Blog

Current and Future State: Burning Platform or On the Back Burner?

It isn’t an overstatement to say that platforms are changing our world.

We are living lives that are far more connected, more personalized and much more in-touch with services and products that are relevant to the way we work, live and feel. This is due, in part, to the development of platform technologies that are continually improving and streamlining aspects of our own personal processes. At a micro-level, this means that we as individuals are increasingly able to do things that were previously impossible. Standing on a street-corner in London, you can change a thermostat in your home in Atlanta. You can order something to be delivered to your mother in Phoenix. You can hire a car with a driver who will pick you up in five or ten minutes. These services and more are brought to us by platforms.

At a macro-level, however, platforms are future-altering. Entire populations are shifting purchase patterns. Cultural norms are being created as communication changes. As data gathering and analytics improve, transparency is improving our knowledge of the decision process and how to influence it and how to fit naturally into new lifestyles with different channels. Platforms are both the drivers and enablers of this massive shift. Someday we may be asking ourselves, “Which came first — customer pressure to change or the rise of platforms?”

This is how crucial it is for insurers to grab hold of a platform strategy. Platforms are the tools with which we will create the products and experiences to keep insurance relevant and well placed within customer lives. As the customer dictates how they want to purchase or engage, we will also be able to step forward with insurance innovations that are ahead of customer desires. Platforms will allow us to anticipate future trends and to do our work to create the future of insurance market demands.

Burning Platforms — Platform Technology’s Ticket to Success.

It’s unfortunate, but here we have to use two distinctively different definitions of the same word — platform. As we discuss crucial technology platforms (those networks, ecosystems and technologies that position us for growth), we must introduce another kind of platform (the kind that a politician uses to get elected). A Burning Platform is that core philosophy that takes a project and moves it from concept or back burner status and says, “This idea is so crucial that we must act as if it is on fire and we must deal with it immediately.”

Hence, the platform models that we are discussing are also the Burning Platform for insurance leaders and executives. In our last blog, we worked to define platforms by looking at how Majesco, other insurers and industry analysts use the term and are putting it into action. In today’s blog, we’re examining how platforms are affecting business models, a conversation that receives deep coverage in Majesco’s new thought-leadership report, Insurance Platforms — A Burning Platform for Market Leadership in the Digital Era of Insurance.

Burning Platforms are powerful drivers of strategic foundational change, particularly during times of industry disruption. They are driven by leadership, commitment and courage, rather than by panic and fear. Leaders use them to generate awareness and convey the need for urgency in order to move from awareness to planning and execution. In the case of insurance, the mixed definition of platform may be beneficial. As we discuss the Burning Platform, we are faced with the constant reminder that insurers are not just in need of platform development, but it is a burning need that deserves our attention, planning and action.

In our 2019 Strategic Priorities report, we found that insurance companies are widely varied in their responses to change and disruption. On one end of the spectrum are the leaders that have a burning platform and are forward-thinking. They understand the intersection of customer, technology and market boundary shifts and are blazing new trails to the future with their focus on operational and disruptive innovation including new products, new channels, incubators, hackathons and InsurTech investments, partnerships and more. They are moving the industry forward and they are building their future with new business models, digital capabilities and ecosystems that will sustain them as the future rapidly unfolds with new competitors, new customers and new market opportunities.

On the other end are laggards who are watching, waiting and wondering, “What’s the rush? We’ll save money and time if we jump in after they have paved the way.” And, there are the followers who lie in between, most trying to roust up enough resources to drive digital change to keep from not falling too far behind the leaders.

Unfortunately, the path leaders are paving can’t be followed. Why? Because their path captures new markets as it exposes their opportunities. The fast followers may gain some benefits, but not all. They will still have to forge their own paths to compete or find new markets. The laggards face something even more daunting because the myth that they will save time and resources through waiting has now been exposed. They will find themselves hacking away, like jungle explorers, trying to find an alternate way around. And, like some explorers, they may never be heard from again – left on the back burner!

According to Boston Consulting Group data, late responders may spend more than double what similar-sized companies will spend if they wait until a disruption has long-passed to invest in innovation.[i] Early responders spend less, and they spend far more evenly year to year, while at the same time reaping the rewards of first market access. The old adage of “being a fast follower can keep you in the game” will be far more costly and still may not get you in the competitive game.

So how can you create a Burning Platform and become a leader?

At the start of InsurTech, Majesco began tracking the industry response to the trends driving change and disruption. We identified a Knowing – Doing Gap. The gap reflects that insurers know and recognize changes in the industry, but are not planning and doing rapidly enough. Why? The ability to maintain strategic focus, obtain sufficient investment and fight against competing priorities are a constant struggle … resulting in three segments of insurers – Leaders, Followers and Laggards. The differences between these segments confirm that Leaders are leveraging the change and trends as a burning platform for change while others are still keeping it on the back burner.

Tracking the differences between Leaders, Followers and Laggards.

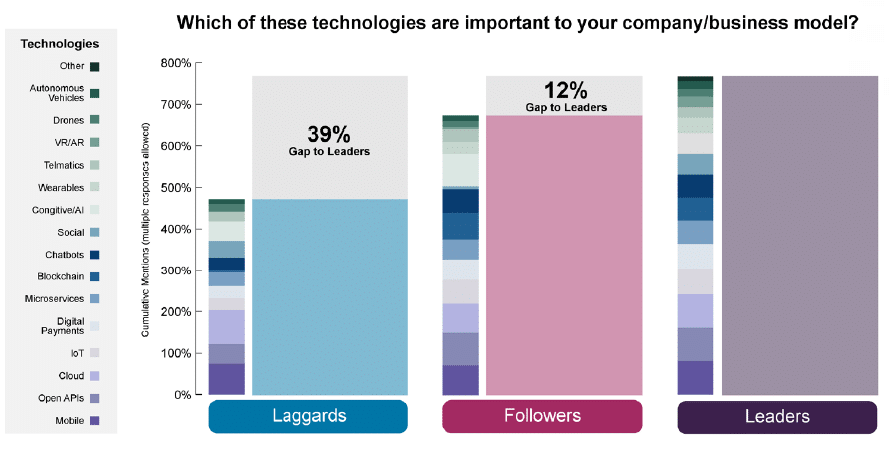

Majesco tracked fourteen separate technologies that will have a bearing upon insurance impact. Leaders view a broader range of these technologies as important to their business model. Followers are close behind, 12% behind leaders. Laggards are 39% behind leaders, clearly placing them at risk.

