Blog

Auto Insurance and the Rise of Mobility Ecosystems

The Industrial Age spawned a new sort of economics where the supply chain became more important than ever. Industry needed coal for steam engines, power looms, steamboats, ships and trains. Kerosene use was on the rise, so refineries were growing in number. But the most powerful people in business realized that owning a commodity business was only as safe as the supply lines that carried it. Magnates, such as Andrew Carnegie, John D. Rockefeller and Henry Ford, made sure that they owned the pipelines, refineries, and related business interests to oil, steel, transport and manufacturing. These may not have been called ecosystems at the time, but they were certainly a hint of things to come.

Flash forward to the digital age with computers, software, the internet and another set of powerful ecosystem creators. Steve Jobs, Bill Gates, Larry Page, Sergey Brin and Jeff Bezos could have been satisfied, perhaps, with smaller competitive shares within their industries. Yet each of them somehow realized that their corporate value would be best applied if they could cross industries, cross platforms, integrate technologies and connect people and products in ways they weren’t connected before. Apple redefined a customer’s ability to customize the user experience. Microsoft, Google and Amazon still struggle to ride the line between monopoly and ecosystem, yet they have arguably enabled organizations, such as insurers, to plug their value and innovation into a wider spectrum of delivery.

Here is where insurance finds itself in the 21st century — wrestling with how a policy transaction is transitioning to a broader customer experience and how thriving in a new world may mean adopting and adapting to an ecosystem approach. While this blog is focused on auto insurance and the shift to mobility, the same shift is happening for all different products and lines of business.

So where do insurers draw their own lines? Or, should they be erasing the lines they have already drawn?

In Majesco’s latest thought-leadership report, Rethinking Auto Insurance: From a 120-Year-Old Policy Transaction to a Next-Gen Mobility Customer Experience, we look closely at the pressures placed upon auto insurance. In my last auto insurance blog, we catalogued those pressures in order to see why change must happen. In today’s blog, we look at the practical response. What are the opportunities for insurers who listen to customer sentiment and use it to clearly define their roles within mobility ecosystems? Can we learn from current mobility ecosystem development?

The Mobility Ecosystem

Swiss Re’s 2019 report, Digital ecosystems: extending the boundaries of value creation in insurance, noted that ecosystems can be structured into broad clusters, such as “Home & Stay” and “Lifestyle” on the B2C side, and “Build/Produce” and “Deliver” on the B2B side. Within these clusters, finer-grained domains can be defined, like “Mobility” or “Transport & Logistics.” Insurance fits within the risk-mitigation component of most of these ecosystem domains, including mobility, healthcare and housing.[i]

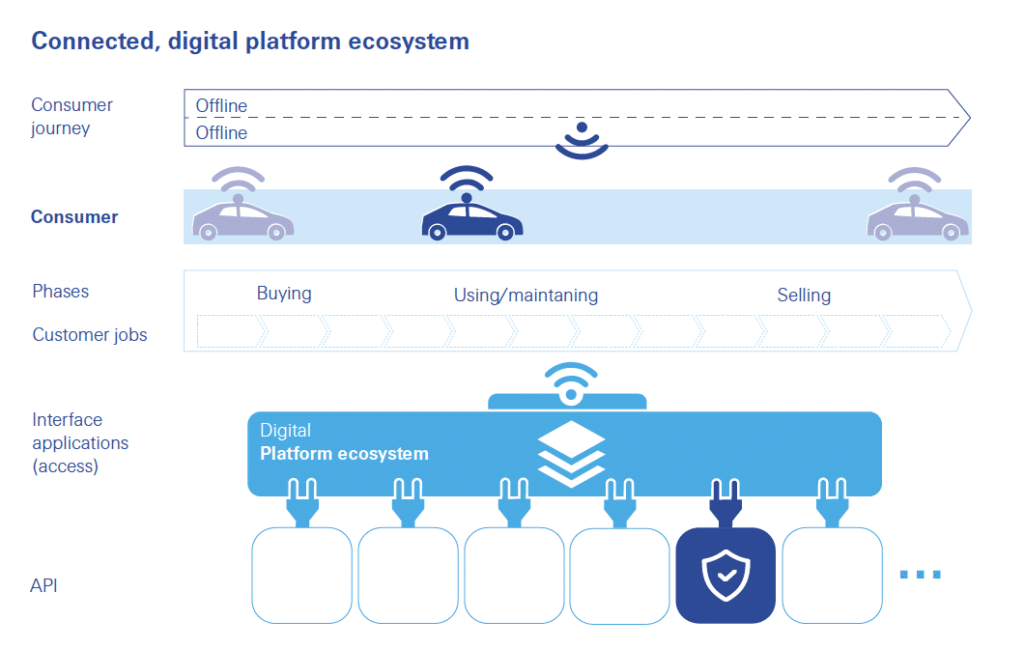

In this new interconnected world, insurance will play within these ecosystems, rather than simply existing as an industry and silo unto itself. Insurers can plug into these ecosystems in different ways. They could create one unified policy to cover any mode of transportation a customer uses, instead of separate policies for each. Or they could provide risk protection services as a component of an ecosystem that provides a broader engagement and experience for all of the “jobs” a customer needs to get done across their mobility customer journey…“a single window of interaction that eliminates points of friction between the different participants of the ecosystem.”[ii] (See Fig. 1)

