Blog

Arriving at Tomorrowland: Are Auto Insurers Preparing for Mobility Ecosystems?

There has almost never been a time when we haven’t asked, “What is the fastest and easiest way to get from here to there?” In the 1950’s and 60’s, when Walt Disney envisioned the various rides at Disneyland, one of his primary themes was, “How will people move in the future?” Tomorrowland was filled with the answers. There was a ride emulating interstate travel, a “People mover,” which was a moving walkway integrated into an emission-free tram with small, individual cars. Space Mountain depicted a time when anyone could travel in space. And to get to the heart of the park, you boarded a monorail — a smoother, cleaner and more modern ride than a bus or a commuter train.

By any estimation, we’ve arrived (and we’re passing) Tomorrowland. Though people have been limiting their movement this year, it hasn’t stopped the momentum of the technologies that move us. In 2020 alone, we’ve seen SpaceX and Boeing take additional steps in the race to become NASA’s space taxi. We’ve watched the recent development of flying taxis, hyperloops, high speed rail and autonomous vehicles – both cars and trucks. We have also seen the rise of simpler and smaller transportation networks that include electric bikes and app-driven electric scooters. And we have seen the expansion of ridesharing to food delivery and more.

The reality is, no single transportation method/vehicle is going to offer up the best transportation experience for all our changing needs. The future of transportation is multi-modal. For many people today and in the future, multiple methods of transportation will be involved in the same commute. Just as bus to metro rail or ferry transfers have always been an option, today’s longer commutes may involve an Uber to metro to walking to scooter. These solutions will increasingly be faster as congested cities grow.

Mobility is the wave of transportation.

What does this mean for auto insurance? For the last month, we have been grappling with the impact and opportunities of Mobility ecosystems upon auto insurers. In June, Majesco published its latest thought leadership report, Rethinking Auto Insurance: From a 120-Year-Old Policy Transaction to a Next-Gen Mobility Customer Experience. In the report, we take a look at not only the trends that are going to be driving auto insurers over the next few decades, but we also look at the ways in which insurers need begin to think outside the vehicle to cover and facilitate the complete journey.

In today’s blog we ask two specific questions.

How large is the potential impact? What changes should insurers make to sustain their relevance as mobility shifts?

Envisioning the Impact of Tomorrow’s Mobility Environment

The nice thing about the future is that the new Walt Disney’s of the world are thinking it up right now. This is certainly the case for the MaaS Alliance, a “public-private partnership to create a common foundation for mobility-as-a-service (MaaS) to integrate various forms of public transportation into a single mobility service, accessible on demand.”[i]

Travel to Europe and you’ll understand why. A “simple” trip from London to Berlin, might involve a cab, metro passes, individual light rail tickets, flight passes, car rentals and international credentials — all in the span of one morning. MaaS has envisioned a better way. “To meet a customer’s request, a MaaS operator facilitates a diverse menu of transport options, be they public transport, ride-, car- or bike-sharing, taxi, car rental or lease, or a combination thereof.”

This all sounds wonderful, unless you are an auto insurer in Europe. MaaS has the added fuel of European regulation to assist it with its vision.

The goal of the regulation is very “MaaSive”: it aims at improving awareness of alternatives to the use of private owned cars for mobility and increased use of ground transport as an alternative to short and medium airline routes even across borders.”[ii]

It doesn’t take much to see how this is going to impact the world of auto insurance, which is already changing across many dimensions due to the shift in how other companies are adapting to a new world of mobility and using new technologies to change and influence the customer experience

Auto insurance is a significant part of the P&C revenue stream, both personal and commercial. According to the NAIC, private passenger auto liability (23.3% of total NPW) and private passenger auto physical damage (15.5% of total NPW) represented 38.8% of the total NPW for US insurers in 2018.[iii] When you add commercial to this it reflects the financial importance of auto for P&C insurers.