Furthermore, Leaders are positioning for the API and platform economy by rapidly using platform technologies as a foundation for their business model – 39% ahead of laggards. Leaders specifically surpass Followers and Laggards in key technologies that are foundational to the platform and API market shift, including open APIs, mobile, IoT, micro-services and digital payments.

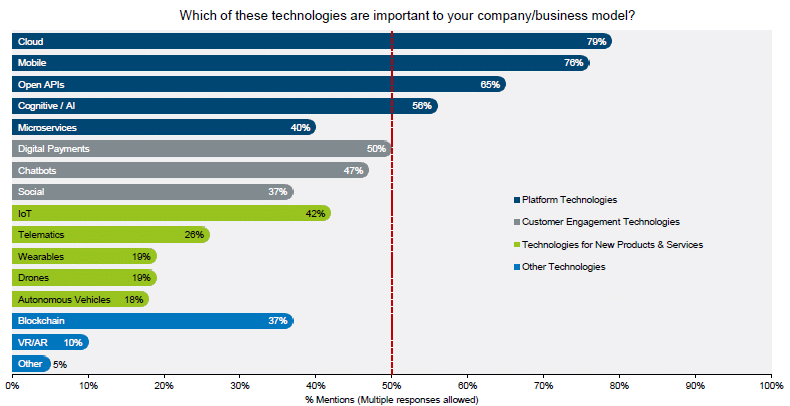

In Majesco’s Strategic Priorities research we found that key platform components of cloud, mobile, open APIs and cognitive/AI, with digital payments, chatbots and microservices close behind, were being planned and implemented as a new foundation for the business model — enabling speed, innovation and flexibility in order to adapt to a rapidly changing market.

Despite the awareness of how important these technologies are to their businesses, most insurers are also keenly aware of the limitations of their current technologies and the barriers they present to adapting to the changes in the industry.

Majesco’s Strategic Priorities research has identified some of the top areas of concern for insurers as:

- Legacy systems

- Data and analytics capabilities

- Talent

- Digital capabilities

All four of these areas of concern can be mitigated to varying degrees by moving to an insurance platform with a strong ecosystem of partner services.

A key success factor in today’s insurance market is a recognition that it’s no longer desirable or optimal to “go it alone,” particularly in the platform economy, where ecosystems are a multiplier effect for growth. Our Strategic Priorities research found that most insurers (80%) agree on the value of partnerships and ecosystems, indicating they are involved with at least one partnership or ecosystem with insurer, reinsurer, MGA or InsurTech.

Leaders partner with others to offer product, service and market options to strengthen their businesses and customer relationships through the growth multiplier effect. A recent McKinsey report, states that, “Ecosystems will account for 30 percent of global revenues by 2025.”[i] This is an area where we expect to see more and more activity – identifying broad ecosystems that encompass key consumer and business needs, like transportation, logistics, housing, and others, and figuring out how to embed insurance as part of the ecosystem, so that it is seamlessly consumed by the customer.

Creating the future through speed of innovation is what makes Leaders stand apart from the pack. Leaders (and to a lesser extent, Followers) are clearly positioning themselves to be competitive in the Future of Insurance, and a platform-based insurance business model is a key route to get there. Leaders have a broader and more focused set of strategic initiatives. They distinguish themselves with a stronger focus on initiatives instrumental to creating a new business model, including channel expansion, entering new markets, adding value-added services and developing new business models. They are redefining and reimaging the future of insurance … taking control before someone else does.

Awareness + Planning + Action = Burning Platform.

The most crucial trait of insurance leaders is — “Doing” — creating a Burning Platform. Leaders are able to move from awareness, through planning and into active change without getting sidetracked or bogged down by the many challenges facing insurance. Without being rash, insurance leaders need to make sure they are moving the organization rapidly forward in order to capitalize on the market opportunities that are opening up.

Undertaking digital transformation begins with customer-centricity that provides the capabilities that deliver the great experience consumers increasingly expect. To do so, you need to bring together core insurance systems, such as Majesco’s P&C suite and L&A and Group suite, Digital1st Insurance digital experience platform and an ecosystem of other digital capabilities, such as chat bots, artificial intelligence and new data sources – Majesco’s Burning Platform to help our customers be leaders. The ability to channel these capabilities requires the adoption of a modern architecture that supports easy, rapid integration through microservices or APIs running in the cloud to drive speed to implementation, speed to market and speed to value, at scale.

So, do you have a Burning Platform?

If not, step one on your action plan involves prioritization and reading our insights on how your organization can utilize a platform model, be sure to download, Insurance Platforms — A Burning Platform for Market Leadership in the Digital Era of Insurance.

[i] Tanguy, Catlin, et al, Insurance beyond digital: The rise of ecosystems and platforms, January 2018

[i] Farley, Foldesy, Wick, and Demyttenaere, Facing Disruption? The Need to Reinvent? Better Move Fast., Boston Consulting Group, December 4, 2018