Figure 1: The role of insurance in a mobility ecosystem

Source: Swiss Re Institute

The Mobility Ecosystem Market Opportunity

Insurance customers favor the idea of an integrated, holistic ecosystem approach for the interconnected tasks that make up their mobility journey, which is highlighted in our survey results. Companies that can achieve an early entry into this space have a tremendous opportunity to create, own and grow a loyal base of current and new customers.

Given the nature of ecosystems, insurers can assume multiple roles, from owner of the unifying platform, to orchestrator of the products and services, or provider of products and services. This requires leadership with an appetite for taking informed risk, an ability to move quickly, the capacity to build partnerships within and outside of insurance, and strong technology capabilities. But most important is a clear vision of the customer’s mobility journey and the ability to assemble the ecosystem of partners, products, services, data, and technology that empowers the customer to accomplish all of their mobility needs in a holistic, satisfying way.

The Desire for Mobility Ecosystems

Currently, a customer must go to multiple, disparate places to fulfill their mobility needs. Our research identified 19 such mobility-related needs. We asked customers how useful it would be to have a single source (an app or portal) to access the information and complete these mobility options. Analysis of their responses identified five “job groups.”

As seen in Figure 2, three of the groups are extremely popular with both Gen Z and Millennials and Gen X and Boomers, with up to 70% or more indicating they would like Local Discounts, Driving & Trip Tools, and Vehicle Health included in the app. Gen Z and Millennials also felt the other two job groups would be useful, Payments and Paperwork (59%) and Other Mobility Modes (45%), but their older counterparts did not feel as strongly about these (50% and 29%, respectively).

Figure 2: Usefulness of a single source to manage mobility “job groups”

All of the options in Driving & Trip Tools were viewed as very useful, including Emergency roadside assistance, Navigation/maps and Vehicle locator/parking reminder.

While emergency roadside assistance has been around for many years, the other services have been rapidly emerging with the newer mobility technology. As an example, parking is often one of the biggest driving headaches. Mapping and car data capabilities allow customers to offer a solution that can identify open parking spaces and streamline the entire parking experience which can save time and money for drivers and fleets, reduce congestion and pollution, and make the experience more enjoyable.

Between 60-64% of those surveyed said fuel economy/spending tracking and auto registration and payment capabilities would be useful. 61% of Gen Z and Millennials said access to a dashboard of their driving behavior and auto insurance payments would be valuable, compared to 53% of the older generation. In addition, the younger generations want the ease of paying their auto loan or lease (50% vs. 36%).

Gen Z and Millennials clearly see the value of using an app to book hotels, book flights, buy passes on local transit systems, reserve and pay for vehicle rentals, and book and pay for rideshare services, with interest levels of 40-53% compared to 28-35% for Gen X and Boomers. Reserving and paying for bikes or scooters has a strong interest at 35% for the younger generation.

The importance of mobility and the utility of an integrated mobility ecosystem approach for Gen Z and Millennials is underscored by their willingness to pay for it. At least 40% of the younger generational segment would pay $10 per month.

Given the diversity of interest in the mobility jobs, allowing customers to pick and choose their options within a service will be important, ensuring personalization to their needs. This concept is what Apple introduced with the Apple App Store and what Majesco Digital1st® EcoExchange offers – providing access and revenue opportunities within the ecosystem.

The Rise of Mobility Ecosystems

In SVIA’s February 2020 OnDemand event, Dr. Evangelos Avramakis from Swiss Re discussed the ecosystem concept and shared examples of companies already doing it – and doing it beyond mobility.[iii] One of these mobility companies with a broader services focus, is Gojeck, an Indonesian company.

Gojeck began in 2010 as a motorcycle ride hailing service and has evolved into a suite of more than 20 services for millions of customers across Southeast Asia. They are creating a seamless experience while also providing a positive socio-economic impact for millions of their partners (drivers, merchants, service providers).

Who Else is Entering the Mobility Space?

Other “traditional” companies are entering the mobility space within the US and Europe with new business models. They are leveraging their customer relationships, vast customer data, technology and ecosystems to create new customer experiences. These are potentially even more threatening for auto insurers.