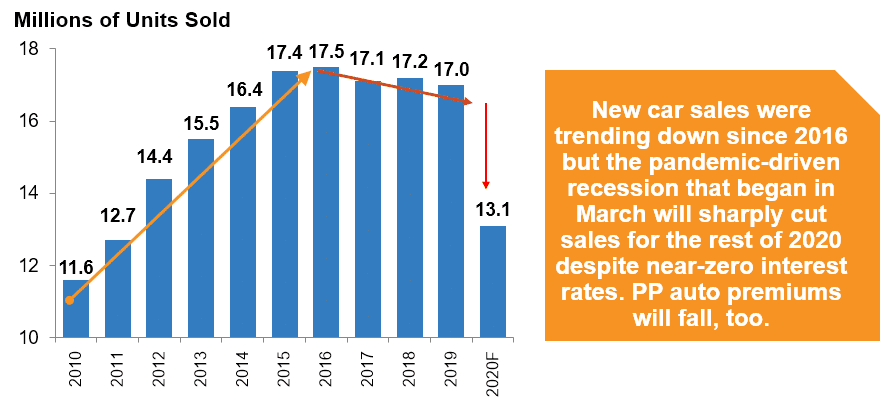

But with all the change in automobiles, a decline in car sales (as reported by the III – see Figure 1[iv]), and a new view on mobility by the younger generation, the future of auto insurance premiums will likely decline and coverages will shift. Changing views of ownership of a vehicle versus considering other mobility options will accelerate due to the cost of owning and driving a personal vehicle.

To put it in perspective, the AAA’s 2019 “Your Driving Costs” study found that the average cost to own and operate a 2019 model vehicle was $9,282 in 2019,[v] an amount that can buy a lot of other mobility options that are of higher interest to the younger generation. As such, insurers must “think fast” to maintain customer relationships and define new revenue opportunities via value added services around mobility in this fast-changing environment.

Figure 1: New vehicle sales trends

A report by Deloitte did a deeper dive into the impact of the evolving transportation ecosystem and the impact on future premium revenue for insurers. They defined the future states of mobility based on vehicle technology and vehicle ownership or non-ownership. The four states they identified included:

- Incremental change

- The world of carsharing

- The driverless revolution

- A new age of accessible autonomy

This view aligns substantially with responses from our research outlined in the Rethinking Auto Insurance report, further validating the significant market shift for auto insurance.[vi]

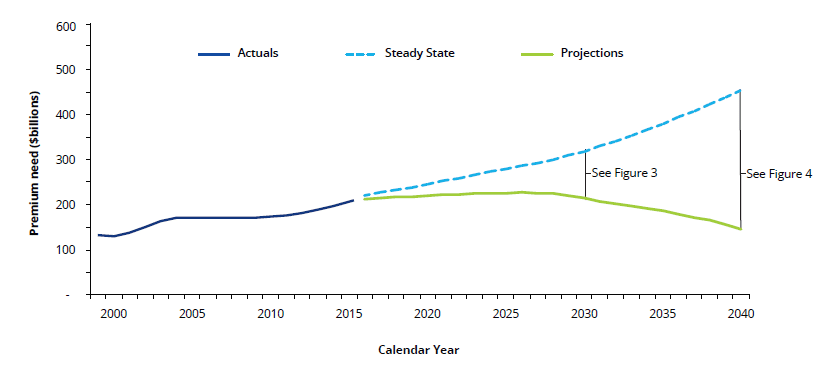

Based on this model, Deloitte did a deeper actuarial analysis of the impact to premiums for the years 2030 and 2040, reflected graphically in Figure 2. They defined a “steady state” scenario that assumes the current mobility environment persists – where there are no further advances in driver-assist technologies, autonomous vehicles do not become part of the national fleet, and ridesharing does not continue to expand – adjusted to account for population growth and inflation. Here is what the future potentially looks like:

- In 2030, the “steady state” premiums would be $320B. The shared economy driving could boost premiums by 10%, autonomous vehicles could reduce premiums by 26% because of safety benefits, reduced fraud and other safety benefits could reduce premiums by 18%. The overall model estimates premiums at $214B – a nearly 33% decrease relative to the “steady state”.

- In 2040, the “steady state” premiums would be $450B. The shared economy could boost premiums by 23 percent, autonomous vehicles could reduce premiums by 80 percent, reduced fraud and other safety benefits could reduce premiums 17%. The overall model estimates at $145B – a nearly 70% decrease relative to the “steady state”.

