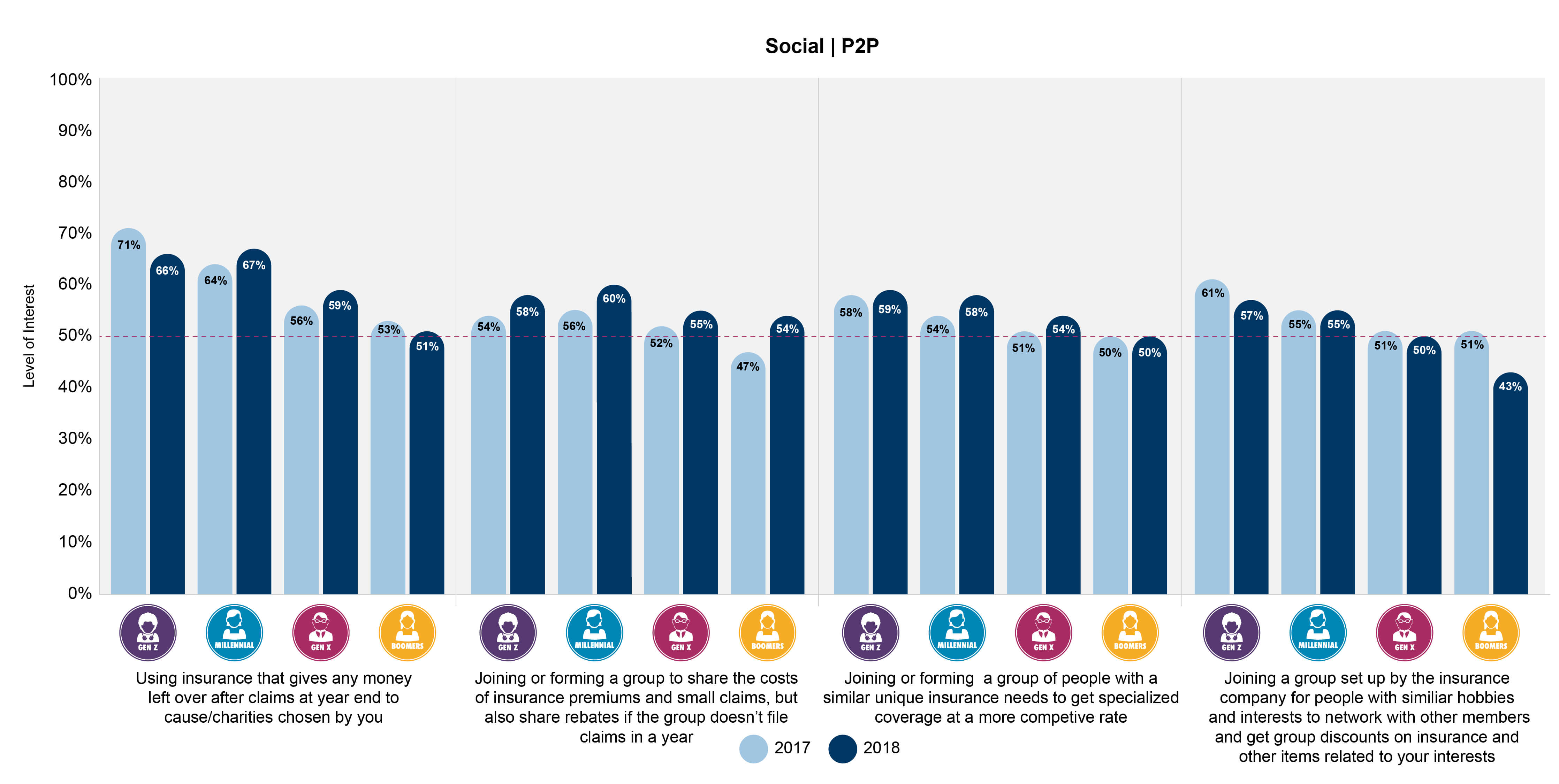

Figure 3

Figure 3

What is telling is year over year growth in social and peer-to-peer interest. (See Figure 3.) Both Joining or forming a group to share the costs of insurance premiums and small claims, and Joining or forming a group of people with a similar unique insurance need to get specialized coverage at a more competitive rate are gaining in interest year over year across all segments.

There may be many reasons for this. Both may be related to the growing gig economy. No one wants an insurance makeover more than those gig and contract laborers who have been isolated on an island of low-to-minimal benefits. They may pay similar rates for P&C insurance, but their high medical premiums are creating undue pressure on all aspects of their life and health insurance. All age groups share this lack of ability for individuals to receive group benefits. If these trends continue, social and peer-to-peer coverage will continue to grow in interest. Insurers that can effectively serve individuals by helping them to form affinity groups stand to gain a whole new market.

Pricing based on data — Is privacy still a barrier?