Ford

In 2015, 107 years after the first Model T rolled off the assembly line, Ford announced that it considered itself a mobility company rather than an automotive company. In early 2016, they established their Smart Mobility business to lead the development of new business models for the future.[iv] In April 2019, they launched a distinctly different division to represent all future lines of business, including micro-mobility, non-emergency medical transport and city solutions. During this time, they also acquired a scooter-sharing company, Spin.[v]

In February 2020, they introduced Ford Insure in partnership with Nationwide, which offers insurance that lets customers earn discounts for safe driving.[vi] Ford Insure works with the FordPass™ app in 2020 model-year Ford vehicles to monitor customer driving behavior and calculate data-based discounts.

General Motors

In April 2019, General Motors Company announced it was changing its name to General Mobility, a historic change for the 110-year-old company recognized as a pioneer in the automotive industry. The name change was made to better reflect their strategy and direction in a rapidly changing world.[vii]

GM’s OnStar service has expanded to include new services such as real-time vehicle diagnostics, dealer service notification, and Smart Driver, which scores drivers based on driving information with a focus on improving driving and overall vehicle performance, reducing wear and tear, and enhancing fuel efficiency. Drivers can share their driving results to receive potential insurance discounts from participating insurance companies.[viii]

Uber

In less than a decade after launching, Uber began rolling out new services including UberX, UberPool, Uber Express Pool, UberEats, Uber Freight, and shared electric bikes through the acquisition of Jump Bikes. They have since expanded to allow customers to rent a vehicle via UberRent in partnership with peer-to-peer car-sharing startup Getaround. And in partnership with Masabi, a mobile payment system for public transit systems in major cities around the world, customers will be able to buy and use tickets for public transportation from their Uber app.

In addition to expanding their platform to include bicycles, scooters and public transit, Uber is looking at allowing third-party autonomous vehicles on its platform. In essence, as an August 2018 Automotive News article points out, Uber, via its multimodal “mobility” app, is rapidly moving toward an end state that more closely reflects Amazon’s online marketplace than an autonomous cab service.[ix]

If there is an Amazon-like threat to auto insurers, Uber may have captured the right combination of services to appeal to consumers quickly.

The Next Mobility Step for Auto Insurers

How do auto insurers (personal and commercial) keep the pipelines of opportunity open to the products that they produce? How do they grow, own and retain a customer base that trusts them for a broader mobility need? Innovation is the key to mobility ecosystem development and use. Insurers that can quickly innovate around new services, new products, enhanced channels and real customer experience improvements, will be the ones who capture the opportunities that mobility presents. As vehicular use globally is in flux, auto insurers need to assess how they can protect and serve across the full spectrum of transportation choices.

Auto insurers need to do some future-thinking around real-time risk assessment, and examine literal customer journeys to find areas where value can be added by creating new products, offering new services and improving experiences and engagement through tools such as Majesco P&C Core Suite Majesco Digital1stâ Insurance . They need to carefully examine the technologies and platforms that are pre-built for plug and play ecosystem design, and they need to have some vital conversations about how willing the company is to capitalize on the business model shifts that a mobility ecosystem will require.

[i] “Digital ecosystems: extending the boundaries of value creation in insurance,” Swiss Re Institute, January 2019

[ii] ibid

[iii] Digital Ecosystems & Insurance: Strategies for Innovators, SVIA, February 11-12, 2020, https://sviaccelerator.com/digital-ecosystems-insurance-strategies-for-innovators-2020-01/

[iv] Abuelsamid, Sam, “Ford’s Farley On Building Mobility Technology And Services Amid Auto Industry Disruption,” Forbes, October 21, 2019, https://www.forbes.com/sites/samabuelsamid/2019/10/21/fords-jim-farley-on-building-mobility-technology-services-and-brands/#1bb322ad99a8

[v] Koenig, Bill, “Ford, Declaring Itself a Mobility Company, Revisits an Old Strategy,” SME, November 8, 2018, https://www.sme.org/technologies/articles/2018/november/ford-declaring-itself-a-mobility-company-revisits-an-old-strategy/

[vi] “Ford, Lincoln Work with Nationwide to Offer Insurance Program for Connected Vehicles Designed to Reward Safer Driving,” Ford website, February 21, 2020, https://media.ford.com/content/fordmedia/fna/us/en/news/2020/02/21/ford-lincoln-nationwide-insurance.html

[vii] Luft, Alex, “General Motors Changes Name To General Mobility,” GM Authority, April 1, 2019, https://gmauthority.com/blog/2019/04/general-motors-changes-name-to-general-mobility/

[viii] “OnStar Smart Driver,” GM Authority, https://gmauthority.com/blog/gm/general-motors-technology/onstar/onstar-smart-driver/

[ix] Silke Carty, Sharon, et al, “Uber’s strategy shift,” Automotive News, August 23, 2018, https://www.autonews.com/article/20180823/MOBILITY01/180829859/uber-s-strategy-shift