Figure 2: Mobility impact scenarios on future auto insurance premiums

A Roadmap: 4 Changes Auto Insurers Can Implement Today to Get Ready for Mobility Ecosystems

How the next generation of insurance buyers use mobility options will dramatically change, requiring insurers to change as well. But they will need to make disruptive innovation to counter the disruptive changes well underway, aligning well with AM Best’s innovation view of disruptive innovation as well as their comments on the importance of ecosystems on insurer development. To be a market leader in the future, insurers need to transition their thinking from being an auto insurer to being a mobility provider, for which auto insurance may be just one component.

In Majesco’s research, we found that four changes, among others, will assist insurers to carve out their roles in the new world of mobility:

- Strategic Focus as a Product Provider or Customer Relationship Owner. The viability of the insurance industry is vitally connected to demographic trends, market trends, customer opinion and adoption of new technologies. If insurers lose touch with our customers, both current and future, insurers will lose business. The result is a porous market, where engagement is everything and the relationships between businesses, customers, channels and partners is crucial. Insurers unprepared for a new dominant insurance buyer may find they are no longer relevant after this major shift. As we make great strides in adapting our business models, we can never lose sight of the customer and what it takes to cultivate customer loyalty.

- Redefinition and Innovation of the Product. The definition of a product must expand to include the risk product, customer experience and value-added services. With all of the changes to vehicles and their use, insurers need to proactively rethink traditional auto insurance from a distinct transaction to a part of a broader customer mobility solution that adapts and changes in real-time based on the customer needs and behaviors.

- Data and Analytics Expansion. Data continues to be a key driver of change and disruption, requiring insurers to become data-driven companies. Driven by IoT and all the data coming from autonomous vehicles, rideshare apps and more, the shift to “real-time” data and continuous underwriting is well underway. Data is one of the crucial elements in the mobility space because it is the only way to truly understand the literal customer journey.

- Partner Ecosystem Development. Market boundaries are no longer clear. They are shifting and, in some cases, evaporating. The combination of technology and customer expectations is directly impacting insurance by altering the traditional ecosystem of agents and brokers, and introducing insurance embedded or sold differently across a broader ecosystem including automotive, transportation businesses, big tech and more.

Ecosystems, though, will tackle broader issues than sales channels and real-time underwriting. The mobility solutions of tomorrow will break down business and market boundaries to make the ecosystems fluid based on the customer needs and expectations for both the risk product and other value-added services. The removal of those barriers will create greater value for insurers due to new revenue streams and access to a broader market through the multiplier effect. Imagine the power of insurers gaining revenue on non-risk services that simply make journeys easier. As insurers expand, they may find further benefits in lowering their portfolio risk as well as risk across their book of business.

The future of insurance is rapidly unfolding. Tomorrowland is today.

Today’s change requires insurers to gain clarity on how to succeed in the new future of insurance, which is coming faster than most realize. Insurers must lay the groundwork of a new digital insurance business model that embraces customer, technology and market boundary changes with vision, energy and speed. Forward-thinking leaders are disrupting their business to build a new future focused on mobility, ensuring customer relevance and revenue growth during a time of tremendous change.

For a quick primer on the rise of the new mobility ecosystems, be sure to download Majesco’s report, Rethinking Auto Insurance: From a 120-Year-Old Policy Transaction to a Next-Gen Mobility Customer Experience. For your first step into building an ecosystem foundation for the future, ask for a demo of Majesco’s P&C Core Suite, the powerful platform for insurers that gives you access to future-focused data, multi-channel, real-world service options and Digital1stÒ EcoExchange technologies.

[ii] Carla, MaaS Monitor: Everything you always wanted to know about NAPs and MMTIS but haven’t dared to ask, MaaS Alliance, February 18, 2020.

[iii] “U.S. Property & Casualty and Title Insurance Industries | 2018 Full Year Results,” NAIC, https://www.naic.org/documents/topic_insurance_industry_snapshots_2018_annual_property_casualty_analysis_report.pdf

misc[iv] “Triple-I Economic Snapshot: Quarterly P/C Industry Snapshot,” Insurance Information Institute, April 29, 2020, https://www.iii.org/triple-i-economic-snapshot-quarterly-p-c-industry-snapshot-042920

[v] Edmonds, Ellen, “Your Driving Costs,” AAA NewsRoom, September 12, 2019, https://newsroom.aaa.com/auto/your-driving-costs/

[vi] Matley, John, et al, “Quantifying an uncertain future: Insurance in the new mobility ecosystem,” Deloitte, 2016.