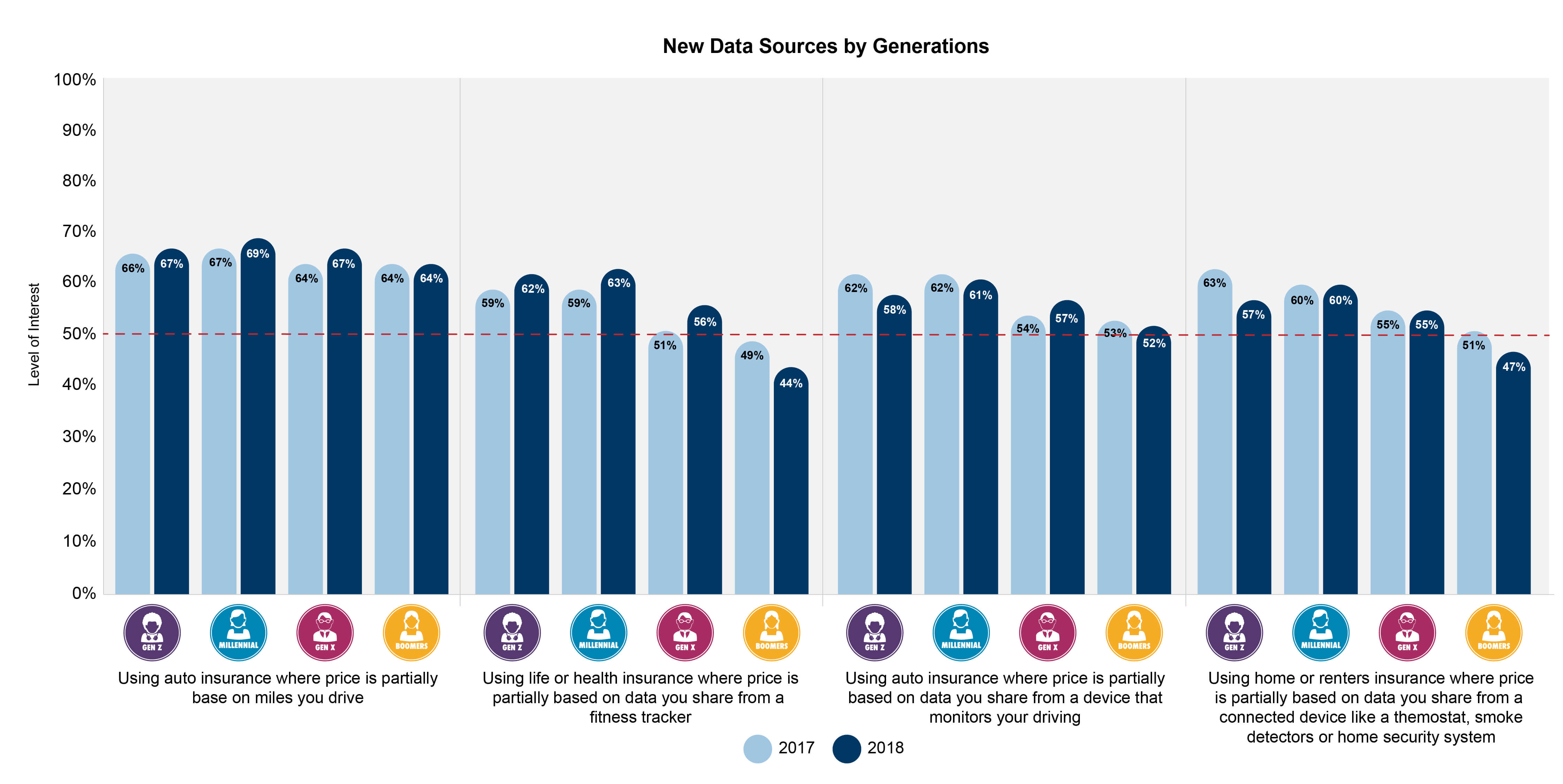

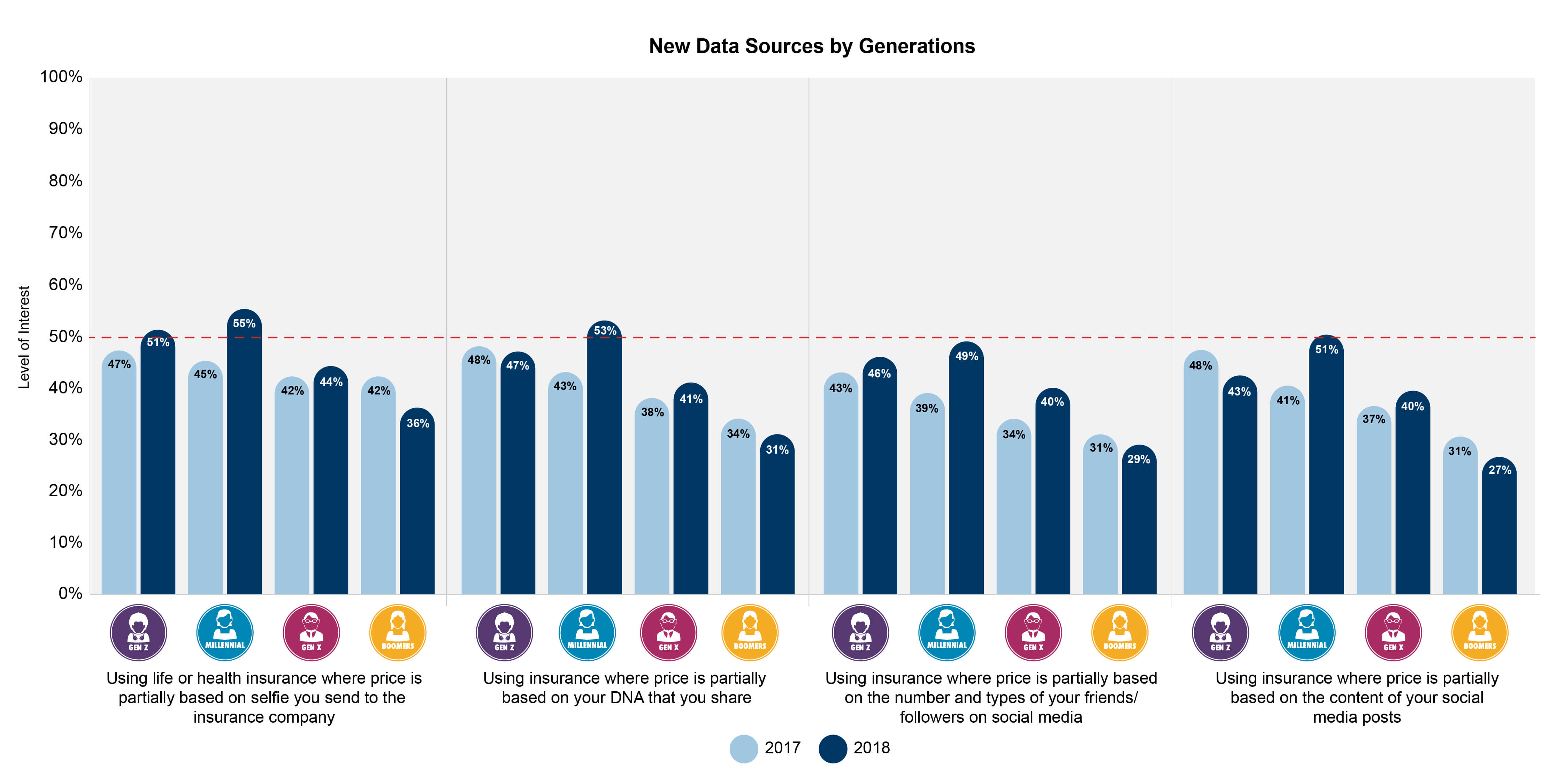

The abundance of new data created by digital interactions and activities has opened up exciting new possibilities for improving accuracy and speed in underwriting and pricing. Yet, the personal nature of this data and concerns about privacy are barriers to acceptance, particularly for Gen X and Boomers, customers of the traditional insurance business model. In fact, when they were given details on 8 potential pricing models, Gen X interest exceeded 50% on half of the models, and Boomers reached that level on only two (see Figures 4 and 5).

Figure 4

Figure 4

In contrast, Gen Z and Millennials are more open to the use of new data sources. While all 8 of the pricing models are driven by a consumer’s personal behaviors or characteristics, the first 4 have a more direct, controllable connection to insured (e.g. car, home, life/health), likely explaining their higher level of interest.

Figure 5

Figure 5

What is striking (as we pointed out in last week’s blog) is that if insurers consider these percentages across all generations, these are very high percentages of people who are willing to share data in exchange for better and more personalized pricing. It is even more striking if you consider that some of these data sharing options will require some kind of life adaptation, such as beginning to wear a wearable or making purchases of connected devices. In nearly every case, the insured will have to do something to share their data.

The startup auto insurer, Root, is a great example of getting customer buy-in for data use. Root requires prospects to load an app on their cell phone and take test drives before they are ever accepted as policyholders. This proves that privacy and barriers to acceptance ARE able to be overcome when policies can be personalized, but only if insurers can choose business models that will foster accuracy in pricing due to real-time analytics. These relationships require a new generation of modern, innovative core and digital systems that can handle data well, frameworks that will handle multi-channel transactions well, and they require communication methods that will build trust and engagement.

In our next blog, we’ll look closely at how insurers can begin to assess business models that fit the customers of the future. For an in-depth look at current customer perceptions and trends, be sure to download, Building a Business Model for the Insurance Customer of the Futuretoday.

[i]https://www.bloomberg.com/news/articles/2019-02-19/autonomous-vehicles-may-one-day-kill-car-insurance-as-we-know-it